Deepak Gupta | Oct 16, 2018 |

GST RFD 01A Refund on Account of Excess Payment of Tax, Facility to Claim Refund of Excess Payment of Tax Updated on GSTN Portal, Facility to claim Refund on account of any other reason now enabled, CBIC issues GST refund related Clarification, refund under gst ppt, export refund under gst, refund process under gst, refund procedure under gst, how to claim refund under gst, gst refund in india, gst refund for exporters, who can claim refund in gst, gst refund process for exporters, gst refund in india, who can claim refund in gst, gst refund for exporters, how to claim gst refund in india, gst refund rules, refund rules under gst, under gst law refund can be for claiming igst cgst sgst, refund process under gst, refund procedure under gst, gst refund in india, who can claim refund in gst, gst refund for exporters, refund of input tax credit under gst, gst refund process for exporters, how to claim gst refund in india

GST-RFD-01A- Refund on Account of Excess Payment of Tax :

The GSTN has introduced the new RFD-01A form for Refund on Account of Excess Payment of Tax. In these article we will see the detailed analysis related to the Refund form, Rules and how to file the refund form online.

1. When refund application on account of excess payment of tax can be filed

Ans. Refund application on account of excess payment of tax can be filed, when the taxpayer has paid excess tax (in the form of advance tax or tax deducted/collected at source or self-assessment tax or payment of tax on regular assessment) against the tax required to be paid by him.

2. Who all can file refund application using ground as Excess payment of Tax

Ans. Normal and casual taxpayers filing Form GSTR-3B, composite taxpayers filing Form GSTR-4 and Non-Resident taxpayers filing Form GSTR-5 can file refund application using ground as Excess payment of Tax.

3. What is the minimum amount that can be claimed while filing refund application using ground as Excess payment of Tax

Ans. Refund can be claimed for the amount of Rs.1000 or more while filing refund application using ground as Excess payment of Tax.

4. What are the relied upon documents which I have to upload with refund application on account of excess payment of tax

Ans. Taxpayer have to upload documents as are required to be filed along with Form RFD-01A, as notified under CGST Rules or Circulars issued in the matter and other such documents the refund sanctioning authority may require.

Taxpayers have an option to upload 4 documents with the refund application, of size up to 5 MB each. Therefore, any supporting document can be uploaded by the taxpayer, if required.

In case, the refund amount claimed is more than 2 lacs, then the taxpayer needs to mandatorily upload Certificate from CA/ICWA in Annexure 2 to the refund application. In case, refund claimed amount is less than 2 lacs, then the certificate is not required, taxpayer needs to provide self-declaration only.

5. Can I file for multiple tax period in one refund application

Ans. No, you cannot file for refund of multiple tax period in one refund application. One refund application can be filed by the taxpayer for a month for claiming refund of excess amount paid.

6. Do I need to upload any statement of invoices for claiming refund

Ans. No statement template is available for uploading the invoice details for claiming refund. You need to mention the refund to be claimed details in the statement 7 available on the refund application screen while filing refund application.

7. Whether there is any ledger entry on filing refund application

Ans. As the taxpayer is claiming refund of the tax amount paid, there is no ledger entry in Electronic Credit Ledger/ Electronic Cash Ledger.

