CA Pratibha Goyal | Jun 1, 2019 |

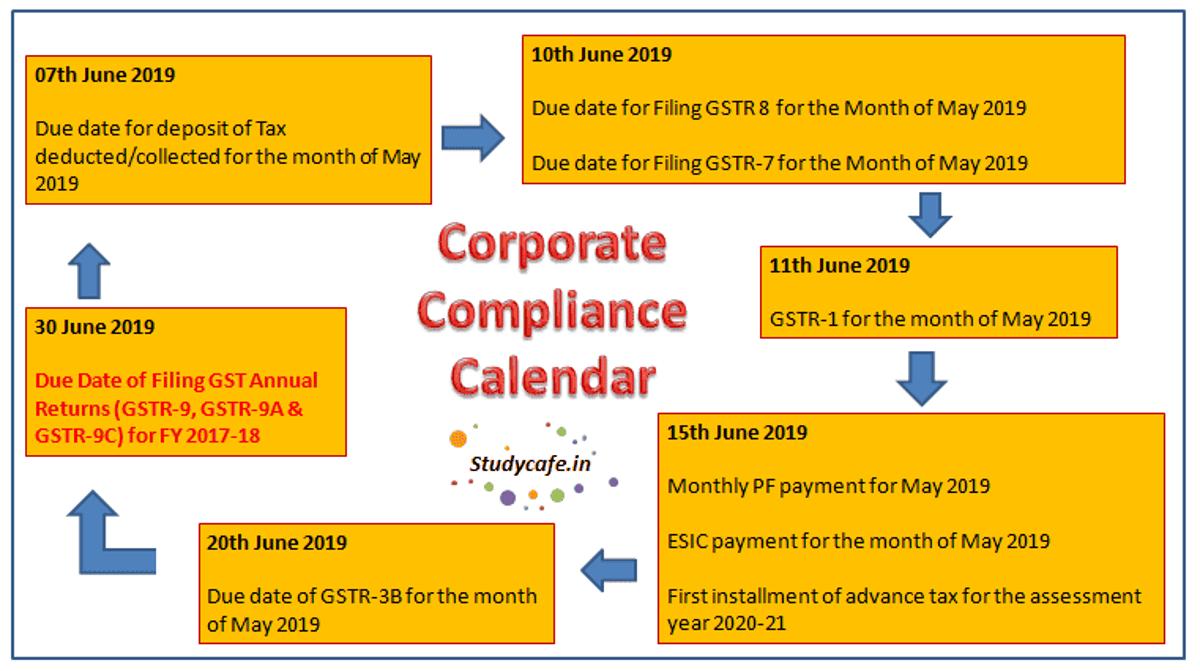

Due Date Compliance Calender June 2019 | GST Due Date Calender June 2019

Below is the Due Date Compliance Calender June 2019, GST Due Date Calender June 2019, Income Tax Due Date Calender June 2019. Kindly refer the calendar in advance and plan your work for smooth compliance and avoiding penalty.

In case we have missed something please leave comment so that we can update it in our article.

Due date | Due date relates to: | Who needs to do the compliance | Relevant provision |

7th June 2019 | Depositing TDS liability | Due date for deposit of Tax deducted/Collected by Assessee during the month of May 2019 | Kindly Refer our Article on Due dates of Filing TDS/ TCS Return and Depositing TDS |

10th June 2019 | Due date for Filing GST TCS Returns or Form GSTR 8 for the Month of May 2019 | Every electronic commerce operator (operator), not being an agent, shall collect TCS at prescribed rate when taxable supplies are made through it by other suppliers and the consideration with respect to such supplies is to be collected by the operator. | Section 52 of CGST Act 2017 |

10th June 2019 | Due date for Filing GST TDS Returns for the Month of May 2019 | Following persons are required to deduct TDS: (a)a department or establishment of the Central Government or State Government; or (b) local authority; or (c) Governmental agencies; or (d) such persons or category of persons as June be notified by the Government on the recommendations of the Council | Section 51 of CGST Act 2017 |

11th June 2019 | GSTR-1 for the month of May 2019 | Taxpayers having turnover of more than 1.5 crs | |

15th June 2019 | PF Monthly PF payment for May 2019 | Employer responsible for deducting Provident Fund | Section 38(1) of The Employees Provident Fund Scheme, 1952 |

15th June 2019 | ESIC payment for the month of May 2019 | Employer responsible for payment of ESIC | |

20th June 2019 | Due date of GSTR-3B for the month of May 2019 | All registered Tax Payers | |

30th June 2019 | Filling Annual Returns for FY 2017-18 | All registered Tax Payers | |

30th June 2019 | GST Audit for FY 2017-18 | All registered Tax Payers whose t/o is more than 2 Crs |

Also We have listed some of the Major MCA Compliance for June 2019, some of them are not notified for June 2019 but one should be prepared about them in advance.

MCA Form | Due date | Who need to do this compliance |

INC-22A | 15th June 2019 | Every company incorporated before 31st December 2017 |

NFRA-1 | 30 Days from the Date of Availability of Form | Every company on which NFRA Rules apply |

BEN-1 | Within 90 days of the commencement of the Companies (Significant Beneficial Owners) Amendment Rules, 2019 E-Form not deployed yet | A person having Significant beneficial owner shall file a declaration to the reporting company |

BEN-2 | Within 30 days from the date of receipt of declaration in BEN-1 E-Form not deployed yet | Reporting Company |

DIR-3 KYC | Within 30 days from the date of deployment of revised e-form E-Form not deployed yet | Any person having Director Identification Number |

E Form DPT 3 (One Time Return) | 29th June 2019 | Companies having amounts which are NOT deposits (exempted deposits) as on 31.3.2019 AND received on or after 1.4.2014 |

E Form DPT 3 (Half Yearly Return) | 30th June 2019 | Transaction during the year, which are deposits as well as and which are not deposits (exempted deposits) |

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information

Tags : gst return due date, gst payment due date, due dates for gst returns, gstr 3b due date for June 2019, gstr 1 due date, gstr 1 due date extended, gstr 1 due date for June 2019, gstr 1 due date for June 2019, tds return due date , tds payment due date for June 2019, tds payment due date

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"