CA Pratibha Goyal | Jul 6, 2019 |

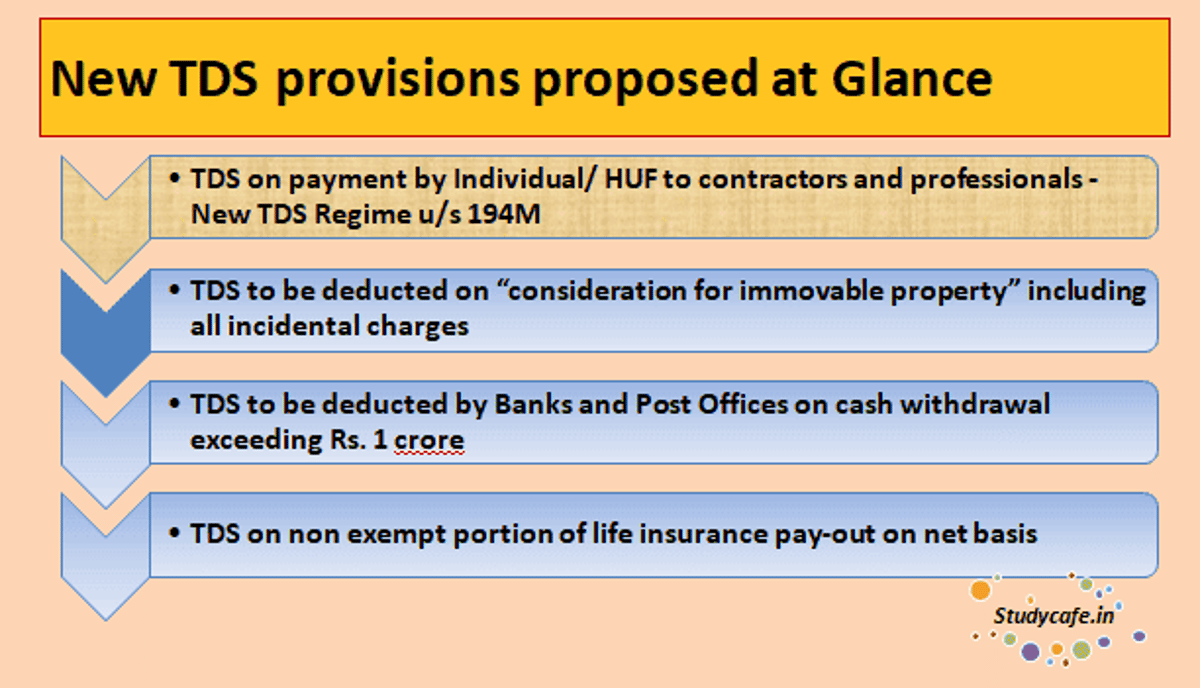

Analysis of all change proposed in TDS provisions : Budget 2019

At present there is no liability on an individual or Hindu undivided family (HUF) to deduct tax at source on any payment made to a resident contractor or professional:

1.) When it is for personal use.

2.) If the individual or HUF is carrying on business or profession which is not subjected to audit, there is no obligation to deduct tax at source on such payment to a resident, even if the payment is for the purpose of business or profession.

Due to this exemption, substantial amount by way of payments made by individuals or HUFs in respect of contractual work or for professional service is escaping the levy of TDS, leaving a loophole for possible tax evasion.

To plug this loophole, it is proposed to insert a new section 194M in the Act to provide for levy of TDS at the rate of five per cent. on the sum, or the aggregate of sums, paid or credited in a year on account of contractual work or professional fees by an individual or a Hindu undivided family, not required to deduct tax at source under section 194C and 194J of the Act, if such sum, or aggregate of such sums, exceeds fifty lakh rupees in a year.

For Example Mr. Deepak engaged a contractor Mr A for construction of his house to whom he paid Rs. 80 lakhs on January 2, 2020 and Mr B for Interior Decoration, to whom he paid Rs. 20 lakhs on March 15, 2020.

So TDS will be deducted as follows:

| Particular | Amount paid | Section | Rate of Deduction | Amount of TDS |

| Construction | 80,00,000 | 194M | 5% | 4,00,000 |

| Interior Decoration | 20,00,000 | No TDS to be Deducted as value is less than 50 Lakhs | ||

This amendment will take effect from 1st September, 2019.

Examples of incidental charges are club membership fee, car parking fee, electricity and water facility fees, maintenance fee, advance fee or any other charges of similar nature, which are incidental to transfer of the immovable property.

For Example Mr Deepak booked a Flat of Rs. 40 Lakhs on 01-06-2019. He paid the entire amount on the date of booking. On that date he was not liable to deduct TDS. At time of handing the possession on 01-11-2019, the seller asked the Mr Deepak for additional payment of Rs. 15 lakhs for car parking and Club Membership Fees.

Now as per the proposed amendment Mr. Deepak shall deduct tax from total consideration (i.e. Rs. 55 lakhs) at 1% (Rs. 55,000) and deposit the same by December 30, 2019.

This amendment will take effect from 1st September, 2019.

In order to further discourage cash transactions and move towards less cash economy, it is proposed to insert a new section 194N in the Act to provide for levy of TDS at the rate of two per cent on cash payments in excess of one crore rupees in aggregate made during the year, by a banking company or cooperative bank or post office, to any person from an account maintained by the recipient.

