CA Pratibha Goyal | Jan 17, 2025 |

Summary of GST Notifications issued on 16.01.2025

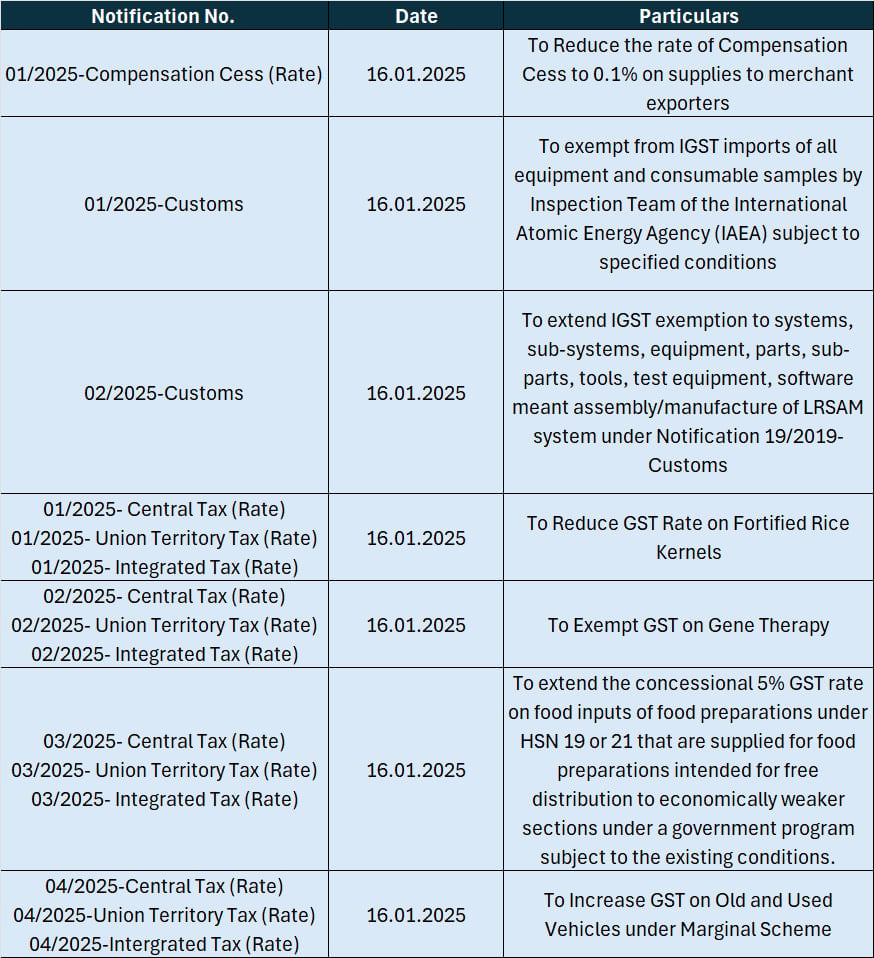

Changes in GST rates of goods

1. Notification No. 01/2025- Central Tax (Rate), 01/2025- Union Territory Tax (Rate) and 01/2025- Integrated Tax (Rate)

To reduce the GST rate on Fortified Rice Kernel (FRK), classifiable under 1904, to 5%.

2. Notification No. 02/2025- Central Tax (Rate), 02/2025- Union Territory Tax (Rate) and 02/2025- Integrated Tax (Rate)

To exempt GST on gene therapy.

3. Notification No. 02/2025-Customs

To extend IGST exemption to systems, sub-systems, equipment, parts, sub-parts, tools, test equipment, software meant assembly/manufacture of LRSAM system under Notification 19/2019-Customs.

4. Notification No. 01/2025-Compensation Cess (Rate)

To reduce the rate of Compensation Cess to 0.1% on supplies to merchant exporters at par with GST rate on such supplies.

5. Notification No. 01/2025-Customs

To exempt from IGST imports of all equipment and consumable samples by Inspection Team of the International Atomic Energy Agency (IAEA) subject to specified conditions.

6. Notification No. 03/2025- Central Tax (Rate), 03/2025- Union Territory Tax (Rate) and 03/2025- Integrated Tax (Rate)

To extend the concessional 5% GST rate on food inputs of food preparations under HSN 19 or 21 that are supplied for food preparations intended for free distribution to economically weaker sections under a government program subject to the existing conditions.

