Stamp duty is a levy imposed by the state government when a property is purchased or a document is created.

Reetu | Jan 16, 2025 |

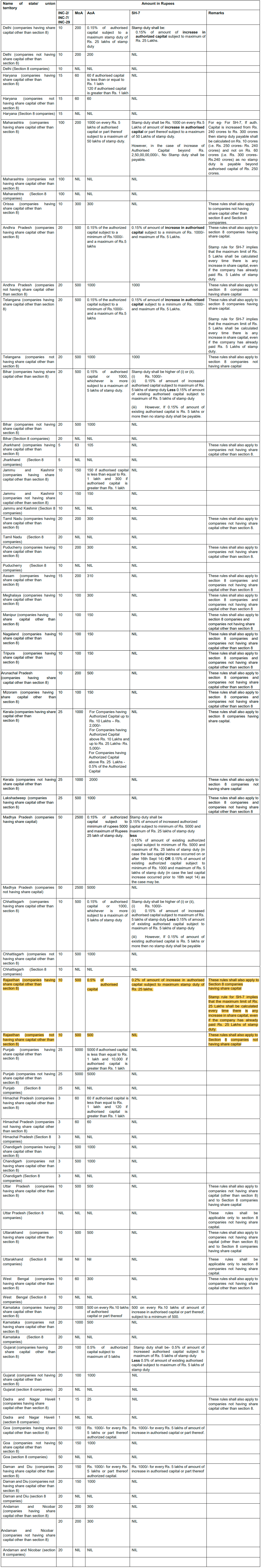

State-wise Stamp Duty Rules for eForm INC-2/ INC-7/ INC-29, MoA, AoA, eForm SH-7 and eForm FC-1

Stamp duty is a levy imposed by the state government when a property is purchased or a document is created. It’s a significant expense that’s usually paid at the time of property registration.

Here in this article, we have shared the State wise stamp duty rules. Let’s look into it.

Rs. 100 for Delhi and Rs. 50 for all other states/ UTs.

Disclaimer: All initiatives have been taken to make the database in respect of stamp duty as authentic as possible. However, users are requested to refer the relevant Stamp Act/ Rules of the concerned State/ Union Territory Government for the authentic version. Along with the above, Ministry of Corporate Affairs or its service provider shall not be responsible for any loss to any person caused by any shortcoming, discrepancy or inaccuracy in the information regarding such database. Any discrepancy found in this regard may be brought to the notice of office of respective Registrar or MCA immediately.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"