It is proposed to exempt payment made to certain recipients, such as :

1.) Government,

2.) Banking company,

3.) Cooperative society engaged in carrying on the business of banking,

4.) Post office,

5.) Banking correspondents and white label ATM operators, who are involved in the handling of substantial amounts of cash as a part of their business operation

6.) Any entity exempted by Central Government through a notification in the official Gazette in consultation with the Reserve Bank of India.

This amendment will take effect from 1st September, 2019.

Under section 194DA of the Act, a person is obliged to deduct tax at source, if it pays any sum to a resident under a life insurance policy, which is not exempt under sub-section (10D) of section 10.

The present requirement is to deduct tax at the rate of one per cent. of such sum at the time of payment.

Several concerns have been expressed that deducting tax on gross amount creates difficulties to an assesse who otherwise has to pay tax on net income (i.e after deducting the amount of insurance premium paid by him from the total sum received). From the point of views of tax administration as well, it is preferable to deduct tax on net income so that the income as per TDS return of the deductor can be matched automatically with the return of income filed by the assessee. The person who is paying a sum to a resident under a life insurance policy is aware of the amount of insurance premium paid by the assessee.

Hence, it is proposed to provide for tax deduction at source at the rate of five per cent. on income component of the sum paid by the person.

For Example, In Financial Year 2013-14, Mr. Deepak buys an insurance policy of Rs. 60 lakhs (for a term of 20 years) by paying the premium of Rs. 10 lakhs. He surrenders the policy for Rs. 20 lakhs on 01-10-2019. Prior to the Finance Bill, 2019, the payer insurance co. was required to deduct tax at the rate of 1% on total sum paid (i.e., Rs. 20 lakhs) to Mr. Deepak. However, after the proposed amendment, tax shall be deducted at the rate of 5% on the net income and not on the gross amount paid to insured (Mr. Deepak).

Thus, the insurance company will be required to compute the taxable amount in hands of Mr. Deepak.

In this case, long term capital gains will arise in the hands of Mr. Deepak as period of holding is more than 36 months.

| Consideration | 2000000 |

| Cost of Acquisition (Rs. 10 lakhs * 290 (CII for FY 2019-20)/220 (CII for FY 2013-14) | 13,18,182 |

| LTCG | 6,81,818 |

| TDS to be Deducted | 34,091 |

Cost inflation index for the financial year 2019-20 has been assumed as 290.

This amendment shall be effective from 1st September, 2019.

Section 201 of the Act provides that where any person, including the principal officer of a company or an employer (hereinafter called the deductor), who is required to deduct tax at source on any sum in accordance with the provisions of the Act, does not deduct or does not pay such tax or fails to pay such tax after making the deduction, then such person shall be deemed to be an assessee in default in respect of such tax.

The first proviso to sub-section (1) of section 201 specifies that the deductor shall not be deemed to be an assessee in default if he fails to deduct tax on a payment made to a resident, if such resident has furnished his return of income under section 139, disclosed such payment for computing his income in his return of income, paid the tax due on the income declared by him in his return of income and furnished an accountants certificate to this effect.

This relief in section 201 is available to the deductor, only in respect of payments made to a resident. In case of similar failure on payments made to a non-resident, such relief is not available to the deductor. To remove this anomaly, it is proposed to amend the proviso to sub-section (1) of section 201 to extend the benefit of this proviso to a deductor, even in respect of failure to deduct tax on payment to non-resident.

Consequent to this amendment, it is also proposed to amend the proviso to sub-section (1A) of section 201 to provide for levy of interest till the date of filing of return by the non-resident payee (as is the case at present with resident payee).

These amendments will take effect from 1st September, 2019.

Under sub-section (2) of section 195 of the Act, if a person who is responsible for paying any sum to a non-resident which is chargeable to tax under the Act (other than salary) considers that the whole of such sum would not be income chargeable in the case of the recipient, he can make an application to the Assessing Officer to determine the appropriate proportion of such sum chargeable. This provision is used by a person making payment to a non-resident to obtain certificate/order from the Assessing Officer for lower or nil withholding-tax. However, the process is currently manual. In order to use technology to streamline the process, which will not only reduce the time for processing of such applications, but shall also help tax administration in monitoring such payments, it is proposed to amend the provisions of this section to allow for prescribing the form and manner of application to the Assessing Officer and also for the manner of determination of appropriate portion of sum chargable to tax by the Assessing Officer.

Similar amendment is also proposed to be made in sub-section (7) of section 195 which are applicable to specified class of persons or cases.

These amendments will take effect from 1st November, 2019.

Section 206A of the Act relates to furnishing of statement in respect of payment of certain income by way of interest to residents where no tax has been deducted at source.

At present, the section provides for filing of such statements on a floppy, diskette, magnetic tape, CD-ROM, or any other computer readable media. To enable online filing of such statements, it is proposed to substitute this section so as to provide for filing of statement (where tax has not been deducted on payment of interest to residents) in prescribed form in the prescribed manner.

It is also proposed to provide for correction of such statements for rectification of any mistake or to add, delete or update the information furnished.

It is also proposed to make a consequential amendment arising out of amendment carried out by Finance Act, 2019 whereby threshold for TDS on payment of interest by a banking company or cooperative society or public company was raised to forty thousand rupees.

These amendments will take effect from 1st September, 2019.

Source : Memorandum to Budget

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information

Tags : Analysis of all change proposed in TDS provisions, Union Budget 2019, changes proposed in tds provisions, Tax Deducted at Source changes Budget 2019, changes in tds provisions after budget 2019

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"