Studycafe | Jul 23, 2020 |

The E-Invoicing turnover threshold to be increased to Rs 500Cr from Rs 100Cr

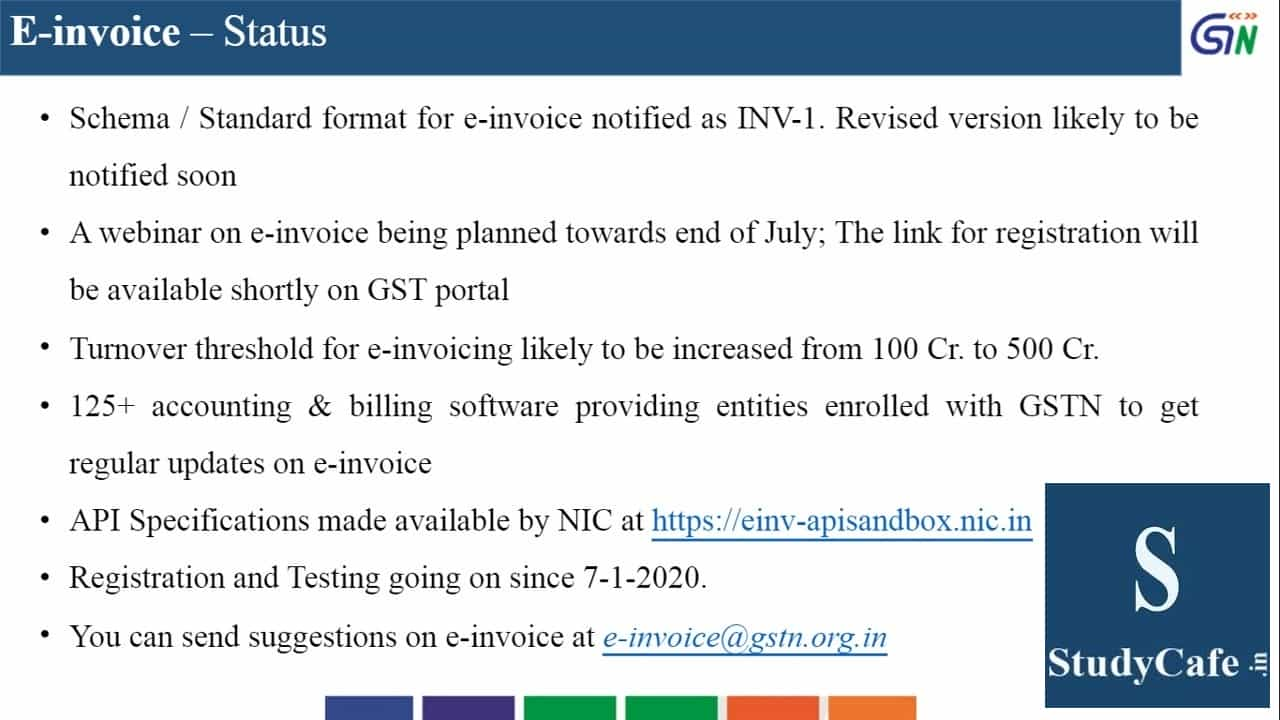

As per news update, now taxpayers with a turnover of Rs 500 crores or more have to comply with E-Invoicing. The CBIC will soon announce this within a week. Earlier the threshold for E-Invoicing was Rs 100 Cr.

This news was confirmed by a top official in the ASSOCHAM webinar. The Central Board of Indirect Taxes and Customs will in a week’s time come out with a notification.

The E-Invoicing turnover threshold to be increased to Rs 500Cr from Rs 100Cr

E-invoicing, a form of electronically-authenticated invoices, is applicable from 1 October 2020.

You May Also Refer:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"