CA Pratibha Goyal | Jan 4, 2020 |

Cash transactions under Income tax act 1961 (Finance Act 2017) :

Indian Government has taken many steps in direction of curbing Black Money. Besides demonetization, Enactment of the Benami Transactions (Prohibition) Amendment Act, 2016, Launching of Operation Clean Money on 31st January 2017 , amending the Prevention of Money-laundering Act, 2002 through the Finance Act, 2015 government has also been making stringent Income Tax provisions to restrict cash transactions.

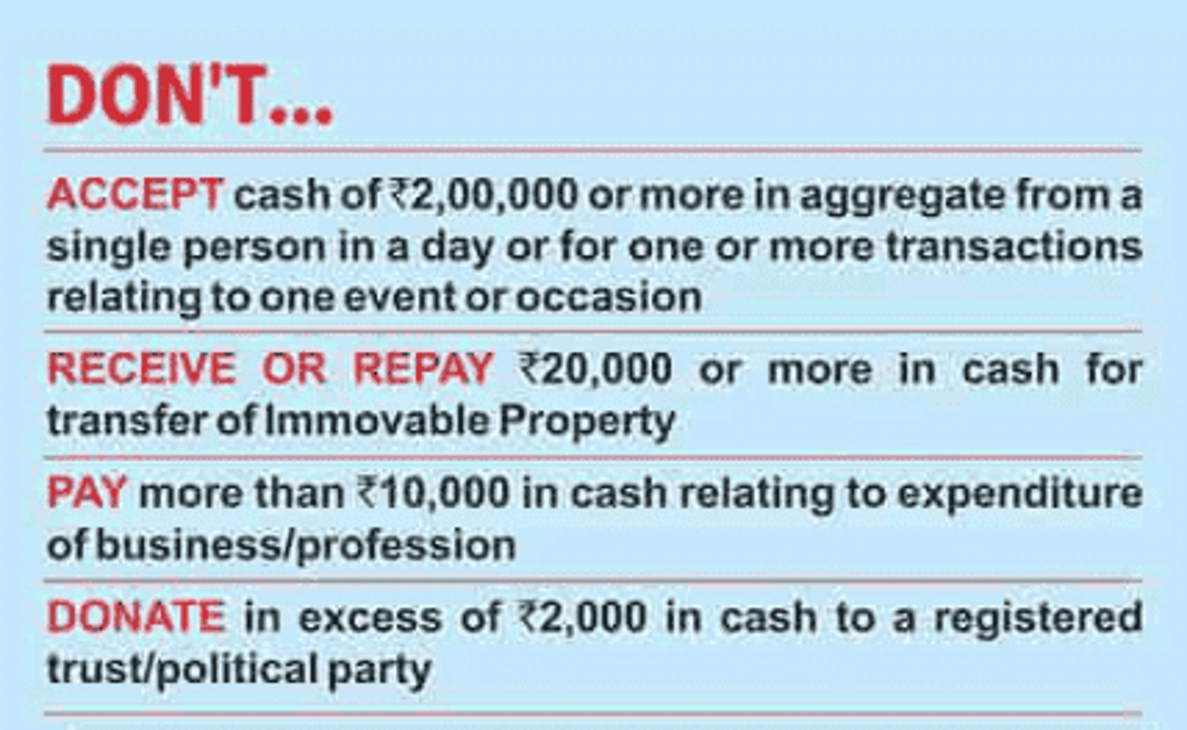

Cash transactions under Income tax act 1961 (Finance Act 2017) have been restricted by below mentioned provisions:

Section 13A of Income Tax Act 1961 [deals with income of political party]

As per this section, no political party shall take contribution of more than 2,000 (reduced from Rs. 20,000) otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account.[As amended by Finance Act 2017 applicable w.e.f. 1st April 2018 i.e. AY 18-19 & onwards ]

Similarly Section 80G of Income Tax Act 1961 [Deduction in respect of donations to certain funds, charitable institutions, etc.] has been amended to reduce the cash donation limit from Rs, 10,000 to Rs 2,000 [As amended by Finance Act 2017 applicable w.e.f. 1st April 2018 i.e. AY 18-19 & onwards ]

Authors Comment : One of the loophole in this provision is that political parties/Charitable Trust can still receive donations in cash. Only bogus number of donors will increase.

