Deepak Gupta | Apr 7, 2019 |

Analysis of changes in Income Tax Forms for AY 2019-20

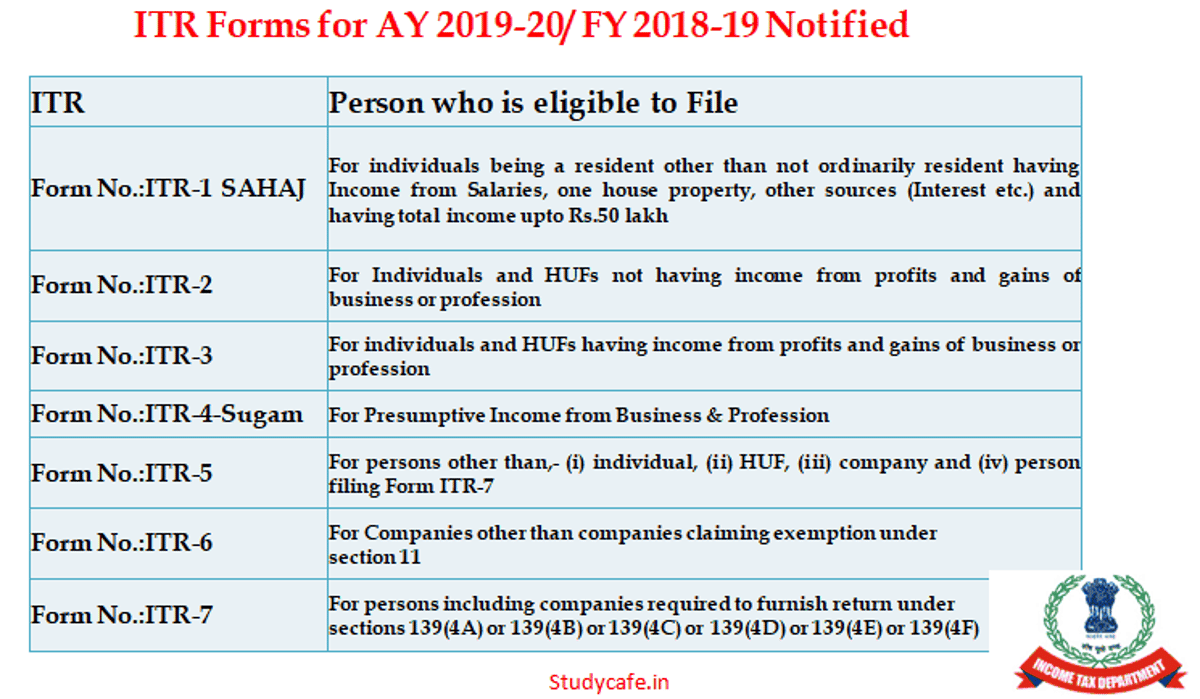

As we all know that CBDT has released ITR Forms for FY 2018-19 or AY 2019-20. The CBDT has notified 7 types of Income-tax return forms. These Forms are ITR-1 or Sahaj, ITR-2, ITR-3, ITR-4 or Sugam, ITR-5, ITR-6 and ITR-7. These New Forms seek more disclosures and compliance. Lets Discuss some of the changes in the New Income Tax Return Forms through this article.

1.) Exemption for Agriculture Income [More Disclosure Required]

Persons who are claiming Exemption of Agriculture Income and there Agriculture Income Exceeds Rs. 5,00,000 now will have to give additional disclosure where in they have to provide below mentioned information about there agriculture Land:

1.) Name of district along with pin code in which agricultural land is located

2.) Measurement of agricultural land in Acre

3.) Whether the agricultural land is owned or held on lease

4.) Whether the agricultural land is irrigated or rain-fed

Screen Shot of Schedule is given below for reference:

2.) Disclosure of Directorship of Unlisted Company by an individual

In new ITR Forms the individual has to disclose his Directorship in Unlisted Company if any. Individual has to provide the name of the Company, it’s PAN and his Director Identification Number.

3.) Disclosure of Shareholding of Unlisted Company by an individual

Individual has to provide details of shareholding of Unlisted Company wherein he has to provide all the details of shares purchased and sold during the financial year.

4.) Facility to file Paper Return

One of the major change is that the facility of filing paper returns will now be available only to those over 80 years.

5.) More Disclosures for Salaried Individuals

For the salaried individuals, details of some of the Exempt allowances, such as house rent, leave travel, children’s education and relocation, too, will need to be shared.

Earlier the tax authorities had sought details of taxable allowances of salary but now there taxpayer need to give details of exempt allowances as well.

6.) Disclosures related to Foreign Assets [More Details Required]

Those with foreign assets will need to provide detailed disclosure of foreign depository account, foreign custodian accounts, equity and debt interest and particulars of overseas cash value insurance contract or annuity contract.

7.) Detailed Disclosure of Residential Status in India (for individuals)

Taxpayer filing Income Tax Return for FY 2018-19 or AY 2019-20 is required to provide detailed disclosure of Residential Status in India.

8.) Income From House Property : It is important to furnish PAN of Tenant where Tax is deducted under section 194-IB.

Similarly it is important to furnish TAN of Tenant where Tax is deducted under section 194-I.

9.) Schedule GST has been introduced for ITR 3 and ITR 6 as well [Earlier the Schedule was for ITR-4 only]

10.) Details of startup to be furnished in ITR-6

These were some of the important changes in the new ITR Forms. Taxpayer needs to be very careful while filing ITR this time. All the data must be carefully prepared and must be matched with each other. We can expect automated scrutiny based on the extensive data required by the ITR Forms.

These ITR can be Downloaded from below mentioned link.

| ITR | Person who is eligible to File |

Form No.:ITR-1 SAHAJ | For individuals being a resident other than notordinarilyresident having Income from Salaries, one house property, other sources (Interest etc.) and having total income upto Rs.50 lakh |

Form No.:ITR-2 | For Individuals and HUFs not having income fromprofits andgains of business or profession |

Form No.:ITR-3 | For individuals and HUFs having income fromprofits andgains of business or profession |

Form No.:ITR-4-Sugam | For Presumptive Income from Business & Profession |

Form No.:ITR-5 | For persons other than,- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7 |

Form No.:ITR-6 | For Companies other than companies claimingexemption undersection 11 |

Form No.:ITR-7 | For persons including companies required tofurnish returnunder sections 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F) |

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information

Tags : income tax assessment form 2019-20, itr forms for ay 2019-20, income tax statement form 2019-20 pdf, income tax return form pdf, income tax form 2019-20 pdf, income tax return form 2019-20 pdf, New Income Tax Return form for AY 2019-20, Income Tax Return forms for AY 2019-20 notified, Govt notifies ITR forms for AY 2019-20

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"