Applicable ITR Forms if Salaried Person is having Stock Market/ Mutual Fund Transactions

Deepak Gupta | Jun 29, 2022 |

Applicable ITR Forms if Salaried Person is having Stock Market/ Mutual Fund Transactions

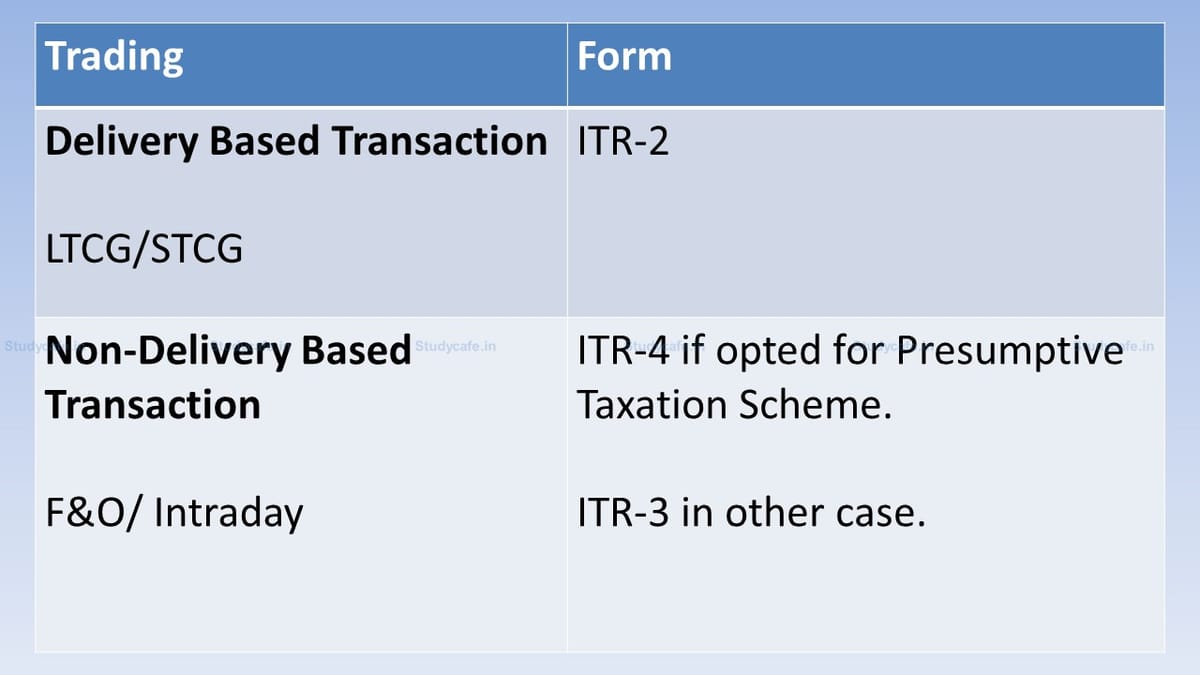

A Salaried Person having income like Sale of Shares, Mutual Fund, income from Futures & Options or Intraday, cannot File ITR-1. So which Form should we opt for?

Through This Article, we have tried to analyze various (Income Tax Return) ITR Forms required to be filed by Salaried Person who is having Stock Market/ Mutual Fund Transactions.

In this case, ITR-2 is required to be filed by the Salaried Individual. Remember here you are an Investor, that’s why the Income would be capital gain and ITR-2 will be Filed.

F&O is considered as a normal business & Profession. Intraday is considered as a Speculation Business. Here you need to maintain books of accounts (BOA) and ITR-3 is required to be filed when you have Income under the head Profit from Bussiness and Profession (PGBP). Also to Carry forward Loss, you need to File ITR-3.

In this case, the salaried individual has the option to opt for the Presumptive Taxation Scheme u/s 44AD of the Income Tax Act. If you opt for the scheme, you get relaxation from maintaining Books of Accounts. Here you need to show a Profit of 8%/6%, as the case may be.

If you have Opted for the Presumptive Taxation Scheme, and you opt-out from the same, the Tax Audit will be applicable on you.

Please also note that Tax Audit will be applicable on you u/s 44AB(a) if you coss the Threshold, which is Rs. 10Cr for AY 2022-23, assuming you have all digital transactions.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"