Studycafe | Apr 3, 2021 |

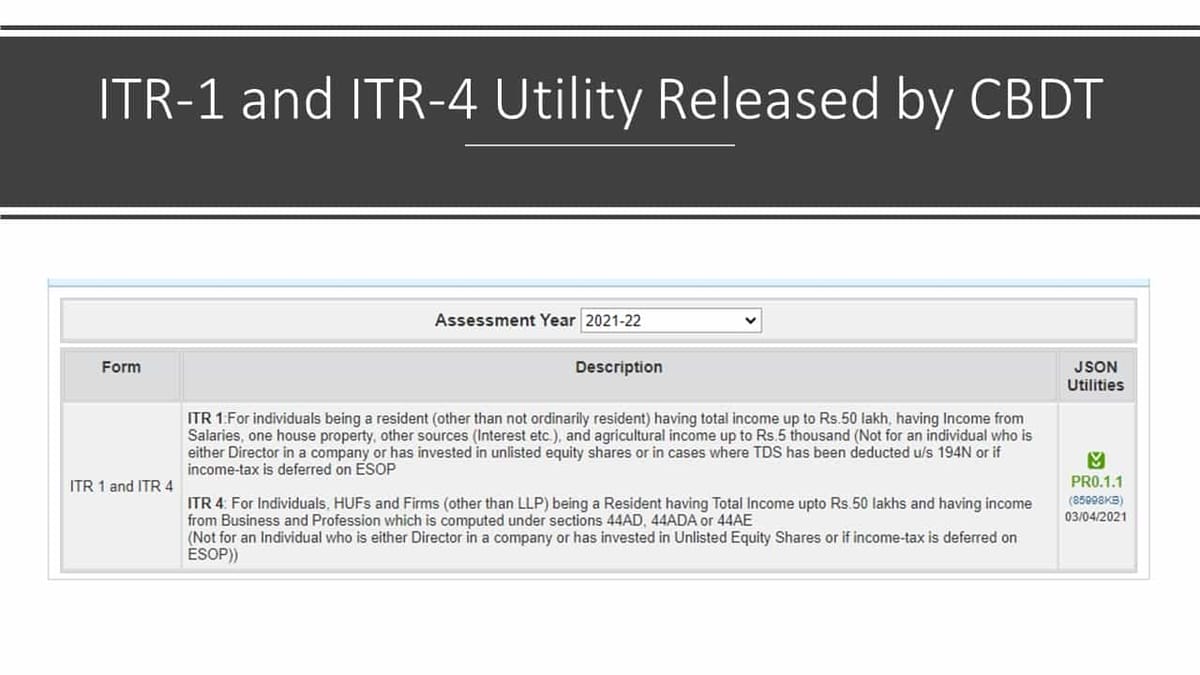

ITR-1 and ITR-4 Utility Released by CBDT

Taxpayers should be happy to note that Income Tax Return Forms [ITR Forms] 1 and 4 have been made available by CBDT.

All the Income Tax Return Forms [ITR Forms] have been notified by CBDT.

Taxpayers who are eligible to file Income Tax Return Forms [ITR Forms] 1 and 4 and do not have TDS Deduction can file their Returns.

The utility for other ITRs will be enabled shortly, the ITR1 to 4 can be filled using a single JSON Utility.

1. Select the Assessment Year

2. Download either excel or Java or JSON utility. The utility by default will get downloaded in your system ‘download’ folder in a compressed mode (ZIP file)

3. Extract (un-compress) the zip file containing the utilities. The folder will be extracted in the same location where the compressed utility was downloaded. Open the utility and start filling.

OS – Windows 7 or later are supported, Processor – Intel Pentium 4 processor or later that’s SSE2 capable or AMD K10 or above core architecture, RAM – 1.5GB of RAM or more, HDD – 500MB or more of free space

Macro enabled MS-Office Excel version 2010/2013/2016 on Microsoft Windows 7 / 8 /10 with .Net Framework (3.5 & above)

Microsoft Windows 7/8/10, Linux and Mac OS 10.x with JRE (Java Runtime Environment) Version 8 with latest updates.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"