The Directorate General of Foreign Trade(DGFT) has extends Date for Mandatory Electronic filing of Non-Preferential Certificate of Origin through Common Digital Platform via Trade Notice.

Reetu | Mar 31, 2023 |

DGFT extends Deadline Electronic filing of Non-Preferential Certificate of Origin through Common Digital Platform

The Directorate General of Foreign Trade(DGFT) has extends Date for Mandatory Electronic filing of Non-Preferential Certificate of Origin through Common Digital Platform via Trade Notice.

The Trade Notice, “In continuation to the earlier Trade Notice 15/2022-23 dated 01.08.2022, it is informed that the transition period for mandatory filing of applications for Non-Preferential Certificate of Origin through the e-CoO Platform has been further extended till 31st December 2023.”

Accordingly, the exporters and Non-Preferential CoO Issuing Agencies as notified under Appendix-2E of the FTP would have the option to use the online system. However, the online application process shall not be mandatory till 31st December 2023. In this interim period, the existing systems of processing non-preferential CoO applications in manual/paper mode is allow permitted.

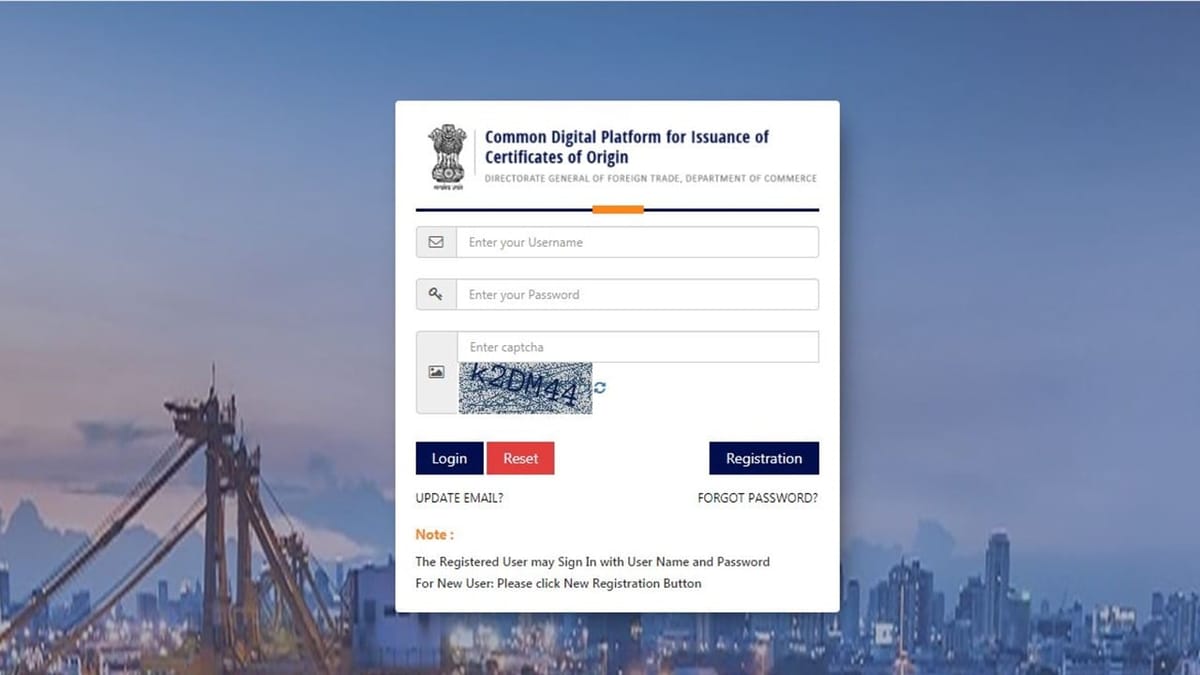

For guidance on registration and online application submission process, the Help Manual & FAQs may be seen on the landing page at https://coo.dgft.gov.in. The authorised issuing agencies are required to sensitize the exporting community and their constituents regarding the online eCoO platform and its registration requirements and encourage the exporters to use the online eCoO platform.

For Official Trade Notice Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"