GST Portal will be unavailable for users beginning tomorrow, Oct 26 at 10:00 PM and lasting until 6:00 AM on Oct 27, 2024, due to a scheduled Disaster Recovery Drill.

Reetu | Oct 25, 2024 |

GST Portal will be Unavailable to access from Tomorrow Night; Know Reason

The Goods and Services Tax (GST) Portal will be unavailable for taxpayers/ users beginning tomorrow, October 26, 2024, at 10:00 PM and lasting until 6:00 AM on October 27, 2024, due to a scheduled Disaster Recovery Drill.

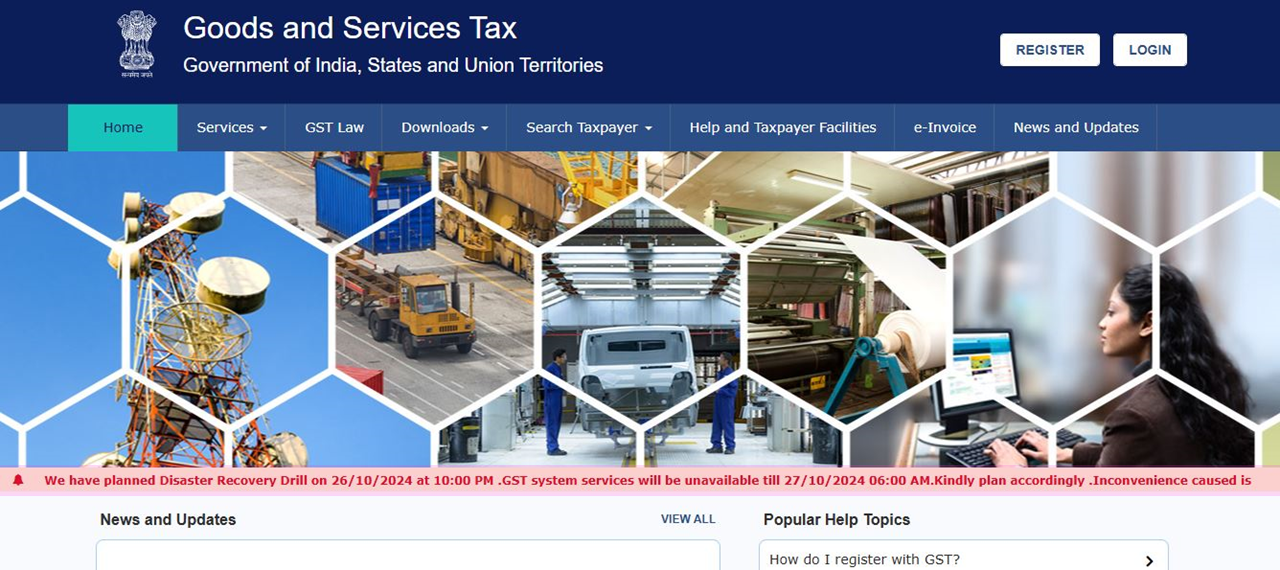

GST Portal is running a disclaimer about this activity on the portal to notify the taxpayers sothat no disruptions will occur at the time.

“We have planned Disaster Recovery Drill on 26/10/2024 at 10:00 PM.GST system services will be unavailable till 27/10/2024 06:00 AM. Kindly plan accordingly . Inconvenience caused is regretted.”

The GST Network services, such as e-invoicing, tax filing, and other taxpayer services, will be unavailable in the Portal during this time. Taxpayers and users should organize their activities accordingly to avoid any disruptions.

Disaster recovery drills are an essential component of IT infrastructure maintenance, ensuring that systems can recover swiftly from potential failures and assuring service continuity in the case of technical issues or cyber threats.

While the inconvenience caused by the temporary outage is unpleasant, regular drills are required to safeguard the GST-Tech infrastructure’s long-term stability and security. Users are asked to complete any urgent work before the scheduled downtime.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"