Deepak Gupta | Mar 23, 2019 |

SC Judgment on Provident Fund : Applicability on employers/ employees

Hello friends, earlier I wrote an article on Understanding recent SC Judgment on deduction of PF of special allowances.

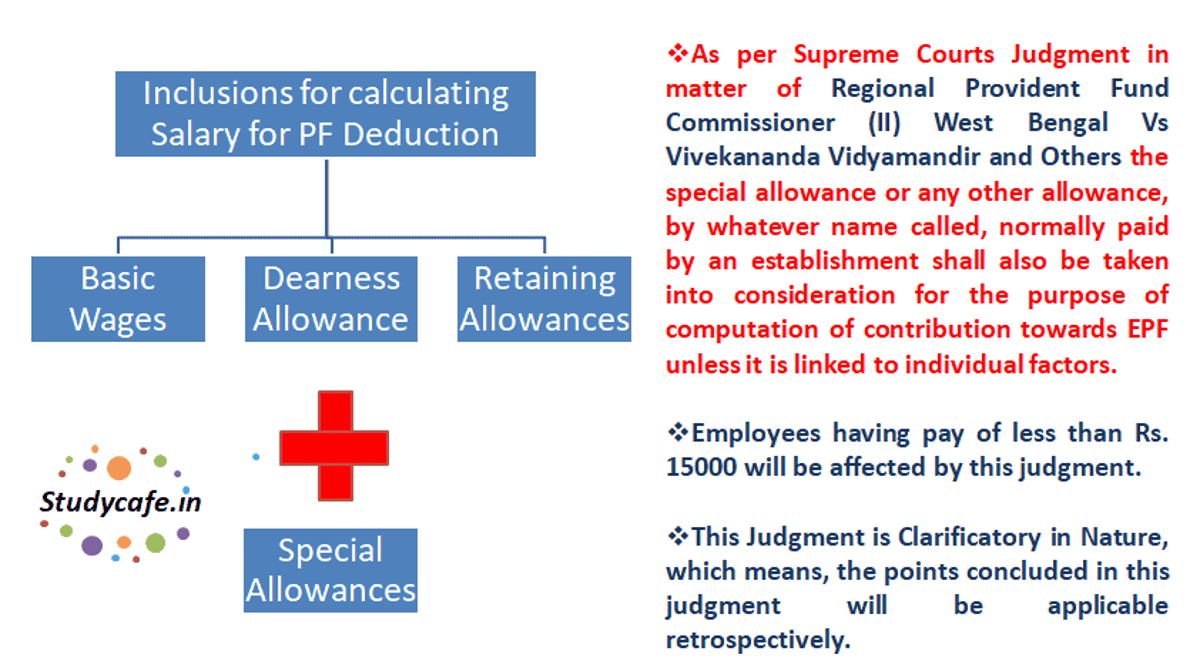

From that judgement we learnt that the special allowance or any other allowance, by whatever name called, normally paid by an establishment shall be taken into consideration for the purpose of computation of contribution towards EPF unless it is linked to individual factors.

I have received 2 queries in that article, which I would like to answer through this article.

What all will be the categories of employers or employees that will be effected by this Judgement

As per Definition of Excluded employee an employee whose pay at the time he is otherwise entitled to become a member of the Fund, exceeds fifteen thousand rupees per month is an Excluded Employee. [ Employees’ Provident Funds Scheme, 1952 is not applicable on Excluded Employee]

Now this means THE EMPLOYEES PROVIDENT FUNDS AND MISCELLANEOUS PROVISIONS ACT, 1952 is not compulsorily applicable when pay of employee is more than Rs. 15000

[The limit of Rs. 15000 was from 1st September 2014, prior to that the limit was Rs. 6500]

This Simply means that employees having pay of less than Rs. 15000 will be affected by this judgment.

Also Employers having employees whose basic pay is less than 15000 will be affected by this Judgement.

Will this Judgement be applicable retrospectively

Applicability of this Judgement : This Judgment was Clarificatory in Nature, which means, the points concluded in this judgment will be applicable retrospectively.

Also still these are the personal views on understanding of the judgment, and official clarification from government is still pending.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information.In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information.

Tags : SC Judgment on Provident Fund : Applicability on employers/ employees, Provident Fund, provident fund deduction from salary, calculation of salary for PF, salarydefinitionfor pf calculation

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"