CA Pratibha Goyal | Apr 21, 2020 |

GST Portal Update: GSTR3B can be filed by Companies/Firms via EVC

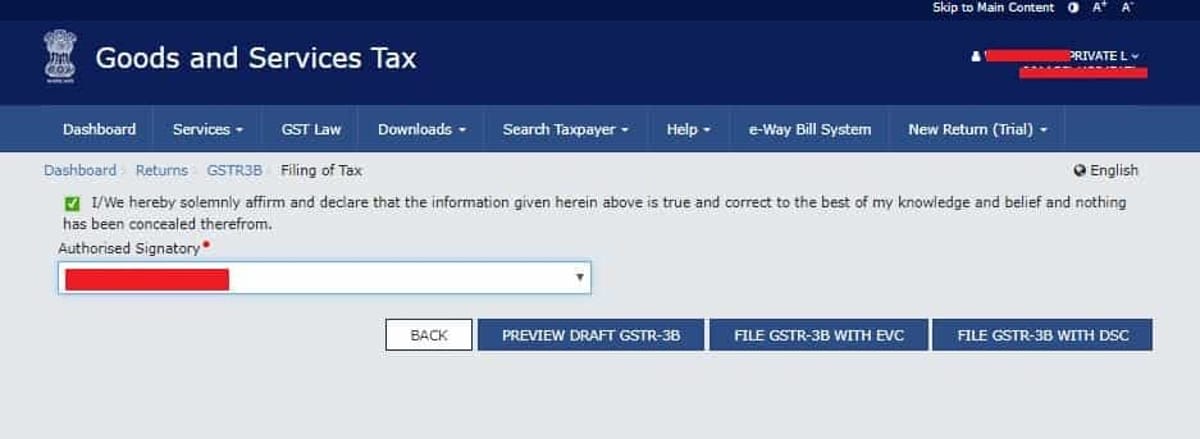

The GST Portal has enabled the option to file GSTR3B via OTP, EVC [Electronic Verification Code] in case on Companies & Partnership Firms Amid COVID-19.

Earlier, companies and Firms could file GSTR-3B only via Digital Signature Certificate. Now GSTR3B via EVC can be filed.

GST Portal Update: GSTR3B can be filed by Companies/Firms via EVC

Please note that as of now this facility is for GSTR3B only. This facility is not their for GSTR1.

You May Also Refer:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"