Course Key Features

- Documents and Preparation for ITR

- Precautions while Filing ITR

- How to Study Form 26/AIS/TIS Statement

- Applicability and Eligibility

- In-depth Analysis of ITR Forms

- Brief about 44AD/44ADA/44AE

- Practical Demo of ITR Filing

Course Description

You will Learn ITR Filing Which will Save you Hours Of Time & Effort, and you will be able to File your ITR and the ITRs of Others as well.

Who is Eligible to Join the Income Tax Return Filing Certification Course:

There is no bound on the eligibility from our side for this Certification Course on Practical Filing of Income Tax Returns. Any person who wants to learn and master ITR Filing can join this course. However, it will be more beneficial for the below-mentioned persons:

⭐Corporate Professionals

⭐Marketing Professionals

⭐Human Resource Professionals

⭐Qualified CA/CS/CMA/LLB

⭐Commerce Graduates/CA/CS/CMA/Law Students

⭐Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐Any Other Person not covered above can join the course if interested

How I will get the course:

This is an online ITR Filing Certification course so there will not be any physical delivery of the lectures. After the purchase of the Certification Course on Practical Filing of Income Tax Returns, you can see the Certification Course on Practical Filing of Income Tax Returns under my account option under purchased courses. All the videos, study materials, PDF files, PPTs will be uploaded there for quick access of participants. This Certification Course on Practical Filing of Income Tax Returns is valid for 1 Year.

Course Duration:

The course duration is around 6 hours.

Certificate:

A Certificate of Participation from the Studycafe will be provided upon completion of this Course.

Views Limitation:

This is a Completely online course, there is no bar on the number of views. During 1 year you can access this Practical Filing of ITR Forms, from anywhere at any time with unlimited views.

Course Timing:

Timing: 6:00 pm to 8:00 pm

Course Content

Day-1: General Discussion about ITR and Form 26 AS/AIS

120 Hrs• What is ITR and Form 26 AS/AIS?

• Disscusion on Income Tax, Old Tax Regime and New Tax Regime.

• Discussion on Exemptions and Deductions allowed in Old and New Tax Regime.

• Documents requirement for Preparation of ITR.

• Precautions while filing ITR.

• How to Study Form 26AS/AIS/TIS Statement.

Day-2: Discussion about ITR Forms and and Practical Filing

2 Hrs• Discussion on ITR 1,2,3 and 4.

• Applicability and Eligibility.

Day-3: Discussion about ITR Forms and and Practical Filing

2 Hrs• Brief about Presumptive Taxation Section - 44AD/44ADA/44AE.

• Discussion on Section 44AA; Maintainence of books of accounts.

• Discussion on Section 44AB; Income Tax Audit.

• Practical Demo of ITR Filing.

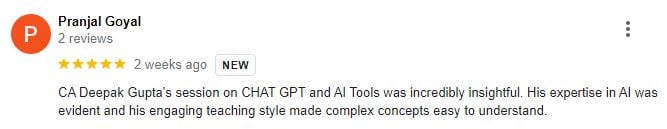

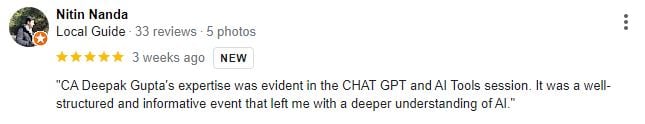

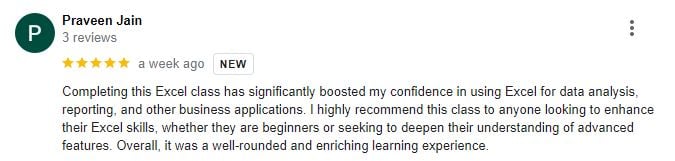

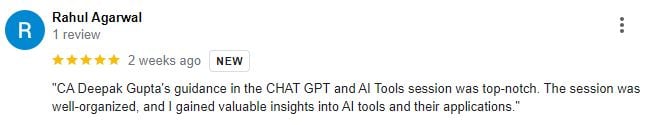

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who can join Certification Course?

⭐ Commerce Graduates/CA/CS/CMA/Law students ⭐ Tax professionals whether in JOB or Practice ⭐ Qualified CA/CS/CMA/LLB ⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry ⭐ Any other person not covered above can join course if interested.

What will be Language of Certification Course

It will be in Mix of English and Hindi Language.

What is the Duration of the Course?

Course Duration will be of more than 6 Hrs.

Whether Course Material will be Provided?

Yes, Course Material will be Provided.

Whether Course Recording will be Provided?

Yes Recording will be Provided for 1 Year.

How Can we Join this Course?

Please register yourself and make the fees. After making fees you will get call form our side.

Featured In

Terms and Conditions

- Course Recording will be Provided for 1 Year!

- No Limitation on Number of Views you can Watch it Unlimited Times

Requirements

- Required internet connection. Lectures can be viewed on Mobile or Laptop

- No Prior Knowledge or Experience Required to Join 2 Days ITR Filing Workshop!

This course includes:

- Hindi, English

- 6+ Hours of Video Content

- Recording is Available for 1 Year

- Studycafe Certificate of Completion

- Access on mobile or Laptop

Certificate to be provided to all the participants.