Section 40A of Income Tax Act 1961 [deals with disallowance of expenditure]

This section prohibits entities from making payment of more than Rs. 10,000 (reduced from Rs. 20,000) otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account. [As amended by Finance Act 2017 applicable w.e.f. 1st April 2018 i.e. AY 18-19 & onwards ] This section disallows all such expenses under income-tax thus prohibiting entities from making cash payments. The cash transaction limit as per income tax act of Rs. 10,000 is extended to Rs. 35,000 for transport contractor.

Similarly assessee will not be eligible for deduction under Section 35 AD [Deduction in respect of expenditure on specified business] if cash payment or aggregate of payments is made to a person in a day exceeds Rs. 10,000. [As amended by Finance Act 2017 applicable w.e.f. 1st April 2018 i.e. AY 18-19 & onwards ]. In simple words you can say that the cash transaction limit 10000 Rupees is there is Income Tax.

Further Section 43 was amended to exclude the expenditure which is done in cash & exceeds Rs. 10,000 from cost of acquisition of asset. This simply means that assessee will not be eligible for depreciation on the excluded portion of cost of acquisition of asset.[As amended by Finance Act 2017 applicable w.e.f. 1st April 2018 i.e. AY 18-19 & onwards ]

So yes we can understand that the cash transaction limit for business is Rs 10,000 and is cash transaction limit per day

Authors Comment : One of the loophole in this provision is that it says that revenue/capital expenditure can still be done in cash. Assessee can easily split expense by number of days or by bogus expense creditors.

269SS of Income Tax Act 1961 [deals with mode of taking or accepting certain loans, deposits and specified sum]

This section forbids assesses from taking/accepting loans or deposits or specified sum of twenty thousand or more otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account if,

(a) the amount of such loan or deposit or the aggregate amount of such loan and deposit ; or

(b) on the date of taking or accepting such loan or deposit, any loan or deposit taken or accepted earlier by such person from the depositor is remaining unpaid and the amount or the aggregate amount remaining unpaid ; or

(c) the amount or the aggregate amount referred to in clause (a) together with the amount or the aggregate amount referred to in clause (b), is twenty thousand rupees or more

This can be explained with an example: If Mr A has a credit balance of a loan of Rs 19000 from Mr B. Now in this case Mr A cannot take loan in excess of Rs 999 more from Mr B except with an account payee cheque or account payee bank Draft.

| Exceptions | |

| A. | If we are accepting/taking loan or deposit or specified sum from below mentioned persons or if below mentioned persons are accepting/taking loan or deposit or specified sum from any person, provisions of this section shall not apply. |

| 1 | Government |

| 2 | Any banking company, post office savings bank or co-operative bank |

| 3 | Any corporation established by a Central, State or Provincial Act |

| 4 | Any Government company as defined in clause (45) of section 2 of the Companies Act, 2013 |

| 5 | Institution, association or body or class of institutions, associations or bodies notified by Central Government in its official gazzette |

| B. | Where the person from whom the loan or deposit or specified sum is taken/accepted and the person by whom the loan or deposit or specified sum is taken/accepted, are both having agricultural income and neither of them has any income chargeable to tax under this Act, the provisions of this section shall not apply. |

269T of Income Tax Act 1961 [ deals with mode of repayment of certain loans or deposits]

Section 269T of Income Tax Act provides that any branch of a banking company or a cooperative society, firm or other person shall not repay any loan or deposit otherwise than by an account payee cheque or account payee bank draft drawn in the name of the person, who has made the loan or deposit, if

(1) The amount of the loan or deposit together with interest is Rs 20000 or more, or

(2) The aggregate amount of loans or deposits held by such person, either in his own name or jointly with other person on the date of such repayment together with interest, is Rs 20000 or more.

