Studycafe | Mar 11, 2020 |

Centre proposes to extend GSTR3B facility till Sept 2020

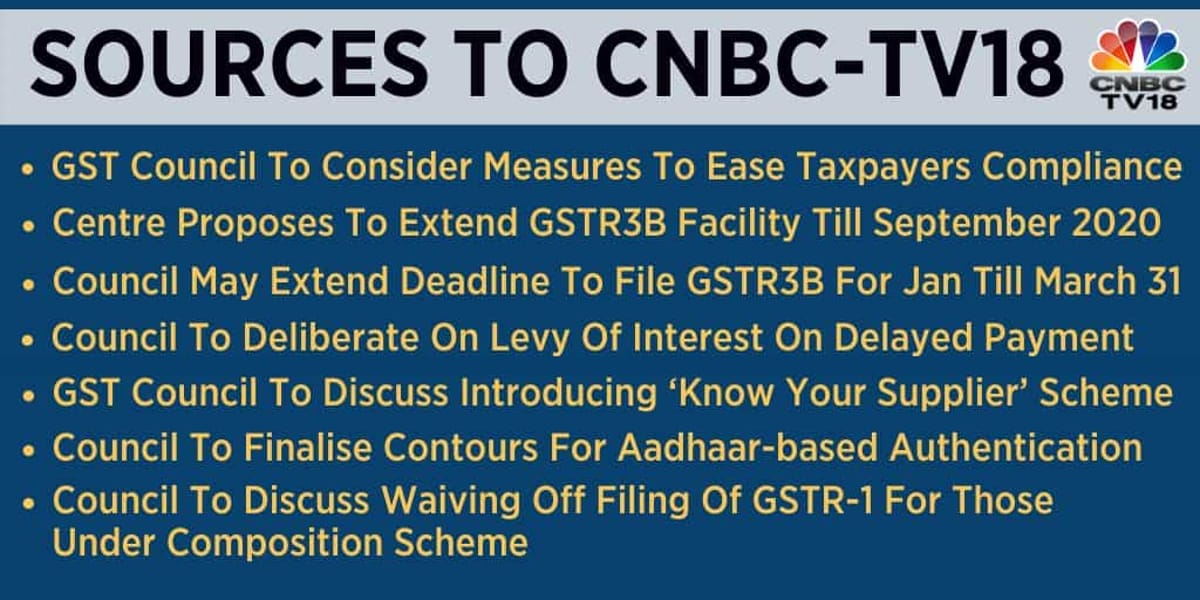

As per recent news updates, Centre has proposed to extend GSTR3B facility till Sept 2020. However GST Council had decided to end GSTR-3B from April 2020 & shift to new return. With these technical issues, there is a big qustion mark if the GST System is even ready for them or not. A Clear Cut decision on the same will be made in upcoming GST Council Meeting to be held on 14th March 2020.

GST Council is also considereing deferment of e-invoicing & QR code scheme. There may be a possibility that Council may also exempt certain taxpayers from e-invoicing & QR Code. Trial of E-Invoices was introduced from 1st January 2020 and it was to be made mandatory from 1st April 2020.

In the meeting, Council will also discuss deferment of e-wallet scheme & extending duty exemptions for exporters.

A clearcut decision would be made on letigative issue of Interest on delayed GST, i.e. payment of interest should be made on Gross or Net GST libility.

GST Council will also discuss know your supplier Scheme.

Source : CNBC-TV18

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"