The Income Tax Department has released a Handbook on Judicial Matters for department purposes.

Reetu | Oct 19, 2024 |

Income Tax Department released Handbook on Judicial Matters

The Income Tax Department has released a Handbook on Judicial Matters for department purposes. The released Handbook on Judicial Matters is intended only to be a reference book and it cannot be a substitute for Acts, Rules, Orders, Instructions, etc. of various authorities.

The Chief Commissioner of Income Tax (Mumbai) said, “Judicial matters are a very important part of our work and I must thank the PCITS (Judicial), Mumbai, the editors and their team, for bringing out this Handbook on Judicial Matters. This Handbook is expected to serve as a useful resource on judicial matters. The Handbook discusses matters relating to the filing of appeals and representation before the ITAT. It discusses the filing of appeals, the removal of objections in appeals before the High Court, and the IAMS portal (Integrated Appeal Management System). It also discusses prosecution matters and matters relating to NCLT and NCLAT. The Handbook also has a separate chapter on the filing of SLPs. Following due process is important and we must be aware of the requirements of law, and should continuously update our knowledge in this area. I am sure that the Handbook will help the officers in dealing with judicial matters.”

“Officers are requested to provide their feedback and valuable suggestions for improving this Handbook. It is necessary that this Handbook be updated periodically and improved, to incorporate the latest changes and suggestions from the officers. I am confident that the PCITS (Judicial) and their team will continue to update and improve this Handbook so that it effectively assists the officers in judicial matters”, he added.

The Department has made every effort to provide accurate and updated information in the Handbook on Judicial Matters. For any inadvertent error and omission or doubt, the Principal Commissioner of Income Tax (Judicial) may be contacted for clarification.

The statements in this Manual should not be construed as the final authority about any provision of law. For the same, the actual text of a provision of law or a judgment or Circular etc, which are quoted in this book, may be referred to.

The Principal Commissioner of Income Tax (Judicial) welcomes suggestions on content or form and inadvertent errors or omissions in this Manual for further improvement.

The Commissioner of Income Tax (Appeals) serves as the first appellate authority, while the Income Tax Appellate Tribunal (ITAT) is the second appellate authority. Established in January 1941, the ITAT is a quasi-judicial institution that specializes in handling appeals under the Direct Taxes Acts. Both taxpayers and Assessing Officers can file appeals to the ITAT if they are dissatisfied with the decision of the first appellate authority. The ITAT operates under the Ministry of Law and comprises two types of members: Judicial members and Accountant members.

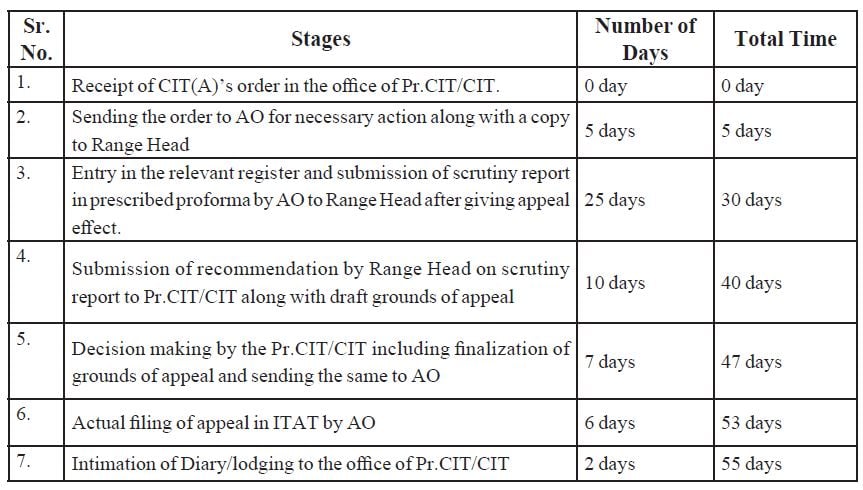

1. Scrutiny Report: The Assessing Officer (AO) or Range Head must submit a scrutiny report under Section 253 of the Act to the concerned Principal Commissioner of Income Tax (PCIT), as per the Central Board of Direct Taxes (CBDT) Instruction No. 08/2011 [F NO. 279/MISC./M-43/2011-ITJ], dated August 11, 2011.

2. Tax Effect: Consider the tax effect for Income Tax and Wealth Tax cases, along with any exceptions.

3. Framing Questions: Properly frame both the question of fact and the question of law.

4. Form No. 36: Ensure the correct completion and submission of Form No. 36.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"