Course Key Features

- Master Microsoft Excel from Beginner to Advanced

- Learn the most common Excel functions used in the Office

- Wow your boss by unlocking dynamic formulas with IF, XLOOKUP, VLOOKUP, INDEX, MATCH functions and many more

- Create dynamic reports by mastering one of the most popular tools, PivotTables

- Understanding Supply and applicability of CGST, SGST, IGST along with B2B & B2C Supply

- Understanding Input Tax Credit [ITC] and Understanding Reverse Charge Mechanism [RCM] Provisions

- Discussion on GSTR-3B, GSTR-1 and Discussion on QRMP Scheme

- Discussion on E-way Bill, Concept of TDS/TCS and How to file GST Return Directly form Tally

- Practical understanding while Filing GST returns including Annual Return

- How to File GST Returns from Tally.ERP9

- Every Practical aspect in Tally.ERP9

- Accounting With GST in Tally.ERP9

- How to File Income Tax Returns

- Practical Aspects of TDS and TCS provisions under Income Tax Act

Course Description

Studycafe has Designed 50 Hrs Certification Course on GST, Income Tax, Tally.ERP9 & Excel for Accountants. This course has been specially designed for Accountants and those persons who want to pursue a career in Accounts Field. This is very effective course for all the persons who are dealing with GSt, Income Tax, Tally, Excel. In this course we have covered Practical aspects of Every topic and all the faculties are Chartered accountants.

Course Content

Day-1: Data Cleansing & Date related Calculation Functions :

120 MinsAlt Function, Excel Smart Shortcuts, Edit Tool Bar, Randomdata, Smart Copy Paste, Smart Paste special, Transpose, now, date function, Format Cell, Concatenate, Trim & Clean, Proper, Upper, Lower, Left, Right, Mid & Len, Filter, Advance Filter, Format Painter.

Day-2: Advanced Excel Functions :

120 MinsConcatenate & Text Join, Giving password to excel and back up, Advance Find & Replace, Smart Sorting, Skip Blank, TDS Working Check list, GST Late Fees Calculator, Import 26 AS data and converting in to excel

Day-3: Advanced Excel Functions :

120 MinsText to Columns, Flash Fill, Remove Duplicate, Data Validation, Consolidation, Conditional Formatting, if functions, Goto Special, Macro of Spell Number, etc.

Day-4: Advanced Excel Functions :

120 MinsCalculate Drs Ageing, Sumif, Sumifs, Advance Subtotal, Iferror, Match Function, Vlookup, IF Error+Vlook up, IFError+Vlookup, Hlookup, Xlookup

Day-5: Advanced Excel Functions :

120 MinsTable, Pivot Table, Sparkline Chart, Use of Onedrive and Google Sheet, Preperation of Balance Sheet from trial.

Day-6: Advanced Excel Functions :

120 MinsReconcillation of GSTR2A with GSTR3B , Relative Size factor Theory (RSF) in Excel to identify red flags or fraudulent transactions in audit, CFO or Management Dashboard, Extract data in Excel from NET, Excel worksheet to corporate (or Tally) database & extract any data that you want, Connect your Excel worksheet to live data on the Internet to track (for e.g.) current value of investments

Day-7: Basic Concepts & Imp Definition Under GST

120 Mins• Constitution of India (Provision related to GST)

• Discussion on definition of goods, service, Business, composite and mixed supply, Continuous Supply, taxable supply and non-taxable supply, supplier and recipient, exempt supply and zero-rated supply, NIL rated supplies, consideration and non-monetary consideration.

Day-8: Levy & Collection of Tax and Concept of RCM

120 Mins• Definition of supply and all forms of supply and purpose thereof including schedule I, II and III.

• Levy of CGST, SGST & IGST

• Discussion on Composition Scheme

Day-9: Valuation and Time of Supply Under GST

120 Mins• Time of Supply Rules

• Valuation Concept and Rules

• Discussion on use of HSN Codes

Day-10: Registrations Under GST

120 Mins• Persons liable and not liable for registration

• Special provision relating with casual taxable person & NR taxable person.

• Amendments, Cancellations and Revocations.

Day-11: Input Tax Credit Provisions Under GST

120 Mins• Ingredients in section 16

• Purpose and exclusions through section 17- Apportionment of credit & blocked credit

Day-12: Exports, Refunds & Imports Under GST

120 Mins• Detailed Discussion on Relevant Sections of IGST Act

• Filing of Bond and LUT

• Discussion on SEZ, EOUs

Day-13: GST Returns: GSTR-1, GSTR3B & QRMP Scheme

120 Mins• Discussion on GSTR-1, GSTR-3B, QRMP Scheme

• Discussion on Eligibilty & new updates of QRMP Scheme

• Filing GST Return with Tally

Day-13: GST Returns: GST Annual Return

120 Mins• Discussion on GST Annual Return

• Filing GST Return with Tally

Day-14: E-Invoicing & E-Way Bill

120 Mins• Process of generating E-Invoice and E-Way Bill

• Procedure its applicability

• Document to be carried with goods in movement

Day-15: Penalties & Assessment

120 Mins• Discussion on Assessments

• Departmental Audits

Day-16: Fundamentals of Tally.ERP 9 and TallyPrime

120 MinsFundamentals of Tally.ERP 9 and TallyPrime, Accounting Masters in Tally.ERP 9 and TallyPrime

Day-17: Tally.ERP 9 Shortcuts & Entries

120 MinsTally.ERP 9 Shortcuts, Advance Entries in Tally.ERP 9 like, RCM, Import, Export, SEZ, Ineligible Goods.

Day-18: Advanced Features in Tally.ERP 9 and TallyPrime

120 MinsAdvanced Features in Tally.ERP 9 and TallyPrime which includes Auto Invoice Series, Tally Back up & Restore, Bank Reconciliation

Day-19: Difference Between Tally.ERP9 and TallyPrime

120 MinsDifference Between Tally.ERP9 and TallyPrime, Technological Advantages of Tally.ERP 9, Tally.NET and Remote Capabilities, Email Facility in Tally

Day-20: Application Management and Controls

120 MinsApplication Management and Controls, Splitting of Company, Creation of Cost Centre, TDS & TCS Provisions, Tally Controls.

