Financial statements are written records that illustrate the business activities and the financial performance of a company.

Reetu | Nov 6, 2023 |

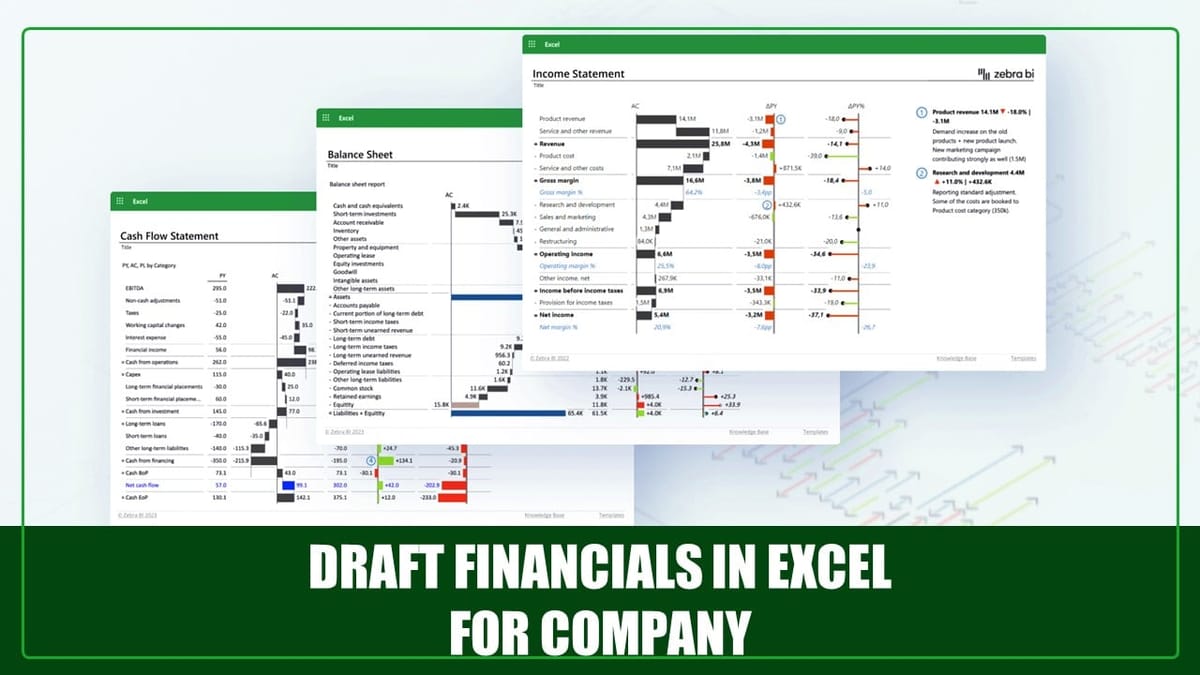

Download Draft Financial in Excel for Company as per Company Law 2013

Financial Statement: Financial statements are written records that illustrate the business activities and the financial performance of a company. In most cases they are audited to ensure accuracy for tax, financing, or investing purposes.

According to S. 2(40) fi financial statement in relation to a company, includes—

(i) a balance sheet as at the end of the financial year;

(ii) a profit and loss account, or in case of a company carrying on any activity not for profit, an income and expenditure account for the financial year;

(iii) cash flow statement for the financial year; and

(iv) any explanatory note annexed to, or forming part of, any document referred to in sub-clause (i) to sub-clause (iv).

However, the financial statement, with respect to one person company, small company and dormant company (S. 455) may not include cash flow statement.

The following are the two types of financial statements:

1. Annual financial statements: These are prepared once in a financial year.

2. Quarterly financial statements: These are prepared by listed companies on quarterly basis as per SEBI requirements.

You can reach the author CA Akshay Garg at caakshaygarg.ag@gmail.com or at 7988355606.

To Download Draft Financial in Excel for company – Click Here

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"