CBDT has notified the electronic submission of certain forms listed in Appendix-II of the Income Tax Rules, 1962, via issuing Notification.

Reetu | Nov 1, 2024 |

CBDT Notifies Specified Forms to be Furnish Electronically under Rule 131 for Income Tax Compliance

The Central Board of Direct Taxes (CBDT) has notified the electronic submission of certain forms listed in Appendix-II of the Income Tax Rules, 1962, via issuing Notification. This directive applies to forms required by sub-rules (1) and (2) of Rule 131, promoting streamlined digital compliance and increasing the efficiency of income tax operations.

The updated rule requires all specified forms to be filed electronically, which is consistent with the CBDT’s overall commitment to modernize and simplify tax procedures. The update is supposed to make filing easier, minimize paperwork, and allow income tax authorities to process returns on time.

The Notification Read as Follows:

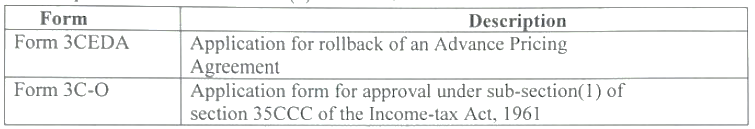

In exercise of the powers conferred under sub-rule (1) and sub-rule (2) of Rule 131 of the Income-tax Rules, 1962 (‘the Rules’), the Director General of Income Tax (Systems), Bengaluru with the approval of the Board, hereby specifies that the following Forms shall be furnished electronically and shall be verified in the manner prescribed under sub-rule (1) of Rule 131.

This Notification shall come into effect from 31st October 2024.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"