Sushmita Goswami | Dec 31, 2021 |

Changes to the GST Exemption on Goods From January 1, 2022

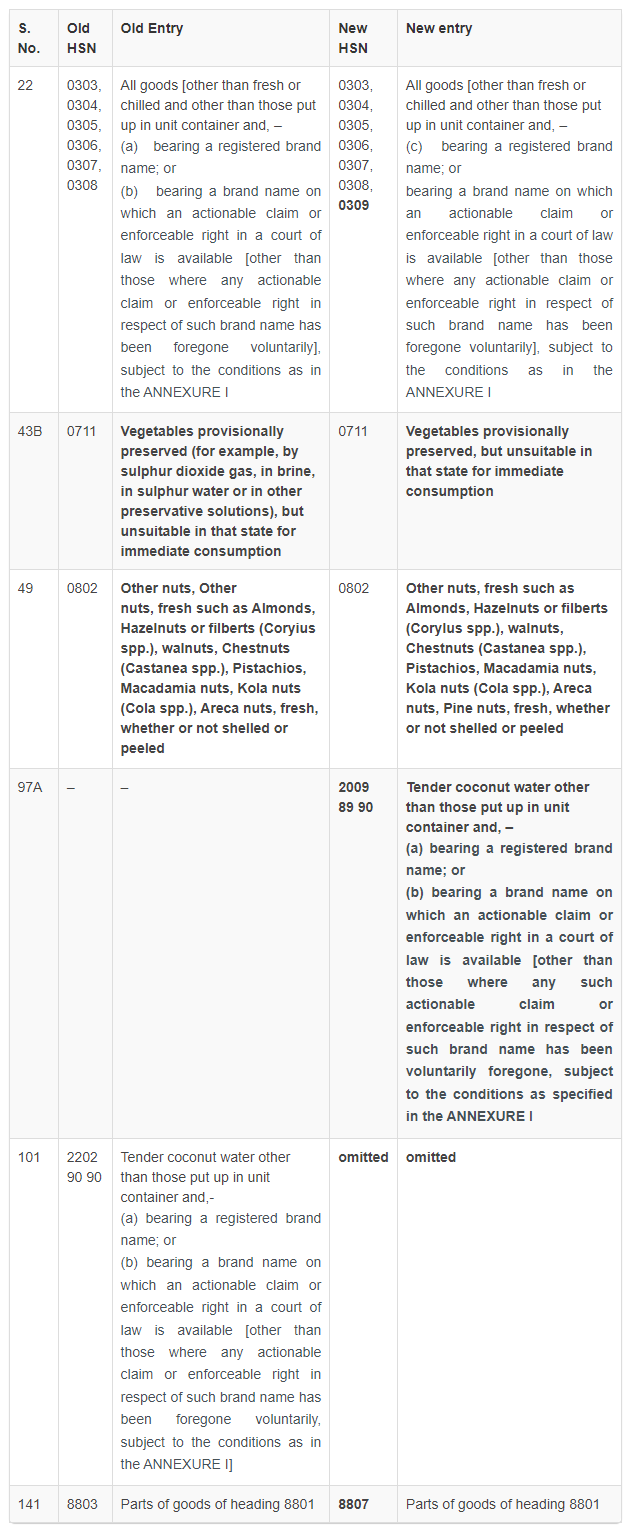

The Central Board of Indirect Taxes & Customs [CBIC ]has previously issued Notification No. 2/2017 Central Tax (Rate) dated June 28, 2017 (Goods Exemption Notification) to notice the exemption on certain supplies of goods listed therein. In addition, beginning of January 1, 2022, the new (seventh) edition of the Harmonized System (HS) nomenclature, namely HS-2022, is in effect. With a total of 351 six-digit revisions covering a wide spectrum of commodities travelling across borders, this edition has made major changes to the Harmonized System.

Because India is a signatory to the HS Convention, the following amendments were made to GST:

As per Notification No. 19/2021-Central Tax (Rate) dated December 28, 2021, With effect from January 1, 2022, the CBIC has changed pertinent entries of the Goods Exemption Notification in the following manner:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"