Reetu | Jan 25, 2025 |

GST Update: GSTR-2B Excel Module introduced with 6 More Tables starting January 2025

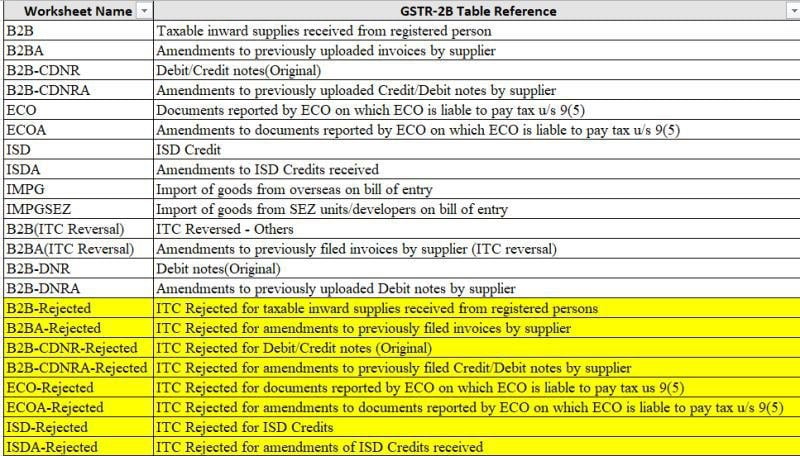

There is a significant development and an update in GST Return, starting for January 2025, 6 more tables have been inserted in GSTR-2B Excel module.

GSTR-2B has introduced six new rejected ITC categories to help taxpayers identify ineligible ITC more effectively – after IMS implementation. Rejected ITC for taxable inward supplies, amendments, debit/credit notes, and ISD credits.

GSTR-2B is an auto-drafted ITC statement which is generated for every normal taxpayer on the basis of the information furnished by his suppliers in their respective GSTR-1/IFF, GSTR-5 (non-resident taxable person) and GSTR-6 (input service distributor). The statement indicates availability and no-navailability of input tax credit to the taxpayer against each document filed by his suppliers.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"