financialcontrol-in | Dec 5, 2018 |

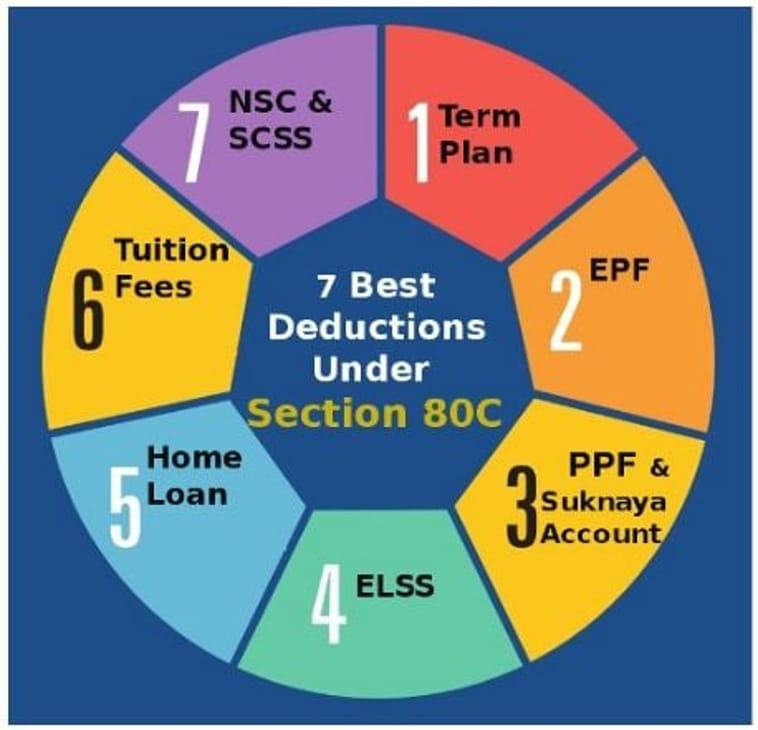

Complete guide on Income Tax deduction u/s 80C, 80CCD, 80CCC & 80CCG:

Section “80C” which is the most widely used section of the Income Tax Act and the deductions available, there is various subsection available in this segment. Under this guide, we will understand all about income tax deduction under section 80C, 80CCD, 80CCC & 80CCG.

Whetherthe taxpayer filling there returns in ITR I to V, the deduction under section 80C and their subsections are permitted.

Every individual, HUF, professional, partnership firm and a small business all are concern about:

Section 80C consists of several segments permitted for the taxpayer to deduct their said expenditure from their income, which results in tax saving.

PPF (Publicprovident scheme) is the long-term investmentsegment which was governedby the Government of India, the investor gets a certainrate of interestwhich is variable.

The investor gets the tax exemption up to 1,50,000 if invested in PPF.

These segments consist of tax saving investment in the mutual fund which is exempted up to 1,50,000, this way people are also encouraged to invest in mutual funds.

Tax saving bank FD is just like a normal fixed deposit with any nationalized bank, the only restriction is (5 years lock-in period).

If you opt for tax saving FD with the bank you will get the benefit of tax saving up to 1,50,000 with the restriction that you can not withdrawbefore 5 years. If you do the amount will be added to your income.

Paying you child tuitionfee is also exempted u/s 80C by the departmentof Income-tax if you paid for the school, college or institutesituated in India.

The tax exemption is only allowed for two children up to 1,50,000.

Having a life insurance policy whether in a form of term plan or some other endorsement plan, secure your family for any unhappening.

The Premium paid for yourself, your spouse or your childrenup to 1,50,000 is exempted u/s 80C. Premium paid for your parents is not included, you can avail insurance premium payment of more than one. Any insurance company policy is considered, whether it is public or private.

Every individual (basically an employee) holding a home loan, if we talk about the home loan:

It consists of repayment of (principal amount and interest),

Payment of interestamount already exempted u/s 80EE (The maximum limit for claiming deduction under section 80EEis 50,000).

And, the principal amount repayment is exempted u/s 80C, so if you are having a home loandon’t format to claim repayment of principal amount u/s 80C.

Other then principal amount repaymentexpenses incurred on stamp duty and registration charges for purchase of house property also qualify for tax deduction u/s 80C.

This segment is as same as “Tax saving bank FD”. You can go for one year, two years, three years or four years but the investment made for 5 yearsunder the scheme would be consideredas exempted u/s 80C.

Important Note: Section 80C, 80CCC and 80CCD(1) are permitted in totality of tax exemption upto50,000.

Under section 80CCC the taxpayer avail the benefit of tax deduction maximum to 1,50,000 for certain pension fund. If the amount claimed u/s 80CCC for the pension fund, it should not be claimed in any other section.

The section is the scheme introduced to encourage the individual to invest in the pension fund of the central government, the only individual taxpayer is eligible for the deduction up to 1,50,000

In other words, this section is the contribution of the employee maximum deduction allowed is 10% of salary or 20% of gross total income if self-employed.

This was the new section introduced for an additional deduction of section 80ccd(1) of 50,000 to pension scheme of central government.

The total tax benefits that can be claimed against NPS u/s 80CCD(1) + u/s 80CCD(1B) equals to 2 Lakhs for financial year.

This was another addition contribution to pension scheme of central government of Indiafor the taxpayer from employer sideup to 10% of the salary of the employee.

This section is a very interesting deduction “Investment made under equity saving scheme”.

Under this section, if you are a first-time equity investor, this action strengthening the power of investing for the individual. The individual having a valid Demat account indulge with equity market or derivative market avail the scheme with 25 % tax benefit for the maximum investment of 50,000.

Also Read:Important facts about home loans (Download EMI calculator)

If the taxpayer investment of 50,000, he will get the tax benefit of 25,000.

You May Also Like:Deductions under section 80C to 80 U of Income Tax Act 1961 AY 2019-20 | FY 2018-19

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"