Studycafe | Dec 17, 2019 |

38th GST Council Meeting Expectations : News and Updates

The GST council is scheduled to meet on Wednesday i.e. 18th December 2019 to take stock of the developments pertaining to the indirect tax regime.

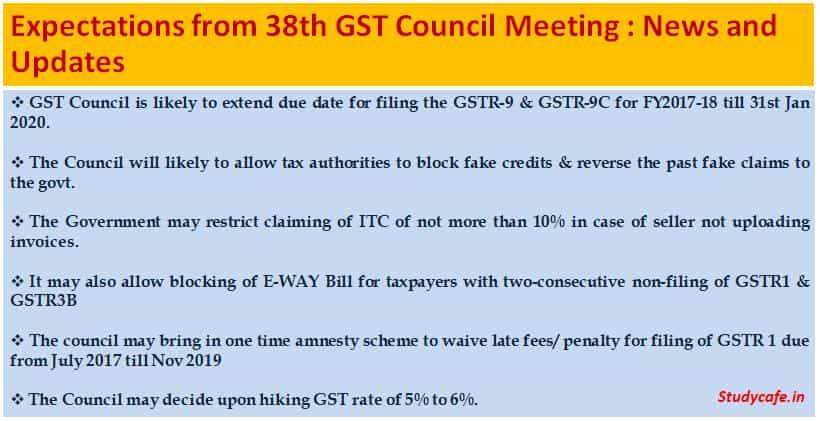

Some of the decisions which may be taken by the council are given below:

38th GST Council Meeting Expectations News and Updates

Source : CNBC TV 18 News

For Regular Updates Join : https://t.me/Studycafe

Tags : GST, GST Annual Return, GSTR-9, GSTR-9C, News, Rule 36(4), E-WAY Bill, GST Council Meeting Updates

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"