Day-21: How to File GST Returns from Tally

120 MinsHow to File GST Returns from Tally, Tally.ERP9 Audit Features, How to Export Tally Data using ODBC

Day-22: Clause by Clause Analysis of ITR-1,

120 Mins• Applicability & issues of ITR-1,

• Significance of proper & correct filling of fields in the ITRs

• New fields and changes made in ITR-1,

• Discussion on important provisions pertaining to ITR-1,

• When to File ITR 1

Day-23: Detailed Explanation of ITR-2 & ITR-4

120 Mins• Applicability & issues of ITR-2 & ITR-4

• Significance of proper & correct filling of fields in the ITRs

• Discussion on important provisions pertaining to ITR-2 & ITR-4

• New fields and changes made in ITR-2 & ITR- 4

• How to File Balance Sheet and Profit & Loss Account in ITR 2

• Can ITR 3 be filed without the Balance Sheet

• Significance of GST Turnover and Return in ITR-2 and ITR- 4

Day-24: Critical Analysis on ITR-5, ITR-6 & ITR-7

120 Mins• Applicability & Issues in Filing of ITR-5, ITR-6 & ITR-7

• Significance of proper & correct filling of fields in the ITRs

• Discussion on important provisions pertaining to ITR-5, ITR-6 & ITR-7

• New fields and changes made in ITR-5, ITR-6 & ITR-7

Day-25: Overview of TDS Provisions Under Section 192 to Section 196

120 Mins👉 Overview of TDS Provisions Under Section 192 to Section 196

👉 Form 15G and Form 15H relevance and its Applicability.

👉 What is Lower Tax Deduction Certificate and How to apply for lower deduction of TDS TCS as per Section 197.

Day-26: Overview of TDS Provisions Under Section 192 to Section 196

120 Mins👉 Detailed discussion on Section 192, 194C, 194I, 194J.

👉 Detailed discussion on TDS on cash withdrawal from Bank section 194N

👉 Applicability of TDS on E-Commerce operator section 194O

Day-27: Overview of TDS Provisions Under Section 192 to Section 196

120 Mins👉 Detailed discussion on Section 192EE, 194G, 194H, 194I, 194I-A, 194-IB, 194-IC, 194-LA,194M, 194N, 194O,

Day-28: Detailed discussion on Section 195

120 Mins👉 Detailed discussion on Section 195,

Day-29: Overview of TCS Provisions under Section 206C

120 Mins👉 Practical demo and insights of TRACES.

👉 Filing of TDS returns and TCS returns for tax deduction and collection under various sections of this chapter.

👉 What is Lower Tax Deduction Certificate and How to apply for lower deduction of TDS TCS as per Section 197.

👉 Overview of TCS Provisions under Section 206C

👉 Panel consequences in case of default of TDS and TCS provisions under Section 201(1A), 220(2), 234E, 271C, 271H, 40(a)(ia).

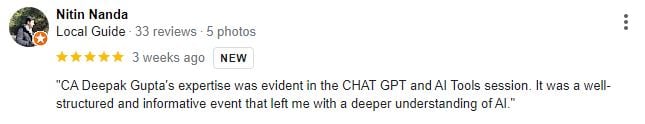

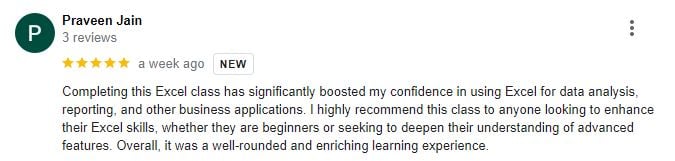

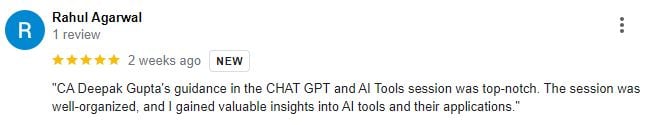

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who can join 50 Hrs Certification Course on GST, Income Tax, Tally.ERP9 & Excel ?

⭐ Commerce Graduates/CA/CS/CMA/Law students ⭐ Tax professionals whether in JOB or Practice ⭐ Qualified CA/CS/CMA/LLB ⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry ⭐ Any other person not covered above can join course if interested.

What will be Language of the Course?

It will be in Mix of English and Hindi Language.

What is the Duration of the Course?

Course Duration will be of more than 50 Hrs.

Whether Course Material will be Provided?

Yes, Course Material will be Provided.

Whether Course Recording will be Provided?

Yes Recording will be Provided for 60 Days.

How Can we Join ths Course?

Please register yourself and pay the fees. After paying fees you can see the Lectures in Course section.

Featured In

Terms and Conditions

- Recording will be Valid for 60 Days Only.

- Fees will not be refunded after purchase of the Course. If you have any query regarding the course please ask in advance.

Requirements

- Required internet connection. Lectures can be viewed on Mobile or Laptop

This course includes:

- Hindi, English

- 50+ Hours of Video Content

- Recording is Available for 60 Days

- Studycafe Certificate of Completion

- Access on mobile or Computer/Laptop

- Downloadable Material

Certificate to be provided to all the participants.