Empanelment of CA Firm for Internal Audit of Assam Skill Development Mission

Sushmita Goswami | Apr 29, 2022 |

Empanelment of CA Firm for Internal Audit of Assam Skill Development Mission

The primary objective of ‘Internal Audit‘ is “to ensure that the financial statements i.e. the Balance Sheet, Income & Expenditure Account and Receipt & Payment Account, give a true & fair view and are free from any material misstatements”. In context of ASDM, Internal Audit also aims at ensuring that the respective program expenditures are eligible for financing under the relevant grant/ credit agreements (under programs supported by development partners) and that the funds have been utilized for the purpose for which they were provided.

Internal Audit is a systematic examination of financial transaction on a regular basis to ensure accuracy, authenticity, compliance with procedure and guidelines. The emphasis under internal audit is not on test checking but on substantial checking of transactions. It is an ongoing appraisal of the financial health of an entity to determine whether the financial management arrangements (including internal control mechanisms) are effectively working and to identify areas of improvement to enhance efficiency.

Independent Chartered Accountant firm shall be appointed as Internal Auditor at Assam Skill Development Mission to undertake periodical audit and report on vital parameters which would depict the true picture of financial and accounting health of the project.

The key objectives of the Internal Audit include: –

The responsibilities of the internal auditor shall include reporting on the adequacy of internal controls, the accuracy and propriety of transactions, the extent to which assets are accounted for and safeguarded and the level of compliance with financial norms and procedures of the operational guidelines.

The internal audit shall be carried out both at State as well as District level as per requirement.

1. The firm must be empaneled with C & AG for the year 2021-22 and the particulars of the Firm H.O., B.O. and Partners and paid Chartered Accountants should match with the certificate issued by ICAI not before 1st January, 2022, without which the application of the firm would not be considered. Proof of empanelment with C&AG to be attached.

2. The firms having H.O. only within the state capital of the same State for which the proposal is given may be given preference. (Such head office should be existed within the state for not less than three years as per the ICAI Certificate).

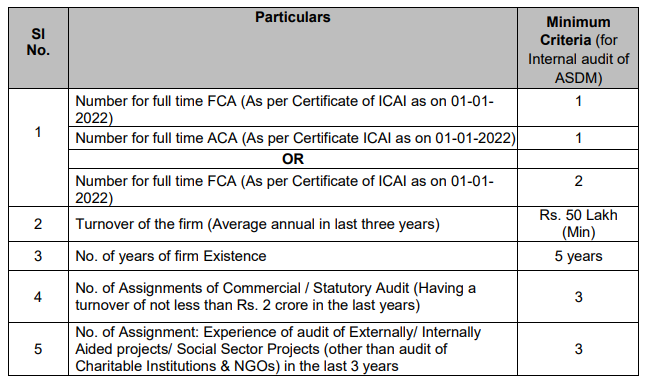

3. Firms must qualify following minimum criteria:

i. Any firm not qualifying on these minimum criteria need not apply as its proposal shall be summarily rejected.

ii. Supporting Documents for Eligibility Criterions:

Following supporting documents must be submitted by the firm along with the technical proposal:

a. For Sl. No. 1 & 3 above, the firm must submit an attested copy of Certificate of ICAI as on 01.01.2022.

b. For Sl. No. 2, the firm must submit, a copy of the Audited Balance Sheet & Profit & Loss Account for the last three years otherwise a Certificate issued by any C.A. Firm may also be provided in this regard giving the break-up of Fees (Audit Fee, Taxation and Others).

c. For Sl. No. 4 & 5, the firm must submit a copy of the appointment letters from the auditee organizations. Branch Audit of any Bank shall not be considered while taking into account the total number of assignments.

4. The firm or any partners of the firm should not be black listed by any PSUs or Govt. Co. or any other organization in respect of any assignment or behavior. [Notarized affidavit on Rs.100/- stamp paper is to be given in this regard by the authorized person of the firm].

5. As regards Sl. No. 5 the turnover of the auditee organization and audit fee paid/ received have to be provided along with the relevant evidences/ documents.

6. CA firm who were auditor of ASDM in any of last three FY (i.e. FY 2018-19, FY 2019-20 and FY 2020-21) will not be eligible to participate

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"