Tax audit, as the name implies, is an inspection or review of the accounts of any business or profession carried out by taxpayers from an income tax standpoint.

Reetu | Aug 9, 2023 |

Important Summary from Business Profession Head useful for TAR

It’s Tax Audit season going on. The term ‘audit’ indicates a formal review of an organization’s finances and the creation of a report, often by an independent entity. It is also known as a systematic review or assessment of anything.

Audits are undertaken under various laws, such as company audits/statutory audits conducted under company law requirements, cost audits, stock audits, and so on. Similarly, income tax law also mandates an audit called ‘Tax Audit’.

Tax audit, as the name implies, is an inspection or review of the accounts of any business or profession carried out by taxpayers from an income tax standpoint. It simplifies the process of calculating income for the purpose of submitting income tax returns.

A Tax Audit Report is a report prepared by a Chartered Accountant in practise after auditing a business’s books of accounts. The CA conducts a Tax Audit to verify that the books of accounts are appropriately produced and that the taxable income is computed correctly in accordance with the rules of the Income Tax Act.

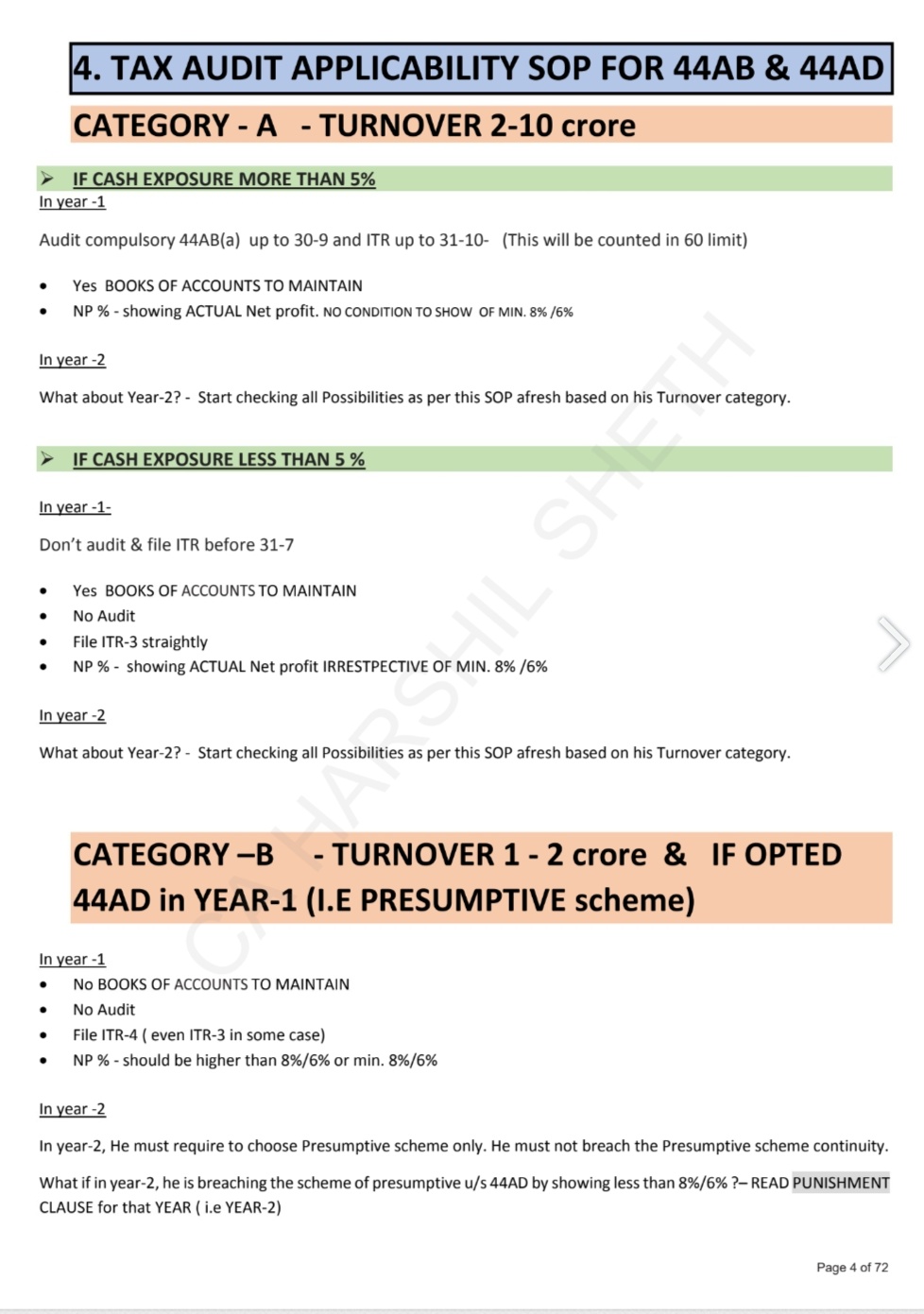

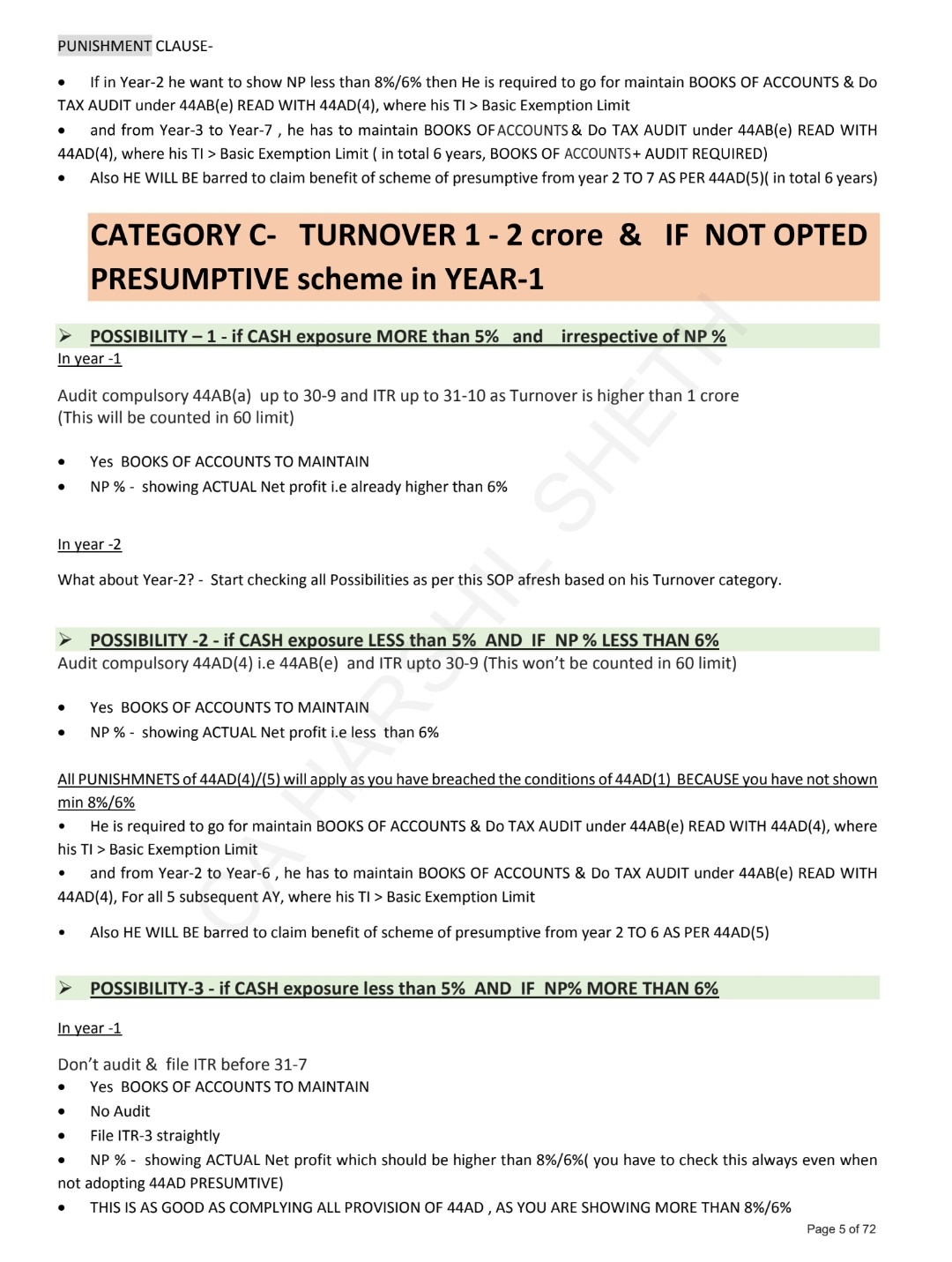

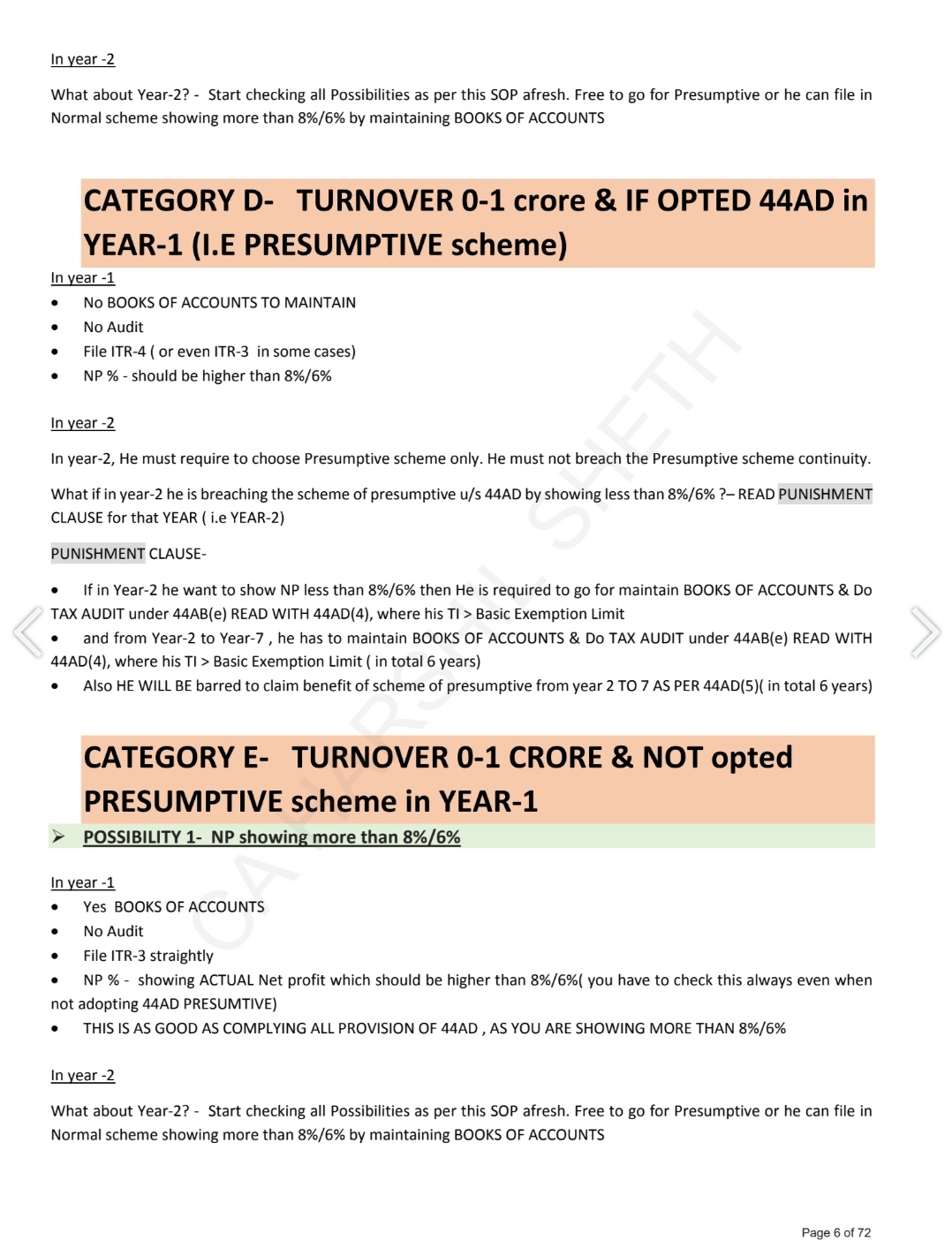

In this article we will see summary of section related to business and profession which is used in audit. Here is an important sections summary in one page from Business & Profession head which are useful for TAR (Tax Audit Report).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"