The Court found that in tax invoice, amount has been mentioned as Rs. 1,97,047.86 whereas, in the e-Way Bill, it has been mentioned as Rs. 19,70,47,086.00.

CA Pratibha Goyal | Apr 15, 2023 |

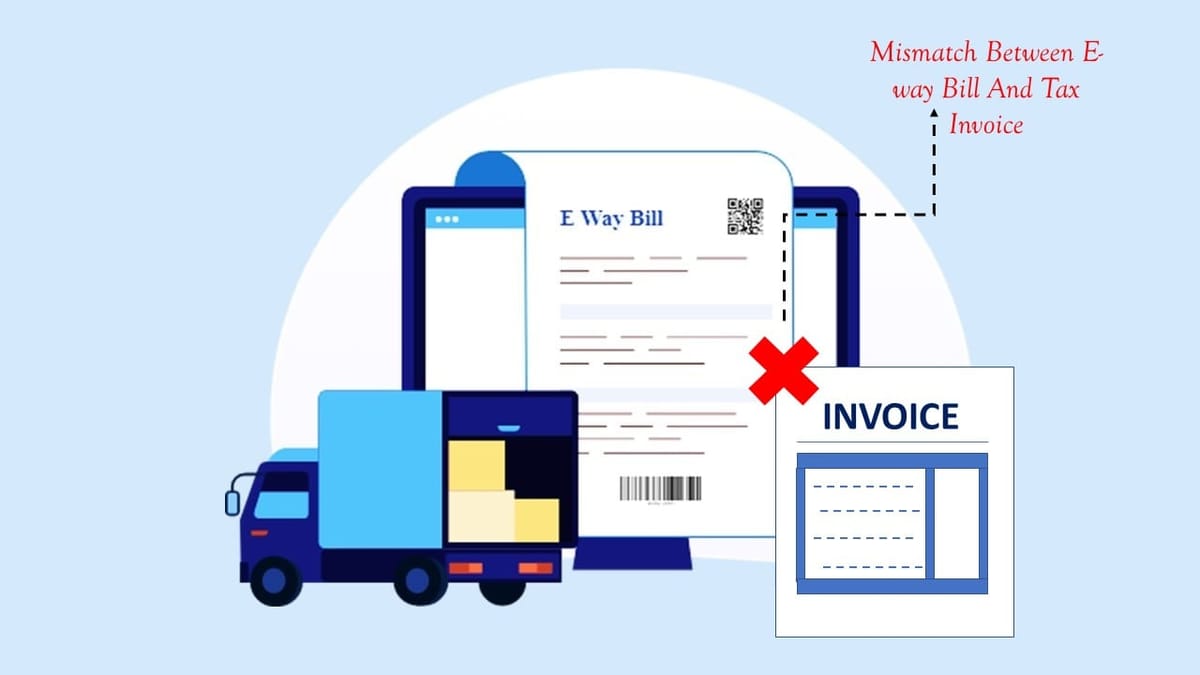

High Court sets aside GST demand on account of mismatch between E-way Bill and Tax Invoice

The petitioner has filed this writ petition seeking to set aside the impugned demand and FORM GST DRC-07 under Annexure- 7 & 8 respectively and to quash the attachment of the petitioner’s bank account under Annexure-9 and to allow the petitioner to file a reply to the show cause notice under Annexure-6 series.

Mr. R.P.Kar, learned counsel appearing for petitioner contended that the petitioner has generated a tax invoice under Annexure-1 for an amount of Rs.1,97,047.86, which is taxable. As, he does not have the computer, the same was a self generated document. But under the law, he is required to generate the computer bill. Accordingly, e-Way Bill was prepared under Annexure-2, wherein the total taxable amount was shown to be Rs.197047086.00, which figure according to him is a typographical mistake, in view of the entry made under Annexure- 1, where the amount has been mentioned as Rs. 1,97,047.86. Therefore, though the figure is tallying but the paise has been entered in rupees, which has created difficulty on the part of the petitioner, because he is a small dealer and cannot have the taxable amount of Rs. 197047086.00. It is thus contended that the human error, which has been committed, has to be rectified.

Mr. S. Mishra, learned Additional Standing Counsel contended that the assessment order has been passed by the assessing authority under Section 74 of the OGST Act with intimation through DRC-01A for the cause of less filing of return for the period of 2019-20, as per the information under possession of the authority, and whereas, no response received against the above mentioned intimation for which online notice in DRC-01 was issued and, as such, no response was received on above. Therefore, in the event the petitioner approaches the assessing authority, the assessment order can be reconsidered by the said assessing authority in accordance with law.

The Court found that in the tax invoice, the amount has been mentioned as Rs. 1,97,047.86 whereas, in the e-Way Bill, it has been mentioned as Rs. 19,70,47,086.00.

Thereby, there is a palpable error in the way bill, which may be construed to be a human error.

Quash demand and order:

The court, sat aside the impugned demand and FORM GST DRC-07.

To Read Judgment Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"