The Union Cabinet approved the ‘Incentive Scheme for promotion of low-value BHIM-UPI transactions Person to Merchant (P2M)’ for FY2024-25.

Reetu | Mar 19, 2025 |

Cabinet approves Incentive Scheme for Promotion of low-value BHIM-UPI Transactions

The Union Cabinet chaired by Prime Minister Shri Narendra Modi today approved the ‘Incentive Scheme for promotion of low-value BHIM-UPI transactions Person to Merchant (P2M)’ for the financial year 2024-25.

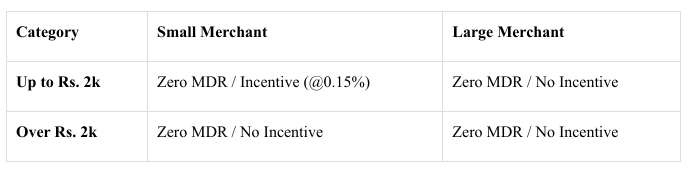

The scheme is approved in the following manner:

i. The incentive scheme for promotion of low-value BHIM-UPI transactions (P2M) will be implemented at an estimated outlay of 1,500 crore, from 01.04.2024 to 31.03.2025.

ii. Only the UPI (P2M) transactions upto Rs.2,000 for Small Merchants are covered under the scheme.

iii. Incentive at the rate of 0.15% per transaction value will be provided for transactions upto Rs.2,000 pertaining to the category of small merchants.

iv. For all the quarters of the scheme, 80% of the admitted claim amount by the acquiring banks will be disbursed without any conditions.

v. The reimbursement of the remaining 20% of the admitted claim amount for each quarter will be contingent upon fulfilment of the following conditions:

a) 10% of the admitted claim will be provided only when the technical decline of the acquiring bank will be less than 0.75%; and

b) The remaining 10% of the admitted claim will be provided only when the system uptime of the acquiring bank will be greater than 99.5%.

i. Convenient, secure, faster cash flow, and enhanced access to credit through digital footprints.

ii. Common citizens will benefit from seamless payment facilities with no additional charges.

iii.Enable small merchants to avail of UPI services at no additional cost. As small merchants are price-sensitive, incentives would encourage them to accept UPI payments.

iv. Supports the Government’s vision of a less-cash economy through formalizing and accounting the transaction in digital form.

v. Efficiency gain- 20% incentive is contingent upon banks maintaining high system uptime and low technical decline. This will ensure round-the-clock availability of payment services to citizens.

vi. Judicious balance of both the growth of UPI transactions and the minimum financial burden on the Government exchequer.

The promotion of digital payments is an important aspect of the government’s financial inclusion agenda, as it provides the common man with a variety of payment possibilities. The digital payment sector recovers its expenses while delivering services to its customers/merchants by charging a Merchant Discount Rate (MDR).

According to the RBI, MDR of up to 0.90% of the transaction value applies to all card networks. (For Debit Cards). Based on the NPCI, MDR of up to 0.30% of the transaction amount applies to UPI P2M transactions. To promote digital transactions, MDR for RuPay Debit Cards and BHIM UPI transactions has been nil since January 2020, through amendments in sections 10A of the Payments and Settlement Systems Act of 2007 and section 269SU of the Income-tax Act of 1961.

The Cabinet approved the “Incentive scheme for promotion of RuPay Debit Cards and low-value BHIM-UPI transactions (P2M)” to help payment ecosystem members deliver services more effectively.

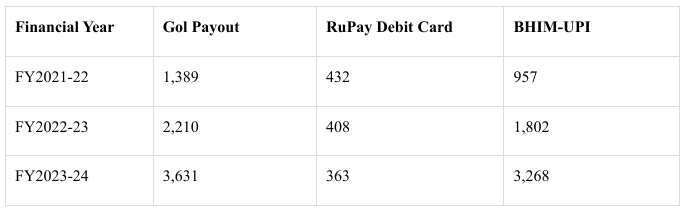

Year-wise incentive payout by the Government (in Rs. crore) during the last three financial years:

The incentive is paid by the Government to the Acquiring bank (Merchant’s bank) and thereafter shared among other stakeholders: Issuer Bank (Customer’s Bank), Payment Service Provider Bank (facilitates onboarding of customer on UPI app/API integrations) and App Providers (TPAPs).

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"