A new field titled 'Mode of Export of Services' will be introduced in eBRC format for the Services Export category from May 1, 2025.

Nidhi | Apr 24, 2025 |

![Export of Service: Govt Introduces Mode of Export of Services Field in eBRC Format [Read Circular]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2025/04/GOVT-INTRODUCES-MODE-OF-EXPORT-OF-SERVICES-FIELD-IN-EBRC-FORMAT.jpg)

Export of Service: Govt Introduces Mode of Export of Services Field in eBRC Format [Read Circular]

The Government of India has made an important update in the export of services. As per the Trade Notice No. 02/2025-26, a new field titled ‘Mode of Export of Services‘ will be introduced in the Electronic Bank Realisation Certificate (eBRC) format for the Services Export category. The update will take effect from May 1, 2025.

The government focuses on improving the information and accuracy of services export data by designing this field. Along with this, the update also lines up with international rules under the General Agreement on Trade in Services (GATS) of the WTO.

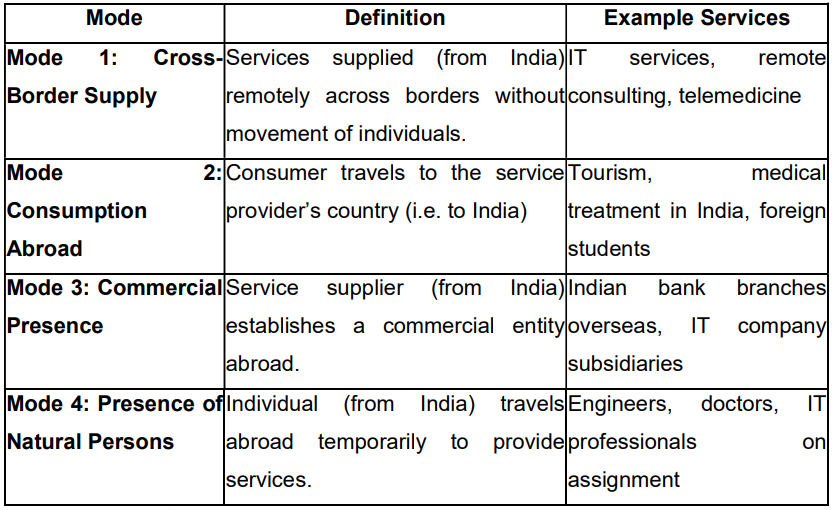

The new update instructs exporters to specify the ‘Mode of Export of Services‘ when certifying eBRCs linked to IRMs. This means that the new field will ask exporters to show how the service was exported, such as whether it was through cross-border supply, consumption abroad, commercial presence or by the presence of persons.

The four modes of services trade stated under GATS are as follows:

Refer to the circular for complete process

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"