GST Rate on Goods

Changes in GST rates of Services

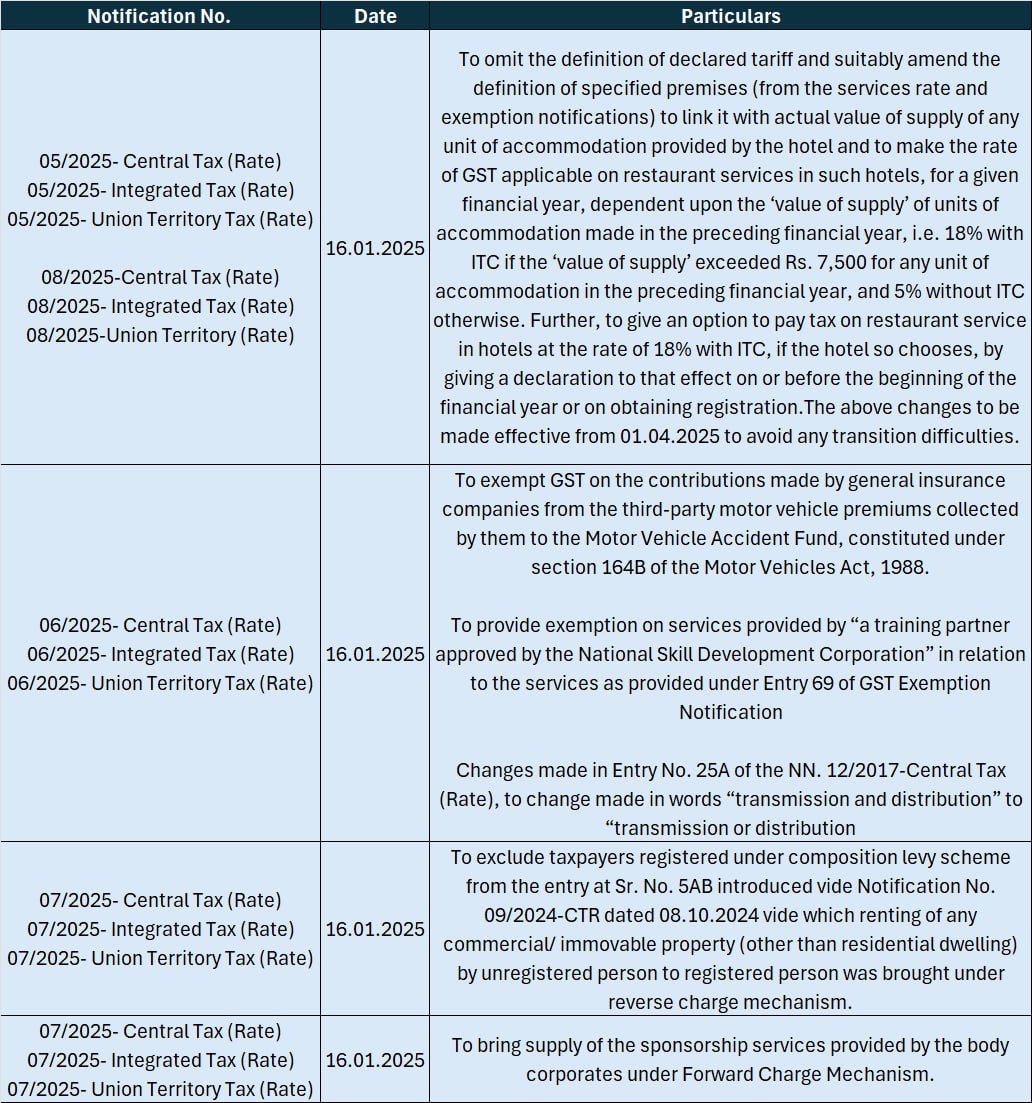

1. Notification No. 07/2025- Central Tax (Rate), 07/2025- Integrated Tax (Rate) and 07/2025- Union Territory Tax (Rate)

To bring supply of the sponsorship services provided by the body corporates under Forward Charge Mechanism.

2. Notification No. 06/2025- Central Tax (Rate), 06/2025- Integrated Tax (Rate) and 06/2025- Union Territory Tax (Rate)

3. Notification No. 05/2025- Central Tax (Rate), 05/2025- Integrated Tax (Rate) and 05/2025- Union Territory Tax (Rate)

Notification 08/2025-Central Tax (Rate), 08/2025- Integrated Tax (Rate) and 08/2025-Union Territory (Rate)

To omit the definition of declared tariff and suitably amend the definition of specified premises (from the services rate and exemption notifications) to link it with actual value of supply of any unit of accommodation provided by the hotel and to make the rate of GST applicable on restaurant services in such hotels, for a given financial year, dependent upon the ‘value of supply’ of units of accommodation made in the preceding financial year, i.e. 18% with ITC if the ‘value of supply’ exceeded Rs. 7,500 for any unit of accommodation in the preceding financial year, and 5% without ITC otherwise. Further, to give an option to pay tax on restaurant service in hotels at the rate of 18% with ITC, if the hotel so chooses, by giving a declaration to that effect on or before the beginning of the financial year or on obtaining registration.The above changes to be made effective from 01.04.2025 to avoid any transition difficulties.

4. Notification No. 07/2025- Central Tax (Rate), 07/2025- Integrated Tax (Rate) and 07/2025- Union Territory Tax (Rate)

To exclude taxpayers registered under composition levy scheme from the entry at Sr. No. 5AB introduced vide Notification No. 09/2024-CTR dated 08.10.2024 vide which renting of any commercial/ immovable property (other than residential dwelling) by unregistered person to registered person was brought under reverse charge mechanism.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"