New Tax Regime introduced by FM in income tax in AY24-25 with various benefits like standard deduction, NPS deduction etc., Which regime is better old or new?

CA Pratibha Goyal | Dec 12, 2024 |

New Vs Old Income Tax Regime: Which one is better for Salaried Employee?

The New Tax Regime was introduced, effective from AY 2021-22. But it was not very lucrative at that time. Overhauling of New Tax Regime in Income tax started from AY 2024-25 where FM introduced benefits like standard deduction, deduction of NPS (Employer Share) etc. in New Tax Regime as well. In the current Budget, the New Tax Regime has been made more lucrative.

Benefits Introduced for New Tax Regime by Finance Act 2024:

| Total Income (Rs) | Rate |

| Upto Rs. 3,00,000 | Nil |

| From Rs. 3,00,001 to Rs. 7,00,000 | 5 per cent |

| From Rs. 7,00,001 to Rs. 10,00,000 | 10 per cent |

| From Rs. 10,00,001 to Rs. 12,00,000 | 15 per cent |

| From Rs. 12,00,001 to Rs. 15,00,000 | 20 per cent |

| Above Rs. 15,00,000 | 30 per cent |

| Net income range | Resident Super Senior Citizen | Resident Senior Citizen | Any other Individual |

| Up to Rs. 2,50,000 | Nil | Nil | Nil |

| Rs. 2,50,001- Rs. 3,00,000 | Nil | Nil | 5% |

| Rs. 3,00,001- Rs. 5,00,000 | Nil | 5% | 5% |

| Rs. 5,00,001- Rs. 10,00,000 | 20% | 20% | 20% |

| Above Rs. 10,00,000 | 30% | 30% | 30% |

Which Regime to Choose: Old or New Tax Regime?

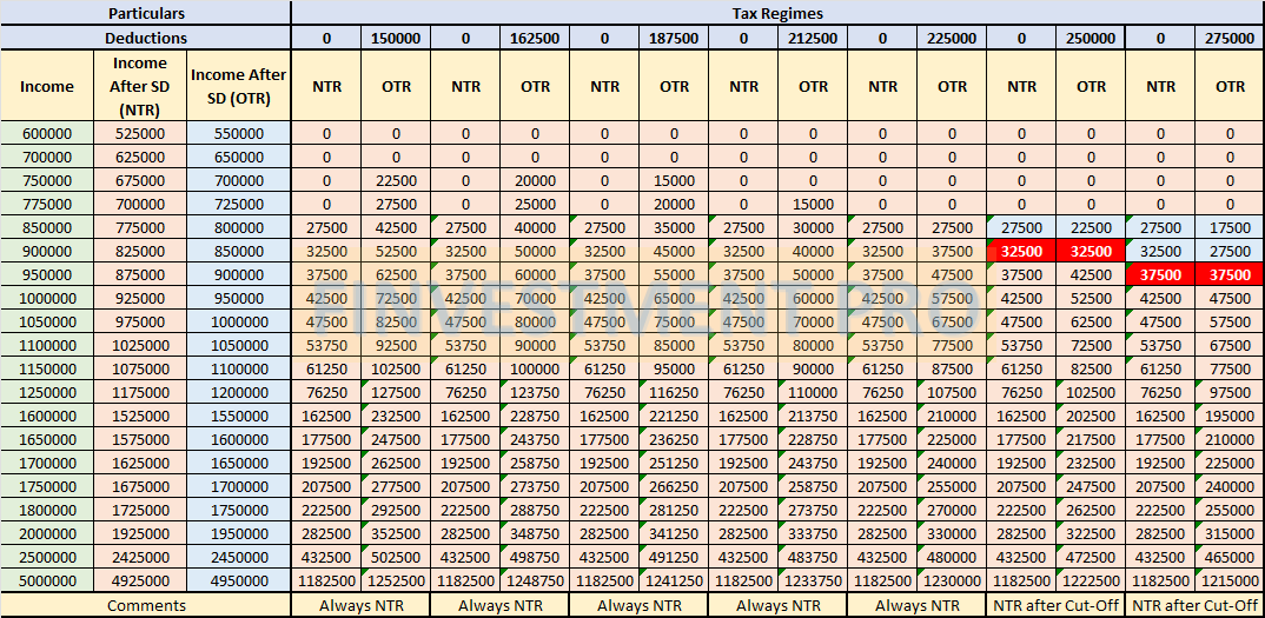

As per the Available Income Tax Deductions, we have made a brief analysis to decide which Income Tax Regime you should opt. We have compared beneficial tax regimes for salaries up to Rs. 50,00,000.

NTR Vs OTR: Chart 1

As you can see the Old Tax Regime would no longer be beneficial if you only have section 80C Deductions. To benefit from the old tax regime, now you need more deductions like HRA, Home Loan etc. in your kitty.

Also for salaried Incomes up to Rs. 7,75,000, New Tax Regime is always beneficial.

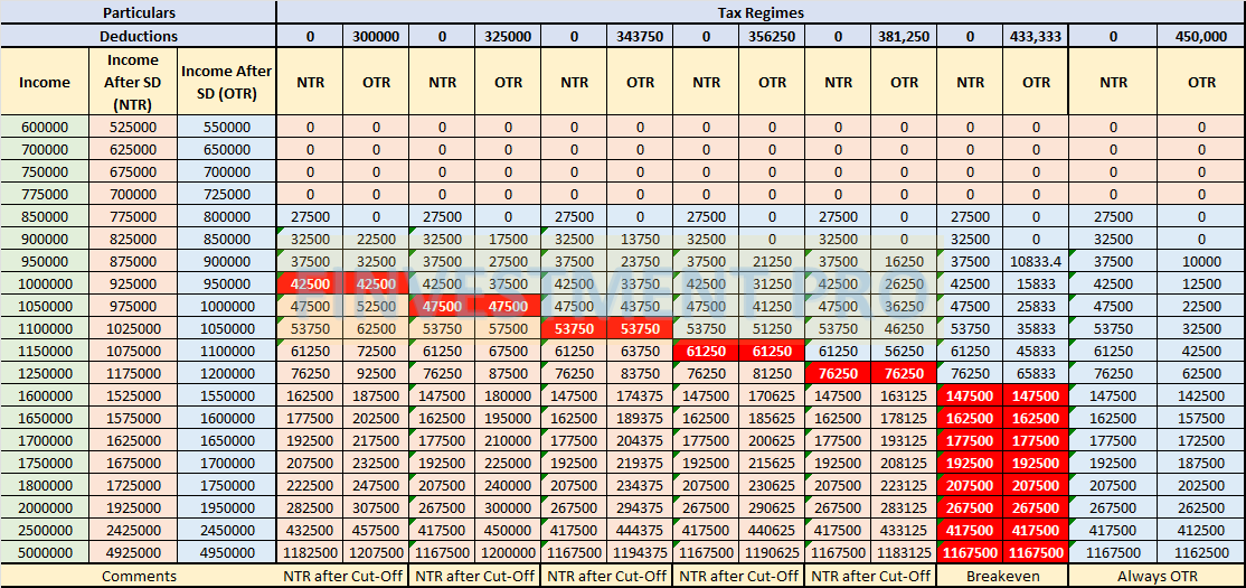

NTR Vs OTR: Chart 2

Achieving Break-Even

If you have deductions of more than 433,333, then Old Tax Regime is always beneficial for you.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"