Now an individual taxpayer can file ITR and Accept Tax Audit with Adhaar OTP.

CA Pratibha Goyal | Jun 29, 2024 |

Digital Signatures Bye Bye: Now file ITR and Accept Tax Audit with Adhaar OTP

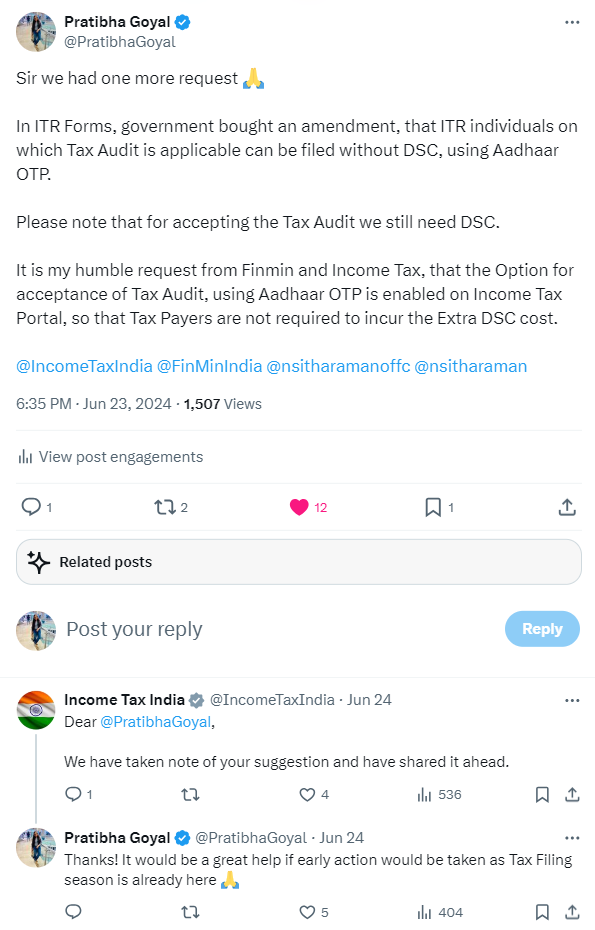

In a very radical step, taken by our Income Tax Department, now Individual Taxpayers having Tax Audit don’t require a Digital Signature Certificate (DSC) to Approve Tax Audits.

In Income Tax Return (ITR) Forms, the government bought an amendment, that the ITRs of individuals on which Tax Audit is applicable can be filed without DSC, using Aadhaar OTP.

However, this amendment was of no use as, for accepting the Tax Audit one still requires the DSC.

However please also note that there was no provision in Income Tax law that mandated an individual for using the Digital Signatures for approval of Tax Audits.

Now the IT Department has made change on the Income Tax Portal also and individuals having Tax Audit can approve the same by using Aadhaar OTP Now.

Please note that a Chartered Accountant still requires a Digital Signature Certificate for Filing the Tax Audit on Income Tax Portal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"