Deepak Gupta | Nov 13, 2018 |

how to file gstr 9 online, gstr 9 pdf, gstr 9 format, gstr 9 format in excel, gstr 9 format pdf, gstr 9 notification, gstr 9 due date, gstr 9 form pdf, GSTR-9, GST Annual Return, GSTR 9 , how to file annual return for GST, filing of GSTR 9, GSTR 9 : Annual Return Filing Format Eligibility & Rules, Filing Process of GST Annual Return GSTR 9, annual return under gst GSTR 9, How to File GST Annual Return GSTR 9, gst annual return format pdf and excel,gst annual return pdf, gst annual return format, gst annual return format in excel, gst annual return format pdf, gst annual return due date, annual return under gst pdf, gst annual return notification, gstr 9 annual return

A Complete Guide on GST Annual Return : GSTR 9All companies (private limited company, one person company, limited company, section 8 company, etc) are required to file an annual return with the MCA every year. In addition to filing MCA annual return, companies would also be required tofile income tax return.

The concept of Annual returns has been effectuated under GST. Although the concept of Annual return was in vogue by virtue of VAT Statutes in certain states, the same wasnt there in the Service Tax Statute as well as the Excise Law.

In this article let us discuss about Annual Return GSTR 9 to be filed by 31st December by every normal registered person.

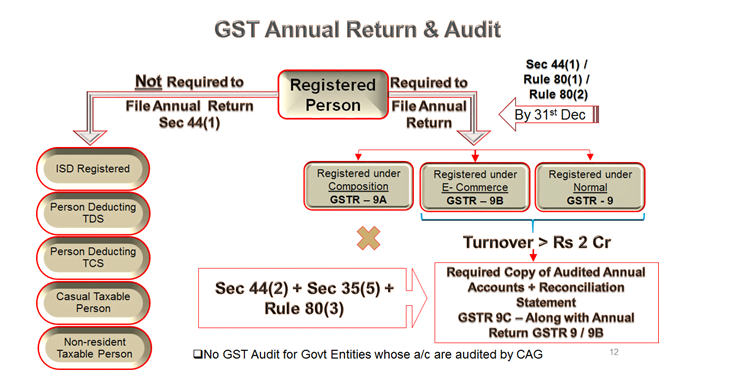

Legal Provisions of Audit & Annual Return:

Section 44 of CGST Act 2017

(1) Every registered person, other than an Input Service Distributor, a person paying tax undersection 51orsection 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and manner as may be prescribedonorbeforethe31 st day of December following theend of such financial year.

(2) Every registered person who is required to get his accountsAuditedin accordance with the provisions ofsub-section (5) of Section 35shall furnish, electronically, theannual returnunder sub-section (1) along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement, and such other particulars as may be prescribed

Sec 35(5) of CGST Act:

Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant Accounts and other records and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed.

Rule 80 of CGST Rules: Annual return.-

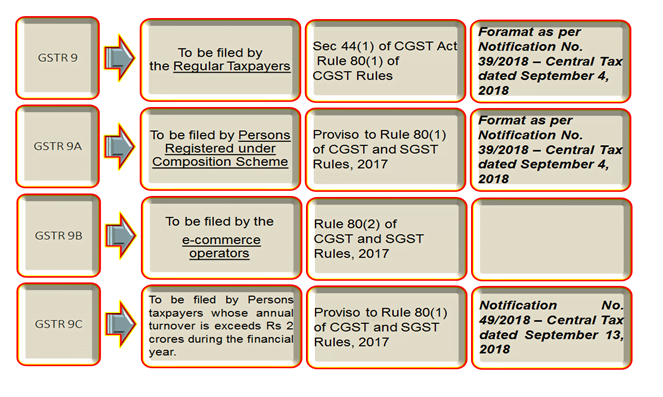

(1) Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return as specified under sub-section (1) of section 44 electronically in FORM GSTR-9 through the common portal either directly or through a Facilitation Centre notified by the Commissioner:

Provided that a person paying tax under section 10 shall furnish the annual return in FORM GSTR-9A.

(2) Every electronic commerce operator required to collect tax at source under section 52 shall furnish annual statement referred to in sub-section (5) of the said section in FORM GSTR -9B.

(3) Every registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR-9C, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

That means every Normal Taxable Person need to file annual Return in the Form GSTR 9

The Annual Return merely summarizes the data for the relevant financial year based on the disclosure made in the relevant Form GSTR 1 and Form GSTR 3B.

GSTR-9 shall be filed on or before 31st December of the subsequent financial year. For instance, for FY 2017-18, the due date for filing GSTR 9 is 31st December 2018

Form Notified vide : Notification No. 39/2018 Central Tax dated September 4, 2018

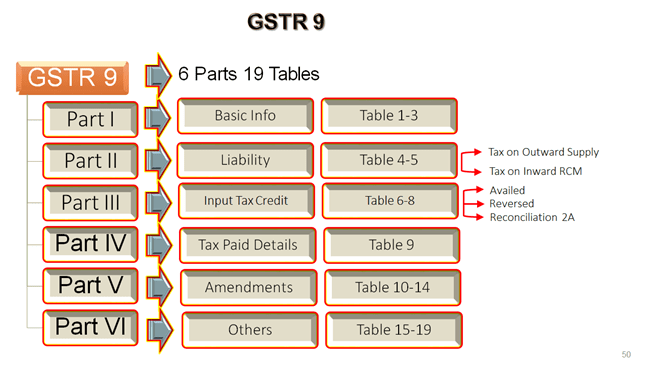

GSTR 9 has Six Parts and Nineteen Table

For more details please see the You Tube @ the following Link

https://www.youtube.com/watchv=yLrsDkAV978&t=107s

Disclaimer :The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & AuthorCan be reached @ [email protected]

You May Also Like:Analysis of GST Annual Return Form GSTR 9

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"