CMA Susanta Kumar Saha | Jun 25, 2018 |

Analysis of unique common enrollment number in FORM GST ENR – 02

Analysis of recent changes notified by Government of India, Ministry of Finance, Department of Revenue, Central Board of Indirect Taxes and Customs

Re: Notification No. 28/2018 Central Tax dated the 19th June, 2018

Central Government, in exercise of the powers conferred by section 164 of the CGST Act, 2017, has made the following rules to amend the Central Goods and Services Tax Rules, 2017, namely:-

1) These rules may be called the Central Goods and Services Tax (Sixth Amendment) Rules, 2018.

2) They (amended rules) shall come into force on the date of their publication in the Official Gazette, save as otherwise provided in these rules.

In the Central Goods and Services Tax Rules, 2017, –

i. Sub-rule (1A) shall be inserted after sub-rule (1) of rule 58 of the CGST Rules, 2017, which stipulates:

(1A) For the purposes of Chapter XVI of these rules, a transporter who is registered in more than one State or Union Territory having the same Permanent Account Number, he may apply for a unique common enrolment number by submitting the details in FORM GST ENR-02 using any one of his Goods and Services Tax Identification Numbers, and upon validation of the details furnished, a unique common enrolment number shall be generated and communicated to the said transporter:

Provided that where the said transporter has obtained a unique common enrolment number, he shall not be eligible to use any of the Goods and Services Tax Identification Numbers for the purposes of the said Chapter XVI.;

A transporter, with single PAN and multiple GSTIN has been allowed to apply for unique common enrolment number in FORM GST ENR – 02. Once theenrolment number is obtained, the transporter cannot use his GSTIN for the purposes of Chapter XVI (LIABILITY TO PAY IN CERTAIN CASES).

ii. A proviso shall be inserted after sub-rule (1) of rule 138C, which stipulates:- Provided that where the circumstances so warrant, the Commissioner, or any other officer authorised by him, may, on sufficient cause being shown, extend the time for recording of the final report in Part B of FORM EWB-03, for a further period not exceeding three days.

Explanation.- The period of twenty four hours or, as the case may be, three days shall be counted from the midnight of the date on which the vehicle was intercepted.;

Rule 138C stipulates Inspection and verification of goods which inter alia states:

1. Proper officer shall record online by uploading,

2. a summary report of inspection of goods in transit in Part A of FORM GST EWB-03 within twenty four hours of inspection;

3. the final report in Part B of FORM GST EWB-03 shall be recorded within three days of such inspection;

4. The time of recording final report now has been extended for further three days when circumstances so warrant with prior permission from the competent authority.

iii. in rule 142, in sub-rule (5), after the words and figures of section 76, the words and figures or section 129 or section 130 shall be inserted;

a. Rule 142 => Notice and order for demand of amounts payable under the Act.

b. Sub-rule (5) of rule 142 => A summary of the order shall be uploaded electronically in FORM GST DRC-07, specifying therein the amount of tax, interest and penalty payable by the person chargeable with tax.

c. Section 129 of the CGST Act, 2017 => Detention, seizure and release of goods and conveyances in transit.

d. Section 130 of the CGST Act, 2017 => Confiscation of goods or conveyances and levy of penalty.

e. Generation of inter-State e-waybill had been made mandatory w.e.f 01st April, 2018 and by now, generation of intra-State e-waybill has been introduced throughout India.

Rule has been amended to realise amount of tax, interest and penalty on account of detention, seizure and release of goods or conveyances in transit and confiscation of goods or conveyances and levy of penalty.

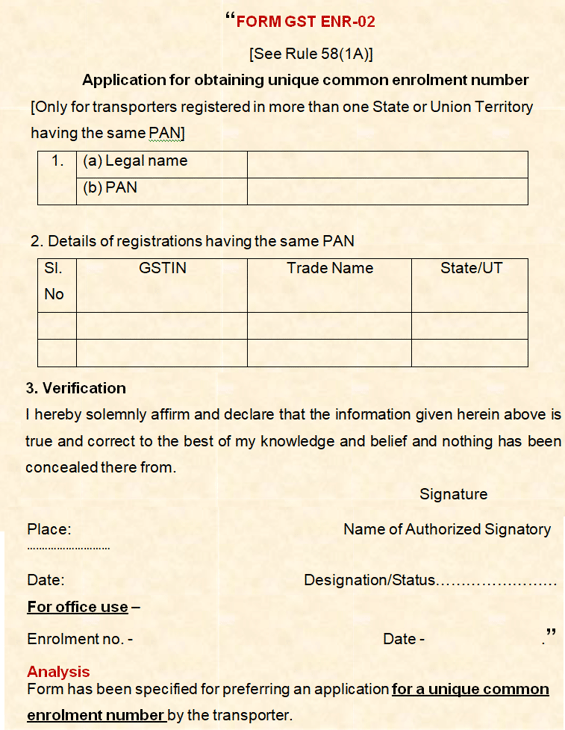

iv. after FORM GST ENR-01, the following FORM shall be inserted, namely:-

Disclaimer: This publication contains information for general guidance and education purpose only. An endeavour to the best of the ability has been made to present the information of the above stated notification in a simple and accurate way for ease of understanding and information. It is neither a guidance note nor is intended to address any specific circumstance of any individual or entity. The undersigned does not accept any responsibility for loss incurred by any person for acting or refraining to act as a result of any matter in this publication.

About theAuthor : CMA. Susanta Kumar Saha

A seasoned professional with around 24 years experience in Corporate Finance, Direct & Indirect taxation, Financial & Management Accounting, Fund Management, Budgeting, ERP Implementation in different sectors of industry.

Corporate trainer in Goods and Services Tax, implementation and compliance consultant, advisory and litigation management.

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

Tags : goods and services tax, unique common enrollment number, central goods and services tax, goods and services, unique common enrollment,Analysis of unique common enrollmentnumber in FORM GST ENR – 02,declaration under rule 91(1) gst, declaration format for gst refund, rule 89(2) requisite documents, statement 3 for gst refund, rule 92 of cgst, self declaration u/s 54(4), cbec, form gst rfd-01a download,gst enrollment portal, form gst enr-02,www.gst.gov.in login portal, gst portal, gst.gov.in registration, gst enrollment login, gst enrollment status, www.gst.gov.in portal, gst portal online, gst migration login,gst registration portal, gst puducherry, gst enrollment portal, www gst gov in odisha, gst migration login

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"