The Last to file belated and revised ITRs is 15th January 2025 i.e. today. But if you can't file the belated or revised return then you can go for the updated ITR.

Reetu | Jan 16, 2025 |

Could not file Revised/Belated Return, Know the Scope of ITR-U

The Last to file belated and revised ITRs is already gone. But if you could not file the belated or revised return then you can go for the updated ITR.

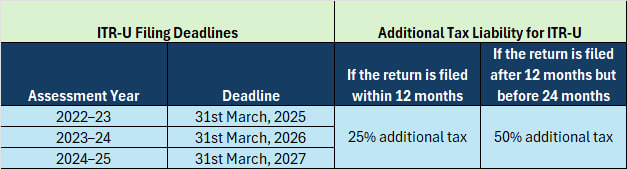

ITR-U or Updated Income Tax Return is the form that allows you to rectify errors or omissions and update your previous ITR. This return can be filed within two years.

An Updated return can be furnished u/s 139(8A) of the Income Tax Act 1961 by any person, whether or not he has furnished a return under sub-section (1) or sub-section (4) or sub-section (5), for an assessment year (herein referred to as the relevant assessment year), of his income or the income of any other person in respect of which he is assessable under this Act, for the previous year relevant to such assessment year, in the prescribed form 61 at any time within twenty-four months from the end of the relevant assessment year.

The provision of section 139(8A) shall not apply, if the updated return,—

(a) is a return of a loss; or

(b) has the effect of decreasing the total tax liability determined on the basis of return furnished under sub-section (1) or sub-section (4) or sub-section (5); or

(c) results in refund or increases the refund due on the basis of return furnished under sub-section (1) or sub-section (4) or sub-section (5), of such person under this Act for the relevant assessment year:

Further, a person shall not be eligible to furnish an updated return under this sub-section, where—

(a) a search has been commenced under section 132, or books of account, other documents, or assets are being requisitioned under section 132A in the case of such person.; or

(b) a survey has been conducted under section 133A, other than sub-section (2A) of that section, in the case of such person; or

(c) a notice has been issued to the effect that any money, bullion, jewellery or valuable article or thing, seized or requisitioned under section 132 or section 132A in the case of any other person belongs to such person; or

(d) a notice has been issued stating that any books of account or documents seized or requisitioned under section 132 or section 132A in the case of another person pertain or pertains to, or any other information contained therein, relate to, such person for the assessment year relevant to the previous year in which such search is initiated, survey is conducted, or requisition is made, as well as any assessment year preceding such assessment year.

No updated return can be furnished by any person for the relevant assessment year, where—

(a) an updated return has been furnished by him under this sub-section for the relevant assessment year; or

(b) any proceeding for assessment or reassessment or recomputation or revision of income under this Act is pending or has been completed for the relevant assessment year in his case; or

(c) the Assessing Officer has information in respect of such person for the relevant assessment year in his possession under the Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976 (13 of 1976) or the Prohibition of Benami Property Transactions Act, 1988 (45 of 1988) or the Prevention of Money-laundering Act, 2002 (15 of 2003) or the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (22 of 2015) and the same has been communicated to him, prior to the date of furnishing of return under this sub-section; or

(d) information for the relevant assessment year has been received under an agreement referred to in section 90 or section 90A in respect of such person and the same has been communicated to him, prior to the date of furnishing of return under this sub-section; or

(e) any prosecution proceedings under the Chapter XXII have been initiated for the relevant assessment year in respect of such person, prior to the date of furnishing of return under this sub-section; or

(f) he is such person or belongs to such class of persons, as may be notified by the Board in this regard:

Provided further that if any person has suffered a loss in any previous year and has furnished a return of loss in the prescribed form within the time allowed under sub-section (1), verified in the prescribed manner, and containing such other particulars as may be prescribed, he shall be permitted to furnish an updated return if such updated return is a return of income.

Provided also that if the loss or any part thereof carried forward under Chapter VI, unabsorbed depreciation carried forward under sub-section (2) of section 32, or tax credit carried forward under sections 115JAA or 115JD is to be reduced for any subsequent previous year as a result of furnishing a return of income under this sub-section for a previous year, an updated return must be furnished for each such subsequent previous year.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"