Deepak Gupta | Nov 25, 2018 |

Basic Detailsfor GST Annual Returns :

GST Annual Return isto be filed once in a year by the registered taxpayers under GST including those registered under composition levy scheme. This form consists of details regarding the supplies made and received during the year under different tax heads i.e. CGST, SGST and IGST. It consolidates the information furnished in the monthly/quarterly returns during the year.

Through this article we have tried to complied basic questions on Basic Detailsfor GST Annual Returns.

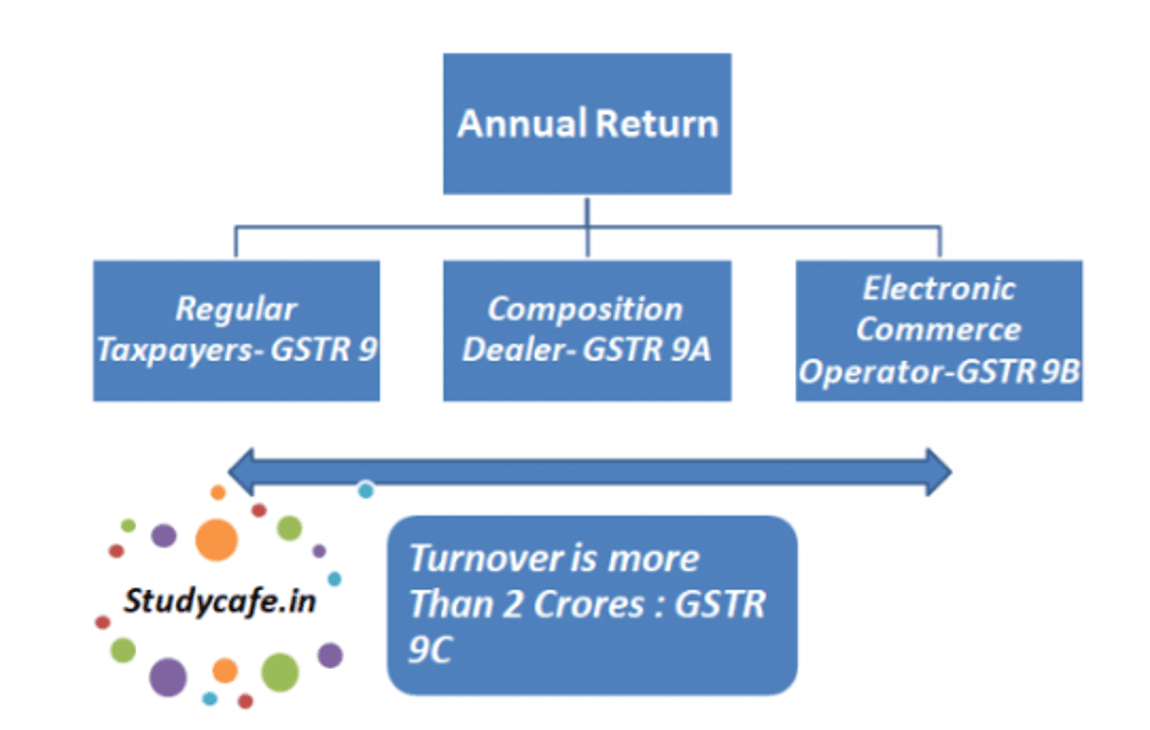

There are 4 types of return under GSTR 9 :

4 types of return under GST

| For FY 17-18 no GST annual return for electronic commerce operator or GSTR 9B has been notified. Also the provisions of TDS and TCS were notified after March 2018, so it is quite clear that no GST 9B is required to be filed for FY 17-18 |

GSTR 9C should be filed by the taxpayers whose annual turnover exceeds Rs 2 crores during the financial year.All such taxpayers are also required to get their accounts audited and file a copy of audited annual accounts and reconciliation statement of tax already paid and tax payable as per audited accounts along with GSTR 9C.

The due date for filing GST Annual Returnfor FY 2017-18 is 30th June 2019.

Following persons are not required to file GSTR 9:

A. Casual Taxable Person

B. Input service distributors (ISD)

C.Non-resident taxable persons

D. Persons paying TDS under section 51.

1. Notice to defaulters: A notice shall be issued to defaulter requiring him to furnish such return within fifteen days in such form and manner as may be prescribed.

2. Late Fee : for delayed filing Late fee of Rs. 100/- per day for delay in furnishing GST Annual Return, subject to a maximum amount of quarter percent (0.25%) of the turnover in the State or Union Territory shall be imposed. Similar provisions for levy of late fee exist under the State / Union Territory GST Act, 2017. Therefore it can be concluded that a late fee of Rs.200/- per day (Rs. 100 under CGST law +Rs. 100/- under State / Union Territory GST law) could be levied which would be capped to a maximum amount of half percent (0.25% under the CGST Law + 0.25% under the SGST / UTGST Law) of turnover in the State or Union Territory.

3. General Penalty : for Contravention of Provisions A General Penalty may extend to twenty-five thousand rupees has been provided under CGST Act. An equal amount of penalty under the SGST/UTGST Act would also be applicable. To sum up a penalty of up to Rs.50,000/- (25000 under CGST Act + 25000 under SGST Act) could be levied. As of now the Due date of submitting Annual Return and GST Audit is 31st March 2018 [For FY 17-18]. Professionals should take due care of this date and do this compliance on time to avoid any penalty or litigation.

No payment is to be made with annual return except late fee and Payment to be made on voluntary basis in DRC-03. While filing GSTR 9C taxpayer can make payment of taxes based on auditors recommendation but in that case also payment will be made by form DRC-03 andNavigation option to make payment will be available in GSTR 9C which will be linked with GSTR DRC-03

Click here to Download Excel and word Formats of GST Annual Return.

After Reading this article viewers are requested to comment there queries on comment section given below. There queries will be incorporated in this article after due research.

(The Author of this Article can be reached at [email protected])

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information.In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information. Please refer your consultant before relying on the provisions of this article.

gst annual return format, gstr 9 annual return format in excel, gst annual return format in excel, gst annual return pdf, gstr 9 pdf, gstr 9 format, gstr 9 format in excel, gstr 9 format pdf

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"