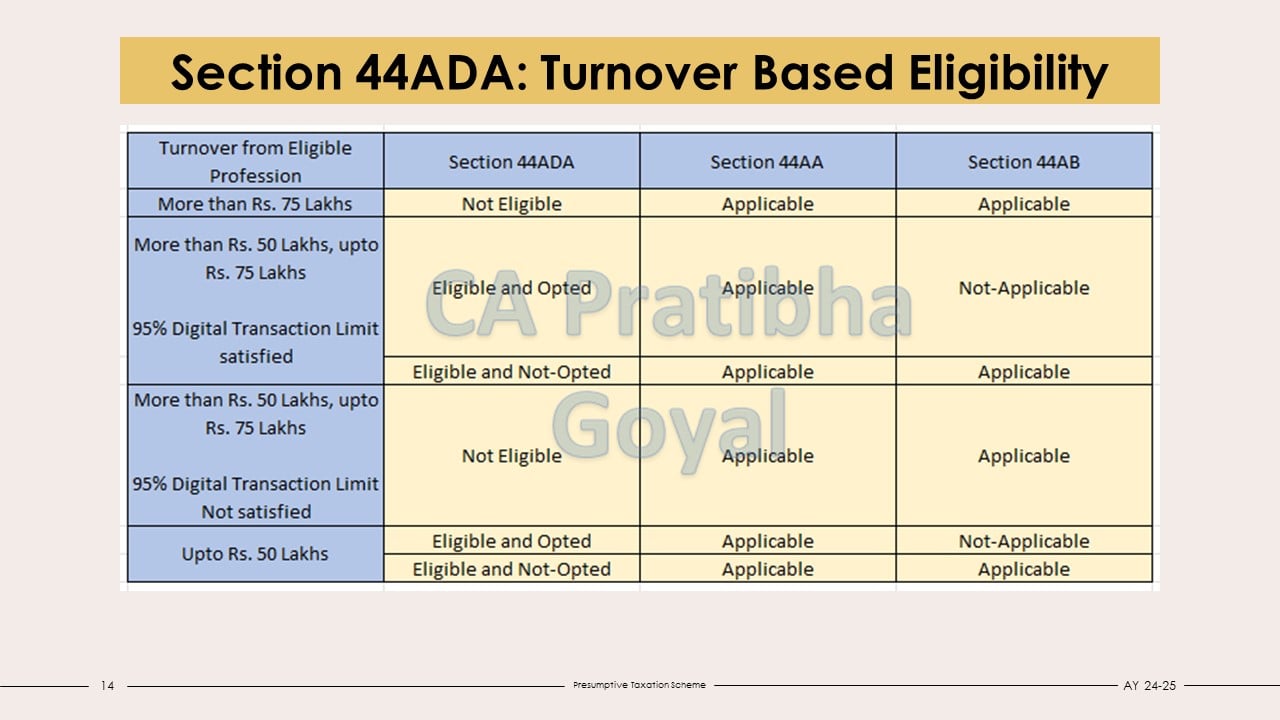

For Section 44ADA, the revised limit for opting Income Tax Presumptive Taxation Scheme from Assessment Year 2024-25 is Rs. 75 Lakhs.

CA Pratibha Goyal | Feb 21, 2024 |

All About New Limits of Income Tax Presumptive Taxation Scheme for Professionals: Section 44ADA

The provisions of Section 44ADA were made applicable from Assessment Year 2017-18. Budget 2023 has enhanced limits for the Income Tax Presumptive Taxation Scheme for Businesses (Section 44AD) and Professionals (Section 44ADA). The new limits are applicable from Assessment Year 2024-25 (Financial Year 2023-24).

This Article discusses all about the Income Tax Presumptive Taxation Scheme for Professionals under Section 44 ADA.

For Section 44AD, the revised limit from Assessment Year 2024-25 is Rs. 3 crore. Earlier, the same was Rs. 2 crore. For Section 44ADA, the revised limit from Assessment Year 2024-25 is Rs. 75 Lakhs Earlier, the same was Rs. 50 lakh.

Read All About New Limits of Income Tax Presumptive Taxation Scheme For Section 44AD

The Increased Limits are subject to the condition that 95% of receipts should be through Onlinemode other than cash/ bearer or crossed cheque/ draft.

Eligible Assessee:

With Effect from Assessment Year 2021-22, Resident Individual, Firm (Other than LLP) is eligible for opting this scheme.

Eligible Professions:

Eligible professions are legal, medical, engineering or architectural profession or the profession of accountancy or technical consultancy or interior decoration or advertising or such other profession as is notified by the Board for the purposes of section 44AA or of this section;

All deductions allowable under the provisions of sections 30 to 38 including Depreciation shall, are deemed to have been already given full effect to and no further deduction under those sections shall be allowed. Even Salary and Interest to Partners are not allowed as deductions.

Further, it will be assumed that disallowance if any u/s 40, 40A and 43B has been considered while calculating the estimated Income u/s 44ADA.

If the above conditions are satisfied, a sum equal to 50 percent or more of the total turnover or gross receipts of the assessee has to be declared as the income of the assessee.

Yes, the assessee opting for Section 44ADA can voluntarily declare higher income in the ITR.

Yes, but he is required to:

a.) Maintain Books of Accounts u/s 44AA,

b.) Get his Books of Accounts audited u/s 44AB.

Maintenance of Books of Accounts:

Section 44ADA does not exempt professionals from the maintenance of Books of Accounts. Professionals opting for Presumptive Taxation Scheme is required to maintain Books of Accounts as per Section 44AA(1).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"