Minister of State for Finance, stated that the government earned Rs 4792.40 crores in Goods and Services Tax (GST) on education services that are not exempt from GST in FY 2023-24.

Reetu | Nov 27, 2024 |

Govt earned Rs. 4,792 Crores of GST Revenue on Education Services in FY24

Educational services, such as those provided by schools, are in GST exemption category.

Pankaj Chaudhary, Minister of State in the Ministry of Finance, stated in Lok Sabha on November 25, 2024, that the government earned Rs 4792.40 crores in Goods and Services Tax (GST) on education services that are not exempt from GST in FY 2023-24. The government charges 18% GST on commercial educational services including coaching and training.

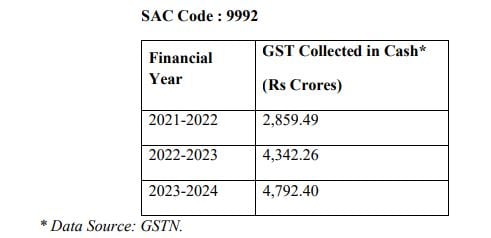

The Service Accounting Code (SAC) for these services is 9992, and an 18% GST rate is applied.

In answer to queries asked by Dr. D Ravi Kumar, the minister stated:

(a) GST rates and exemptions are prescribed on the basis of the recommendations of the

GST Council, which is a constitutional body comprising of members from both the Union and State/UT Governments.

Services provided by educational institutions to its students, faculty, and staff are exempt from GST.

‘Educational institution’ has been defined under GST exemption notification to mean an institution providing services by way of:

(i) pre-school education and education up to higher secondary school or equivalent;

(ii) education as a part of a curriculum for obtaining a qualification recognised by any law for the time being in force;

(iii) education as a part of an approved vocational education course.

Furthermore, supply of services relating to admission or conduct of examination by educational institutions are exempt from GST.

Additionally, the following services provided to schools, up to higher secondary, are also exempt:

(i) transportation of students, faculty and staff;

(ii) catering, including mid-day meals sponsored by government;

(iii) security or cleaning or housekeeping services.

Services of affiliation provided by a Central or State Educational Board or Council or any other similar body, by whatever name called, to Government schools have been given exemption from GST w.e.f. 10.10.2024 as recommended by GST Council in its 54th meeting.

Other than the above exempted education services, the services such as commercial training and coaching services attract 18% GST rate.

Printed books including Braille books, Newspapers, journals and periodicals, whether or not illustrated or containing advertising material, and Children’s picture, drawing or colouring books attract Nil GST rate.

(b) The data for GST collected on non-exempt education services, such as commercial training and coaching, for the past three years is listed below.

(c) The fee charged for issuance of migration certificates and duplicate certificates by educational institutions to its students is exempt from GST.

(d) and (e): GST rates and exemptions are prescribed on the basis of the recommendations of the GST Council, which is a Constitutional body comprising of members from both the Union and State/UT Governments. Details of exemptions from GST on education related services have been given in the reply to parts (a) and (c) above. Currently there is no recommendation from the GST Council for further exemption in this regard.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"