Now we will see the online procedure to file the application through the portal

1. Login > Services > Refund > Application for refund type, then click on create tab and select the refund period month.

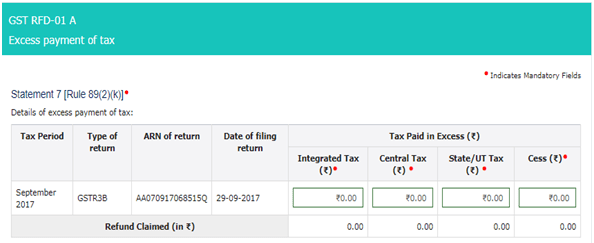

2. After clicking on create tab following screen is visible :

3. Enter the tax amount paid in excess which needs to be claimed in the Details of excess payment of tax

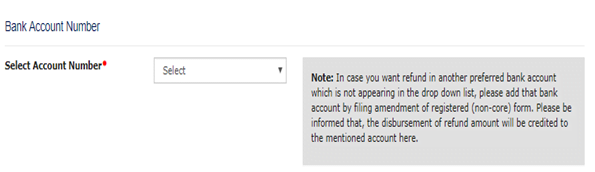

4. Select the Bank Account Number from the drop-down list.

5. Under section Upload Supporting Documents, you can upload supporting documents (if any).

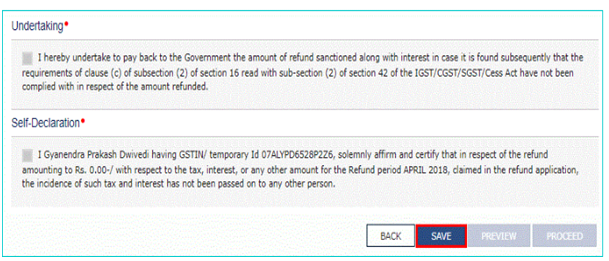

6. Click the SAVE

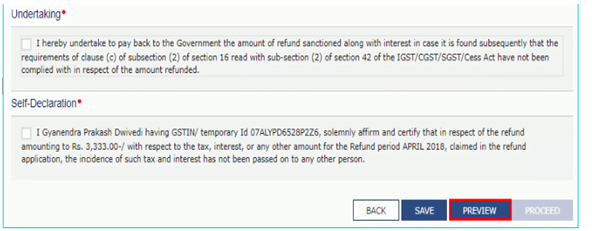

7. Click the PREVIEW button to download the form in PDF format.

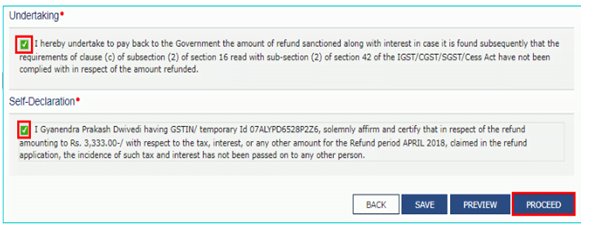

8. Select the Undertaking, Self-Declaration checkbox then click the PROCEED

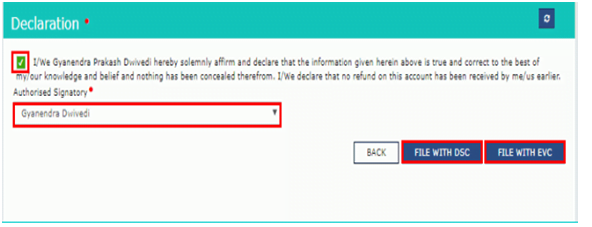

9. Select the Declaration checkbox, in the name of Authorized Signatory drop-down list, select the name of authorized signatory then Click the FILE WITH DSC or FILE WITH EVC

10. After successful filing of refund form the success message is displayed and status is changed to Submitted. Application Reference Number (ARN) receipt is downloaded and ARN is sent on your e-mail address and mobile phone number. Click the PDF to open the receipt.

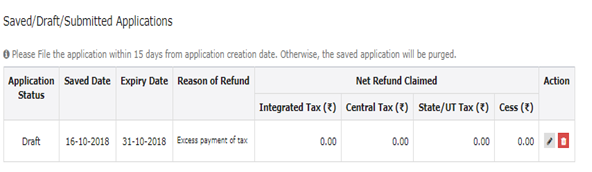

11. After successful filing of Refund Form, the filed refund application can be viewed in Saved/Filed Applications tab : Notes :

Notes :

This Article has been Written by CS Shashank Kothiyal. He Can be reached atshashank.kothiyal9@gmail.com

You May Also Like : Refund Under GST | How to File Refund under GST

GST-RFD-01A- Refund on Account of Excess Payment of Tax, Facility to Claim Refund of Excess Payment of Tax Updated on GSTN Portal, Facility to claim Refund on account of any other reason now enabled, CBIC issues GST refund related Clarification, refund under gst ppt, export refund under gst, refund process under gst, refund procedure under gst, how to claim refund under gst, gst refund in india, gst refund for exporters, who can claim refund in gst, gst refund process for exporters, gst refund in india, who can claim refund in gst, gst refund for exporters, how to claim gst refund in india, gst refund rules, refund rules under gst, under gst law refund can be for claiming igst cgst sgst, refund process under gst, refund procedure under gst, gst refund in india, who can claim refund in gst, gst refund for exporters, refund of input tax credit under gst, gst refund process for exporters, how to claim gst refund in india

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"