Reetu | Feb 21, 2023 |

CA held guilty for signing the Financial Statements which was not signed by Directors

The Disciplinary Committee of Institute of Chartered Accountant of India(ICAI) has found Chartered Accountant Guilty for signing the Financial Statements which was not signed by Directors.

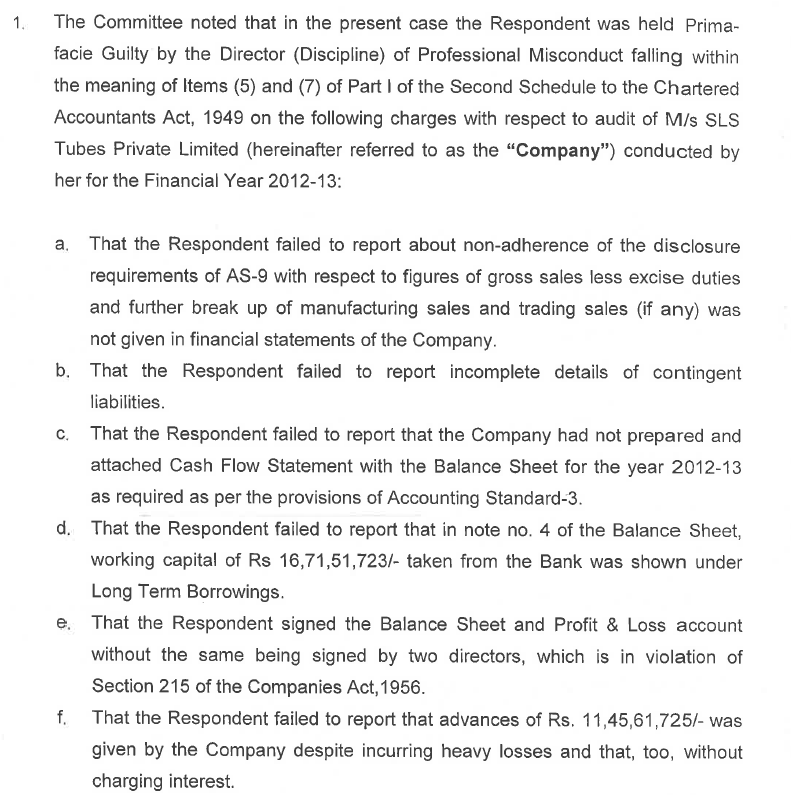

Disciplinary Committee was inter-alia of the opinion that CA. Sandhya Vasandani (M.No.128973), Ahmedabad (hereinafter referred to as the “Respondent”) was GUILTY of Professional Misconduct falling within the meaning of Item (5) and (7) of Part I of the Second Schedule to the Chartered Accountant Act, 1949.

At the outset, the Counsel of the Respondent pleaded that his client i.e the Respondent had just signed the financial statements and the actual auditor was CA. Tarang Shah. His client had merely signed based on reliance on another auditor and had refunded the fee to CA. Tarang Shah. The Committee on the same, clarified to him, that since the signatures on the financial statement and the Audit Report were of the Respondent and hence the accountability for true and fair view of the documents, signed by her, lies with the Respondent only. The Committee accordingly directed him to argue his case on the merits.

With regards to the first charge, the Counsel of the Respondent submitted that there are two methods of presentation, one is the inclusive method, and the other is the exclusive method. Therefore, whatever sales are net of excise duty, the same has been mentioned by his client in her Audit Report. The Committee is convinced by the Respondent’s plea that sales can be shown in both ways i.e by way of net of excise or by way of disclosing sales and excise duty separately. Since, either of option exercised by the Company cannot considered to be wrong. The Committee noted that the lapse in reporting was purely technical in nature and was not affecting the decision of users of the financial statements. Hence the Committee decided to extend, benefit of doubt in favour of the Respondent and hold her not Guilty on this charge.

The Counsel of the Respondent submitted as under:

a. That in allegation the Complainant failed to mention about which contingent liability the Respondent failed to report in her audit report.

b. In the absence of any contingent liability, the Respondent was not required to report the same in her audit report.

c. That the Respondent was not informed about any bank guarantee by her client therefore in the absence of any information, the Respondent did not require to report the same.

d. Since there was no contingent liability, hence, the Respondent had not mentioned about it in her Audit Report.

The Complainants’ representative in this regard had submitted that there were more than 10 Bank Guarantees issued to the Company total amounting to Rs. 4,93,63,797/- which were not expired as on 31st March 2013 and which the Company should have shown as contingent liability and which the Respondent as an auditor failed to report in her audit report.

The Respondent’s Counsel in this regard mentioned that as per management of the Company there was no bank guarantee exiting. He further added that there is no such bank guarantee as on 31st March 2014 at the MCA portal also.

The Committee accordingly noted that the Respondent despite being grossly negligent in her professional duties, had also failed to report material fact in the financial statements. Accordingly, the Committee held the Respondent guilty of Professional Misconduct falling within the meaning of Items (5) and (7) of Part I of the Second Schedule to the Chartered Accountants Act, 1949.

With regards to the third charge regarding failure in attaching cash flow statement with the Balance Sheet for the year 2012-13, the Counsel of the Respondent submitted that the Respondent as an auditor is not required to sign cash flow statement. The Committee regarding the alleged charges observed that the cash flow statement was optional during the period 2012-13 and hence non reporting of the same cannot be tantamount to misconduct on the part of the Respondent. The Committee accordingly decided to exonerate the Respondent from this charge.

With regards to the fourth charge relating to disclosure of working capital loan of Rs 16,71,51,723/- taken from the bank, which was shown under Long Term Borrowings, the Counsel of the Respondent draw attention of the Committee to pages C-23 and C-31 of Prima-facie Opinion and mentioned that working capital and the bank from whom it was borrowed was specifically mentioned.

The Committee on perusal of page C-31 of Prima-facie Opinion noted that working capital was shown under Long-term borrowings, whereas the Working Capital is the capital of a business which is used for its day-to-day trading operations, and its disclosure under long term borrowings is not appropriate. The disclosure depicts that the funds raised on a short-term basis have been used for long term investments/purposes. The Committee noted that, to the contrary, the Respondent in her CARO report (page C-22 of the Prima-facie opinion) under para 17 had opined that there are no funds raised on a short-term basis that have been used for long term investment.

To read the complete Order Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"