CA Pratibha Goyal | Jul 29, 2020 |

What is the due date of TDS Return for Quarter 1 FY 2020-21

These days there is a lot of confusion in reference to the due date of filing TDS return for Quarter 1 of FY 2020-21. Let us understand, has the due date been extended or it is 31st July 2020, as per rule 31A.

Due Dates as prescribed in the Income Tax Act is given below:

| Quarter | Quarter Period | TDS Return Due Date |

| 1st Quarter | 1st April to 30th June | 31st July of the Financial Year |

| 2nd Quarter | 1st July to 30th September | 31st Oct of the Financial Year |

| 3rd Quarter | 1st October to 31st December | 31st Jan of the Financial Year |

| 4th Quarter | 1st January to 31st March | 31st May of the Financial Year |

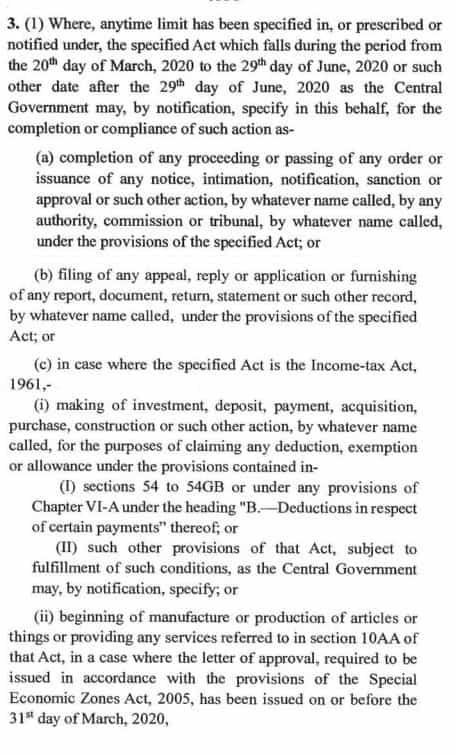

Now as per Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 (hereinafter referred to as “Ordinance 2020”) passed to provide relaxation in relation to tax matters under direct tax laws due to outbreak of COVID-19 pandemic and subsequent nation-wide lockdown imposed.

Based on a literal interpretation of the Notification, it is reasonable to conclude that the due dates of all compliances falling between 20-03-2020 to 31-12-2020 have been extended to 31-03-2021. This extension is not available for all those compliances which are mentioned in the Proviso to the said notification. In the absence of reference to the due date for filing of TDS statement for Q1 of FY 2020-21, it could be concluded that the due date should be 31-03-2021.

The due date for filing of TDS Statement for Q1 and Q2 falls beyond the due date for filing of TDS Statement of Q3. If the literal interpretation of the Notification is applied the deductor gets time till 31-03-2021 to furnish TDS statements for Q1 and Q2 but for Q3 he is required to furnish the statement by 31-01-2021 as this due date is not falling between the stated duration of 20-03-2020 to 31-12-2020. This will create an unyielding situation for the tax deductors as they have to prepare and submit the TDS statement of Q3 much before the due date of furnishing TDS statements of Q1 and Q2 of Financial Year 2020-21.

What is the due date of TDS Return for Quarter 1 FY 2020-21

Further, in the absence of any announcement of a change in the TDS utility, the CPC may automatically charge the late filing fees of Rs. 200 per day if the TDS statement is not filed on or before 31-07-2020.

Thus, it is advisable that the deductors should follow the original prescribed limitation period as far as the due dates for filing of TDS/TCS Statement for Q1 and Q2 of FY 2020-21 are concerned.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"