Naman Sharma | Jun 29, 2024 |

Delhi CA warns that filing your own ITR is not a smart decision

The due date for filing Income Tax Return (ITR) is not very far away and the last date for filing ITR is July 31, 2024. To the untrained eye, it is very crucial to ensure the returns are well filled and done so before the due date to avoid issues with the IT department.

This is very crucial for first-time ITR filers and those whose income is received from multiple sources, such as from salary income, property income, capital gains, income from foreign sources, and income earned from cryptocurrency transactions. Candidates who have a salary income and who did not avail themselves of the old tax regime while filing the return in April 2023, or those who have switched jobs during the financial year, should be little cautious while filing the return, as this process has become highly sensitive. It is, however, recommended that for any complexity experienced while developing the schedules, professional chartered accountants or tax consultants be consulted.

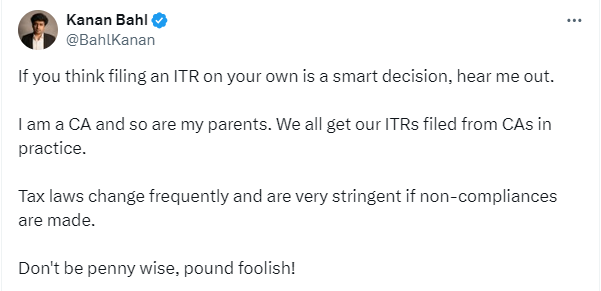

In a post on X discussing the ITR filing process, a Delhi-based Chartered Accountant encouraged people to consult someone if they were filing the ITR on their own.

In her response post on X, Bahl wrote: “If you really think that filing the ITR on your own is smarter, then let me tell you this: I am a CA and my parents are also CAs. We all get our ITRs filed from CAs in practice because tax laws are very dynamic and very strict, if any non-compliance is made. Don’t be penny wise, pound foolish!” Bahl posted on X.

Several comments were made by Kanan Bahl, who introduced himself as CA and Finance educator, and highlighted the need for professional help for filing ITRs. He added that even he and his parents, who are practicing CAs, have to approach other CAs to help file their ITRs. Bahl stated that there are frequent alterations in the provisions of tax laws and severe penalties for offenses; therefore, professional help is essential in legal proceedings.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"