CA Pratibha Goyal | Feb 20, 2024 |

![CBIC exempts Agriculture Infrastructure and Development Cess of 5% for certain goods, effective from February 20, 2024 [Read Notification]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2024/02/CBIC-notified-Agriculture-Infrastructure-and-Development-Cess-of-5-for-certain-goods-effective-from-February-20-2024-Read-Notification.jpg)

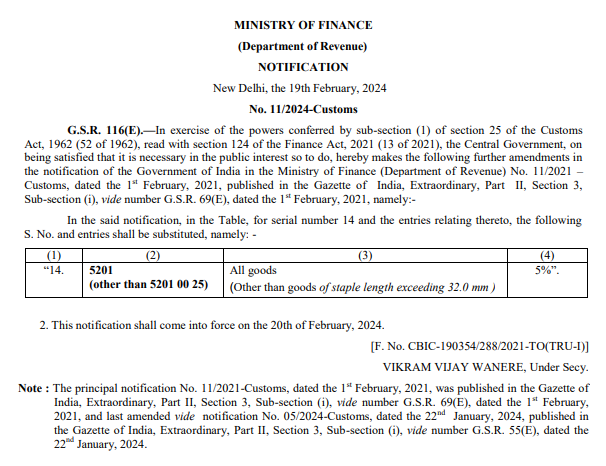

CBIC exempts Agriculture Infrastructure and Development Cess of 5% for certain goods, effective from February 20, 2024 [Read Notification]

The Central Board of Indirect Taxes and Customs has amended Notification No. 11/2021-Customs vide 11/2024-Customs dated 19-Feb-2024 in order to exempt Agriculture Infrastructure and Development Cess (AIDC) on goods falling under tariff item 5201 00 25.

Also Read: Custom Duty Rate for Meat, Cranberries, Blueberries Revised [Read Notification]

The notification reads as follows:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"