Studycafe | Dec 31, 2020 |

Important GST Changes Applicable from 1st January 2021

1. Rule 86B, Restriction on use of ITC [Input Tax Credit] for paying GST

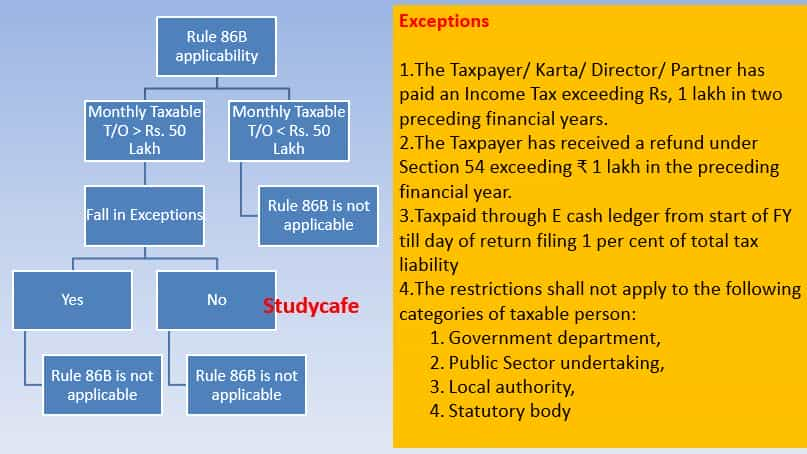

As per GST Notification number, 94/2020-Central Tax dated 22nd Dec 2020, GST rule 86B has been introduced. This rule has imposed a 99% restriction on ITC (Input Tax Credit) available in the electronic credit ledger of the Registered Person. This means 1% of Output liability to be paid in cash. This limitation is applicable where the value of taxable supply other than exempt supply and zero-rated supply, in a month, exceeds fifty lakh rupees.

The Rule has been explained by the below-mentioned Chart:

GST Rule 86B misconceptions, How Taxpayers are interpreting it wrongly

2. QRMP Scheme [Quarterly Return Monthly Payment] for Small Taxpayers with turnover upto Rs 5 Crores

This scheme has been introduced with effect from 1st January 2021. As per this scheme, Small Taxpayers with turnover upto Rs 5 Crores are required to file only 4 Quarterly Return GSTR-3B instead of 12 monthly GSTR-3B. This means now small taxpayers have to file only 8 GST Returns in a year [ 4 GSTR-3B & 4 GSTR-1]. The payment of taxes, however, would be still required to be done on monthly basis.

3. Eway Bill

The period of validity of e-way bills under Rule 138 has been amended (with effect from January 2021) and e-way bill generation shall be restricted under Rule 138E during the period of suspension of registration under Rule 21A.

4. ITC (Input Tax Credit) Restriction under Rule 36(4)

ITC under Rule 36(4) shall be restricted to an additional 5 percent of eligible credits with effect from January 2021 (down from the earlier limit of 10 percent) in respect of invoices or debit notes not furnished by the suppliers.

5. Restriction on Filing GSTR-1

6. GST Registration

7. Registration can be suspended without affording an opportunity of being heard if the proper officer has reasons to believe that that the registration of a person is liable to be canceled under Section 29 or Rule 21. (Amendment in Rule 21A)

8. CBIC appoints January 1, 2021, as the date on which various sections of Finance Act, 2020 shall come into force

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"