Some Important FAQs which will help you in Deciding which ITR form to File.

CA Pratibha Goyal | Apr 15, 2023 |

Confused? Which ITR Form to File? This might help!

Some Important FAQs which will help you in Deciding which ITR form to File.

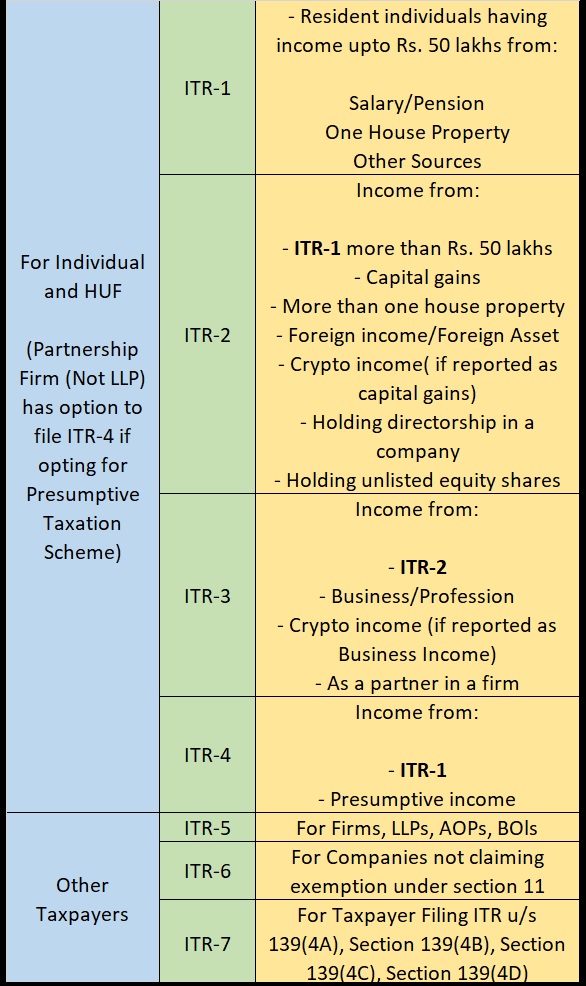

Delivery-Based Trading: This will result in Capital Gains. In this case, the Taxpayer is required to file ITR-2.

Futures & Option: This is considered as Bussiness Income (Non-Speculation Based). In this case, the taxpayer is required to file ITR-3. The Taxpayer can also opt for the Presumptive Taxation scheme and File ITR-4.

Intra-Day: This is considered Bussiness Income (Speculation Based). In this case, the taxpayer is required to file ITR-3. The Taxpayer can also opt for the Presumptive Taxation scheme and File ITR-4.

Although Mr. A is having Salary Income only, but ITR-1 cannot be filed by an individual who is Director in a company. So, Mr. A is required to file ITR-2.

ITR-1 can be filed by individuals being a resident (other than not ordinarily resident) having a total income of upto Rs. 50 lakh. So, Mr. X is required to file ITR-2.

Mr. A is having Income from Capital gain. He is required to file ITR-2.

Mr. A can file ITR-1.

ITR-4 can be used by Taxpayers who have opted for a presumptive Taxation Scheme. Taxpayers cannot opt presumptive Taxation scheme for commission Income, hence ITR-4 cannot be used. For disclosing commission Income one should use ITR-3.

The Taxpayer can file:

ITR-3: If he is maintaining Books of Accounts

ITR-4: If the Taxpayer has opted for the Presumptive taxation scheme.

No ITR-1 cannot be filed in case you need to carry forward Loss.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"