The Income Tax Department has issued an Advisory to remind taxpayers whose accounts need to get audited to file their income tax returns on or before the due date.

Reetu | Oct 15, 2024 |

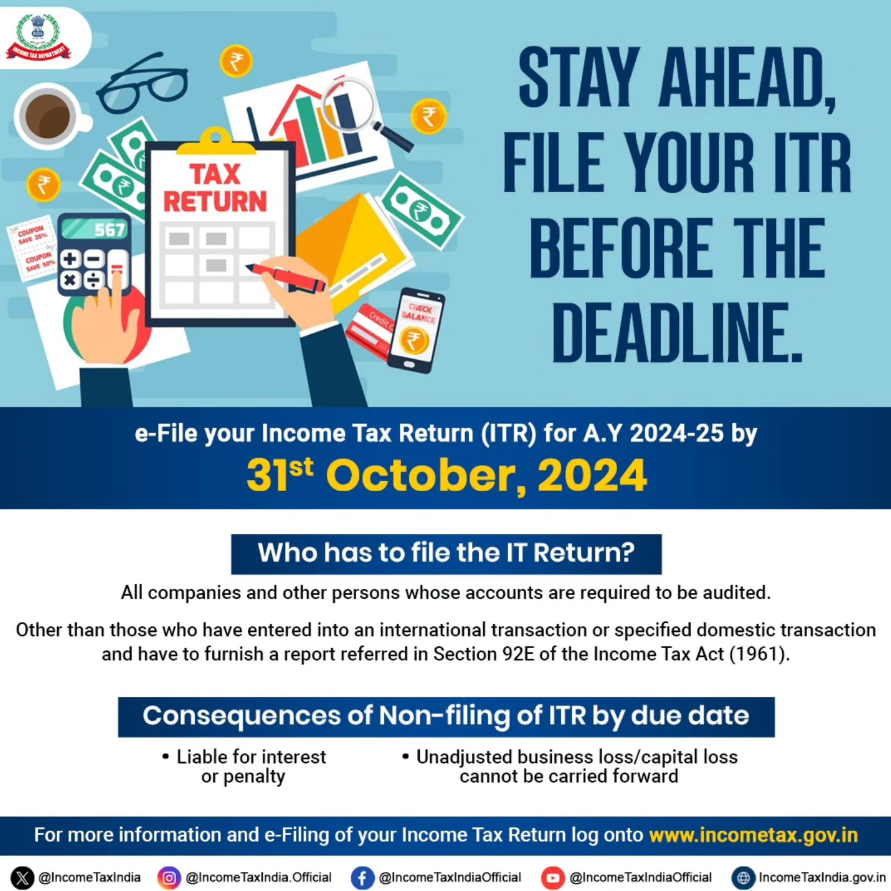

File Your ITR Before 31st Oct to avoid Penalties: Income Tax Department

The Income Tax Department has issued an Advisory to remind taxpayers whose accounts need to get audited to file their income tax returns on or before the due date. The due date to file income tax returns for these particular taxpayers is 31st October 2024.

The Advisory read as follows:

As per Explanation 2 to Section 139(1) of the Income Tax Act, 1961, the below classes of taxpayers must file their return on or before 31 October 2024:

(a) Corporate assessee; or

(b) Non-corporate assessee whose books of account are required to be audited under the Income Tax Act or any other law for the time being in force; or

(c) Partner of a firm whose accounts are required to be audited under the Income Tax Act or any other law for the time being in force or the spouse of such partner if the provisions of section 5A (Apportionment of Income between spouses governed by the Portuguese Civil Code) applies to such spouse.

All the above-mentioned classes of taxpayers need to be aware of the due date for filing tax returns that will be due in no time and file their respective returns to avoid penalties. In case of failing to file the returns, the taxpayers will have to face penalties.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"