Concerns regarding the process of taxation in India are frequently being raised, among which the stark disparities between salaried professionals and agricultural industry

Anisha Kumari | Mar 22, 2025 |

Disparities of Taxation: Unwanted Burden on Salaried Professionals but Agriculture and Other Industries Exempt

Concerns regarding the process of taxation in India are frequently being raised, among which the stark disparities between salaried professionals and agricultural industry earners and others are striking. While nearly 50% of the Indian population is engaged in agriculture, the industry contributes a mere 17% to the country’s GDP. Despite this, farm income is wholly exempt under Section 10(1) of the Income-Tax Act, 1961. The section was originally introduced to benefit small and marginal farmers who were economically distressed, but over time it has helped wealthier farmers avoid taxes while they reap generously from public funds, subsidies, and government infrastructure. Big Taxation Differences

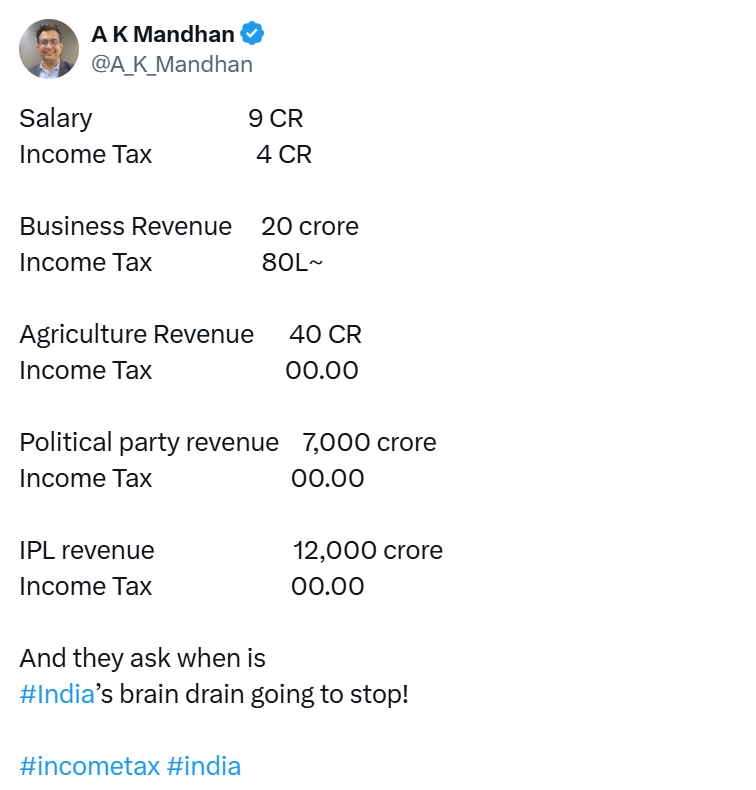

In recent years, a report highlighting major taxation imbalances has recently gained attention, particularly among wage earners who carry most of the tax burden.

From the figures given, a salaried individual with an income of Rs. 9 crore pays Rs.4 crore as income tax, whereas a company with an income of Rs. 20 crore pays only Rs. 80 lakh. A comparison is drawn with Rs. 40 crore of agricultural income that remains fully exempt from taxation. And, also, political parties with revenues of Rs. 7,000 crore and large business houses such as the Indian Premier League (IPL), which is reputed to generate Rs. 12,000 crore in revenue, do not pay income tax.

The division of these amounts is as follows:

These imbalances have fuelled fears regarding the fairness of the tax system, particularly where a limited number of taxpayers pay high taxes while other groups are largely exempt.

A survey by PRICE found that around five million wealthy farmers in India earn more than Rs.25 lakh per year. Interestingly, two-thirds of their earnings are from agriculture and the remaining one-third from non-farm activities. Although they constitute only 8% of the farmers, these affluent farmers control approximately 28% of the total agricultural income.

The survey report highlights that almost 45% of farmers in the high-income category are getting benefits under the PM-Kisan Samman Nidhi Scheme, a government scheme designed and implemented to support and provide funds for small and marginal farmers. These high-income farmers mostly belong to the states like Andhra Pradesh, Punjab, Kerala, Haryana, Tamil Nadu, and Karnataka, where commercial agriculture, large landholding, and modern farming methods are prominent.

Furthermore, their consumer expenditure habits also indicate their financial position. However, 67% out of them possess two-wheelers and 29% possess cars; just 28% possess tractors, indicating that most of their generated wealth is being spent on things other than essential farm machinery.

Only about 6% of the population of India pays income tax, and even a smaller fraction, less than 3%, pays income tax.

They are also among the largest contributors to overall personal income tax collections, constituting about half of such collections.

This heavy tax burden may cause a brain drain, as many skilled professionals in technology and finance move abroad for better tax conditions.

The frustration that is increased is due to the fact that salaried workers bear the tax burden, and political parties and multinational corporations still enjoy exemptions. This imbalance between the two sectors has widened economic inequalities and challenged the requirement for a more equitable taxation system. As the increasing controversy of taxation equity gains momentum, demands for policy reform to address such disparities are growing. The view of many people is that a reconsideration of tax exemptions, especially for agriculture and wealthy individuals with big businesses, would introduce a balanced and equitable tax system in the nation.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"