The government has said that anyone who got their PAN card using an Aadhaar enrollment ID must update it with their actual Aadhaar number by December 31, 2025.

Janvi | Apr 7, 2025 |

PAN Card may Become Inoperative: Check out CBDT’s New PAN-Aadhaar Linking Deadline

The government has said that anyone who got their PAN card using an Aadhaar enrollment ID must update it with their actual Aadhaar number by December 31, 2025.

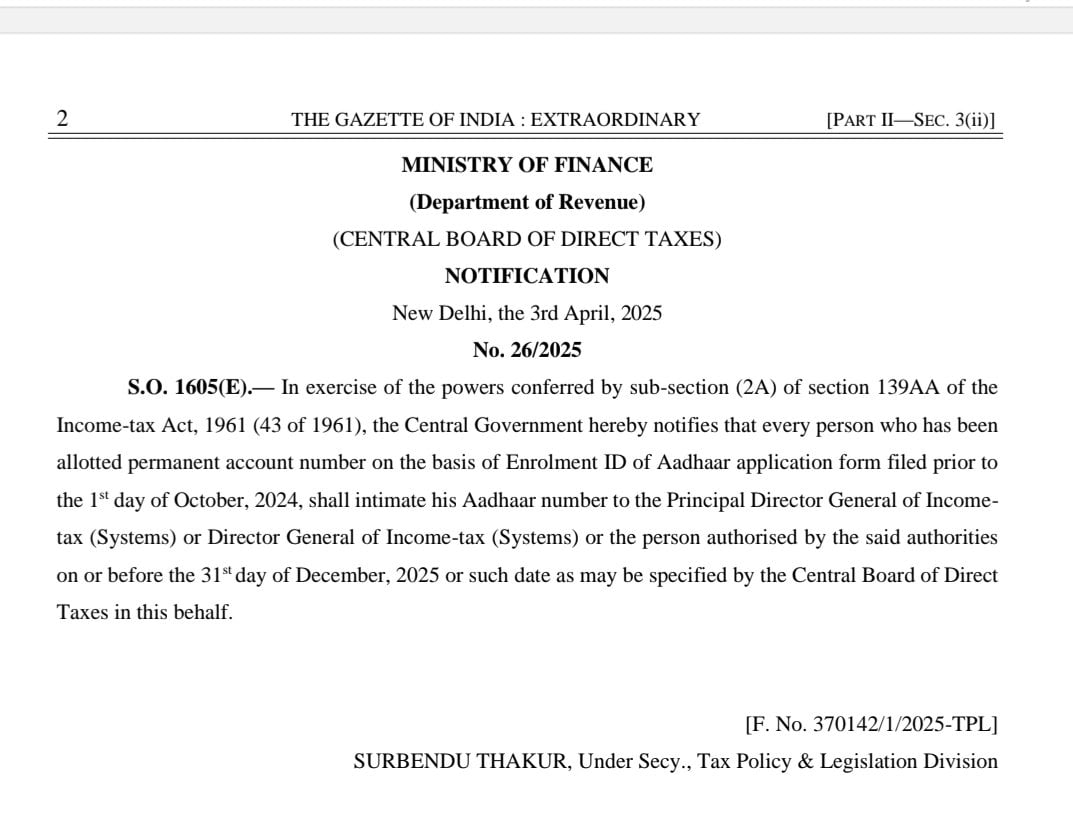

The Central Board of Direct Taxes (CBDT) has issued a notification for certain PAN card holders. If someone got their PAN using the enrollment ID from their Aadhaar application on or before October 1, 2024, they need to share their Aadhaar number with the Income Tax Department. This must be done before December 31, 2025.

The government has announced that anyone who got a PAN card using the Enrolment ID of their Aadhaar application before October 1, 2024, must update their PAN by sharing their actual Aadhaar number. This should be done by December 31, 2025, or by another date if the Income Tax Department sets one later. The Aadhaar number must be shared with the Income Tax Department’s authorized officers or systems.

This notification applies to PAN holders who received their PAN on or before October 1, 2024, using their Aadhaar enrolment ID instead of the actual Aadhaar number.

The notification was officially issued on April 3, 2025, by the government.

According to an expert, PAN holders who got their PAN using an Aadhaar enrolment ID will likely have to follow the same process used for PAN-Aadhaar linking. They may need to visit the Income Tax Department’s e-filing portal and complete the linking process there. It is expected that no penalty will be charged for these specific PAN holders. However, more detailed instructions from the Income Tax Department are still awaited.

At present, there is a penalty for linking PAN with Aadhaar since the last date for regular PAN holders to do so was June 30, 2023. Anyone linking their PAN and Aadhaar after that date must pay a fine. However, people who got their PAN using only an Aadhaar enrolment ID didn’t have their actual Aadhaar number back then. So, they couldn’t have linked the two by the deadline.

Logically, these PAN holders should not be charged a penalty now, as they didn’t have the required Aadhaar number at that time. It’s also important to understand that the June 30, 2023, deadline applied only to those who already had both PAN and Aadhaar numbers.

The government has said that PAN holders who got their PAN using an Aadhaar enrolment ID must update it with their actual Aadhaar number by December 31, 2025, or any other date announced later. However, the notification does not mention what action will be taken if someone fails to update their Aadhaar number in time. More clarity is expected from the Income Tax Department in the future

The penalty of Rs 1,000 may apply (though CBDT has not clarified this for specified taxpayers after Jan 1, 2026).

PAN will become inoperative, which means it will no longer be valid for financial transactions.

Filed ITRs (Income Tax Returns) may be considered invalid if PAN-Aadhaar is not linked.

No tax refunds will be processed for PANs that are inoperative.

Filing of income tax returns will not be allowed using an inoperative PAN.

TDS/TCS may be deducted or collected at higher rates due to an inoperative PAN.

Credit for TDS/TCS may not appear in Form 26AS, and such credit claims may be rejected.

Form 15G/15H cannot be submitted, leading to unnecessary TDS deductions.

Interest on tax refunds may not be granted to PAN holders with an inoperative PAN.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"