sanskritijain86gmail-com | Mar 25, 2019 |

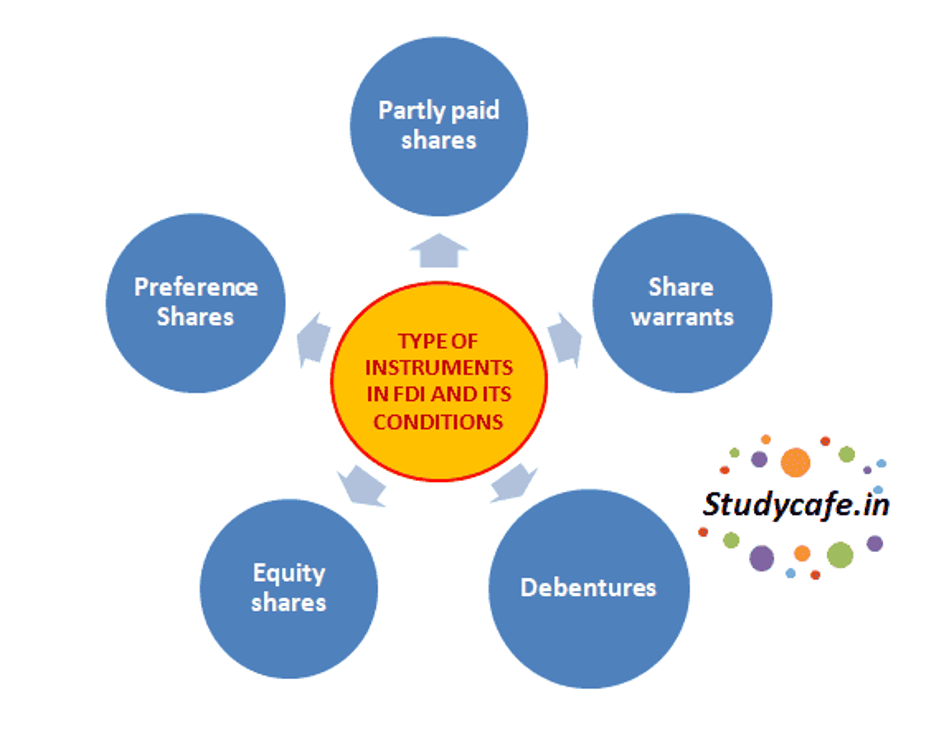

TYPE OF INSTRUMENTS IN FDI AND ITS CONDITIONS

An Indian company is permitted to receive foreign investment by issuing capital instruments to the investor. The capital instruments are equity shares, debentures, preference shares and share warrants issued by the Indian company.

Equity shares: Equity shares are those issued in accordance with the provisions of the Companies Act, 2013 and will include equity shares that have been partly paid.

Partly paid shares: Partly paid shares issued on or after July 8, 2014 will be considered as capital instruments. Partly paid shares that have been issued to a person resident outside India should be fully called-up within twelve months of such issue. Twenty five percent of the total consideration amount (including share premium, if any), shall be received upfront.

The time period of 12 months for receipt of the balance consideration need not be insisted upon where the issue size exceeds rupees five hundred crore and the issuer complies with Regulation 17 of the SEBI

Share warrants: Share warrants issued on or after July 8, 2014 will be considered as capital instruments. At least twenty five percent of the consideration shall be received upfront and the balance amount within eighteen months of issuance of share warrants

Debentures: Debentures are fully, compulsorily and mandatorily convertible debentures.

Preference shares: Preference shares are fully, compulsorily and mandatorily convertible preference shares.

Issue of Securities:

The capital instruments should be issued within 180 days from the date of receipt of the inward remittance received through normal banking channels including escrow account opened and maintained for the purpose or by debit to the NRE/FCNR (B) account of the non-resident investor. In case, the capital instruments are not issued within 180 days from the date of receipt of the inward remittance or date of debit to the NRE/FCNR (B) account, the amount of consideration so received should be refunded immediately to the non-resident investor by outward remittance through normal banking channels or by credit to the NRE/FCNR (B) account, as the case may be.

Pricing of shares

Price of shares issued to persons resident outside India under the FDI Policy, shall not be less than

1.) the price worked as per SEBI guidelines, as applicable, where the shares of the company are listed on any recognised stock exchange in India;

2.) the fair valuation of shares done as per any internationally accepted pricing methodology for valuation of shares on arms length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker where the shares of the company are not listed on any recognised stock exchange in India

3.) the price as applicable to transfer of shares from resident to non-resident is

– where shares of an Indian company are listed on a recognized stock exchange in India, the price of shares transferred by way of sale shall not be less than the price at which a preferential allotment of shares can be made under the SEBI Guidelines, as applicable, provided that the same is determined for such duration as specified therein, preceding the relevant date, which shall be the date of purchase or sale of shares.

where the shares of an Indian company are not listed on a recognized stock exchange in India, the transfer of shares shall be at a price not less than the fair value worked out as per any internationally accepted pricing methodology for valuation of shares on arms length basis which should be duly certified by a Chartered Accountant or a SEBI registered Merchant Banker.

However, where non-residents (including NRIs) are making investments in an Indian company in compliance with the provisions of the Companies Act, as applicable, by way of subscription to its Memorandum of Association, such investments may be made at face value subject to their eligibility to invest under the FDI scheme.

Exit from foreign direct investment with optionality clauses for the unlisted Indian companies

In case of an unlisted company, the non-resident investor shall be eligible to exit from the investment in equity shares, Compulsorily Convertible Debentures (CCDs) and Compulsorily Convertible Preference Shares (CCPS) of the investee company at a price not exceeding that arrived at as per any internationally accepted pricing methodology on arms length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker.

The guiding principle would be that the non-resident investor is not guaranteed any assured exit price at the time of making such investment/agreements and shall exit at the fair price computed as above at the time of exit, subject to lock-in period requirement, as applicable.

To any foreign investor looking into an opportunity to invest in India, one of the primary concerns is the time required to set up a legal entity in India and how simple / difficult it is to get various registrations / approvals, if any, and the compliance regime of the country. Indian Government had been proactively involved for past few years to improve Indias standing in ease of doing business and has achieved remarkable success in doing so. In a bid to simplify the existing compliances with respect to the Foreign Direct Investment, the Indian Government came out with major changes with the policies which seeks to revamp regulations to regulate investment in India by a Person Resident Outside India.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"