For example if A is having loan of Rs 21,000 outstanding to B. Then B cannot repay such loan in cash to A.

| Exceptions | |

| A. | If we are repaying any loan or deposit taken or accepted from below mentioned persons, provisions of this section shall not apply. |

| 1 | Government |

| 2 | Any banking company, post office savings bank or co-operative bank |

| 3 | Any corporation established by a Central, State or Provincial Act |

| 4 | Any Government company as defined in clause (45) of section 2 of the Companies Act, 2013 |

| 5 | Institution, association or body or class of institutions, associations or bodies notified by Central Government in its official gazzette |

“specified sum” means any sum of money receivable, whether as advance or otherwise, in relation to transfer of an immovable property, whether or not the transfer takes place.[Explanation (iv) of Section 269 SS of Income Tax Act 1961]

“Government company” means any company in which not less than fifty-one per cent of the paid-up share capital is held by the Central Government, or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments, and includes a company which is a subsidiary company of such a Government company;[section 2(45) of the Companies Act, 2013]

Authors Comment: 269 SS/269T has been very carefully drafted in order to forbids assesses from taking/accepting loans or deposits or repaying loans or deposits of twenty thousand or more otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account.

Also Government has specifically included any sum of money receivable, whether as advance or otherwise, in relation to transfer of an immovable property, in purview of this section 269 SS.

269ST of Income Tax Act 1961 [deals with mode of undertaking transactions]

Section 269ST is introduced to deter cash transaction for other than loans. To limit the most preferred mode of generating black money or as often used to turning black into white and vice versa, restriction is placed for transacting in cash for above Rs. 2,00,000.

This restriction is for

– A single transaction on

– A single day with

– A single person for

– Single occasion

In short, one can deal in cash, but any transaction in a day from a party should not exceed Rs. 2,00,000 for a transaction related to any one event or occasion. You can also get income tax notice for cash transaction in case you get caught in AIR of Bank etc.

| Exceptions | |

| A. | If we are receiving cash from mentioned persons, provisions of this section shall not apply. |

| 1 | Government |

| 2 | Any banking company, post office savings bank or co-operative bank |

| 3 | Institution, association or body or class of institutions, associations or bodies notified by Central Government in its official gazzette |

Penal Action

| Section | Section Contravened | Penalty |

| Section 271D | Deals with penalty for failure to comply with the provisions of section 269SS | a sum equal to the amount of the loan or deposit accepted/taken |

| Section 271DA | Deals with penalty for failure to comply with provisions of section 269ST | sum equal to the amount of such receipt |

| Section 271E | Deals with penalty for failure to comply with the provisions of section 269T | a sum equal to the amount of the loan or deposit repaid |

Giving incentive when transaction is made via banking Channels

Besides this, Income-tax Act has also been amended to incentivise non-cash transaction. For small traders, who do not maintain proper books of accounts and pay tax based on presumptive basis, an incentive has been given. Unlike, in the past, traders going cashless can declare their income at 6% of profit rather than 8%, if their annual gross turnover is below Rs. 2 crores.

For example, when a trader declares his gross income to be Rs. 180 lakhs, his presumptive profit u/s 44AD will be

– Rs. 14.4 lakhs if he were to deal in cash(Rs. 180 lakhs * 8%)

– Rs. 10.8 lakhs if he were to go cashless(Rs. 180 lakhs * 6%)

The difference in taxable income would amount to Rs. 4 lakhs, almost 25% income being exempt. If we see at the other way, it would amount to great saving in taxes. In the same example, if we were to suppose that the individual proprietor has no other income and is eligible for no other deductions, his tax liability will be

– (1,12,500 + 30% of 4,40,000) + 3% cess = 2,51,835 when his deals in cash; and

– (1,20,000 + 30% of 80,000) + 3% cess = 1,40,595 when he goes cashless.

The result is saving of Rs. 1,11,240 is taxes, which is a great incentive for small traders to go cashless.

Tags : cash transaction limit as per income tax act, cash transaction limit 10000, cash transaction limit for business, cash transaction limit per day, income tax notice for cash transaction

CA Pratibha Goyal

This article has been shared by CA Pratibha Goyal. She runs a youtube channel in name of Studycafe and has a telegram channel as well.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"