Reetu | May 12, 2020 |

FAQs on Computation of Tax with examples and illustrations

1. When do I have to pay the taxes on my income?

Ans. The taxes on income can be finalized only on the completion of the previous year. However, to enable a regular flow of funds and for easing the process of collection of taxes, Income-tax Act has provisions for payment of taxes in advance during the year of earning itself or before completion of previous year. It is also known as Pay as your earn concept.

Taxes are collected by the Government through the following means:

1. Voluntary payment by taxpayers into various designated Banks such as Advance tax, Self-Assessment tax, etc.

2. Taxes deducted at source

3. Taxes collected at source

Ans. Section 14 of the Income-tax Act has classified the income of a taxpayer under five different heads of income, viz.:

3. What is gross total income?

Ans. Total income of a taxpayer from all the heads of income (as discussed in previous FAQ) is referred to as Gross Total Income.

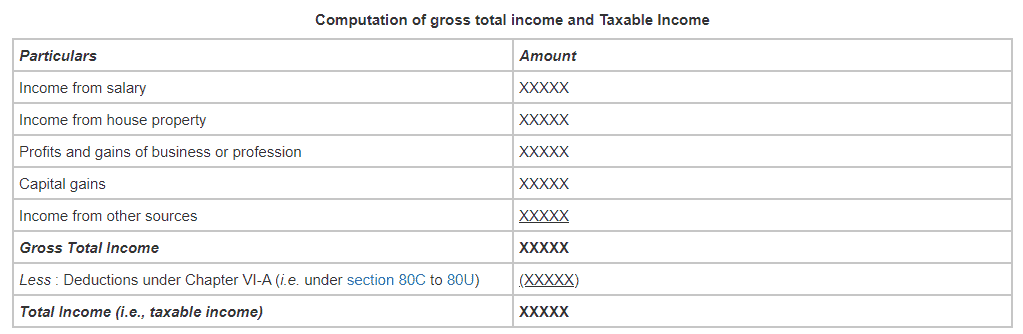

Ans. Total Income is the income on which tax liability is determined. It is necessary to compute total income to ascertain tax liability .Section 80C to 80U provides certain deductions which can be claimed from Gross Total Income (GTI). After claiming these deductions from GTI, the income remaining is called as Total Income. In other words, GTI less Deductions (under section 80C to 80U) = Total Income (TI). Total income can also be understood as taxable income. Following table gives a better understanding of the difference between GTI and TI :

FAQs on Computation of Tax with examples and illustrations

Note : Inter source losses, inter head losses, brought forward losses, unabsorbed depreciation, etc., (if any) will have to be adjusted (as per the Income-tax Law) while computing the gross total income.

Note: If the eligible assessee has opted for concessional tax regime under section 115BAA, 115BAB, 115BAC and 115BAD, the total income of assessee is computed without claiming specified exemptions or deductions:

Ans. As per section 288A, total income computed in accordance with the provisions of the Income-tax Law, shall be rounded off to the nearest multiple of ten. Following points should be kept in mind while rounding off the total income:

• First any part of rupee consisting of any paisa should be ignored.

After ignoring paisa, if such amount is not in multiples of ten, and last figure in that amount is five or more, the amount shall be increased to the next higher amount which is in multiple of ten and if the last figure is less than five, the amount shall be reduced to the next lower amount which is in multiple of ten and the amount so rounded off shall be deemed to be the total income of the taxpayer.

If the taxable income of Mr. Keshav is Rs 2,52,844.99, then first paisa shall be ignored, i.e., 0.99 paisa shall be ignored) and the remaining amount of Rs 2,52,844 shall be rounded off to Rs 2,52,840 (since last figure is less than five). If the total income is Rs 2,52,845 or Rs 2,52,846.01, then it shall be rounded off to Rs 2,52,850 (since the last figure is five or above).

Ans. No, you cannot claim deduction of personal expenses while computing the taxable income.

While computing income under various heads, deduction can be claimed only for those expenses which are provided under the Income-tax Act.

Ans. What is done after the income is earned by you will not give you tax exemption. However, contribution to approved institutions will give you the benefit of deduction from taxable income under section 80G subject to limits specified therein.

Ans. Rental income is charged to tax in the hands of the owner of the property. Your daughter is the owner of the house and, therefore, she is liable to pay tax, even though you receive rent. If the house is transferred to you, then you will become the owner and you will have to pay Income-tax on the rental income.

FAQs on Computation of Tax

Ans. At this moment (i.e., for the financial year 2020-21) Individual, HUF, AOP, and BOI having income below Rs 2,50,000 need not pay any Income-tax. In respect of resident individuals of the age of 60 years and above but below 80 years, the basic exemption limit is Rs 3,00,000 and in respect of resident individuals of 80 years and above, the limit is Rs 5,00,000. For other categories of persons such as co-operative societies, firms, companies and local authorities, no basic exemption limit exists and, hence, they have to pay taxes on their entire income chargeable to tax.

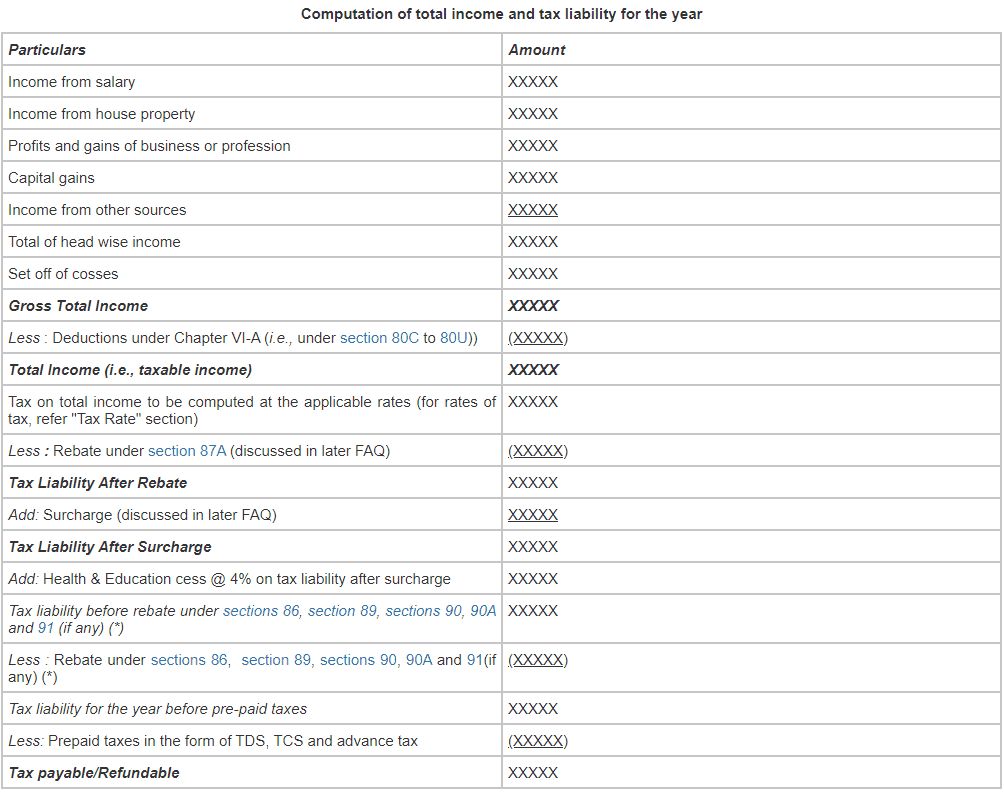

Ans. After ascertaining the total income, i.e., income liable to tax, the next step is to compute the tax liability for the year. Tax liability is to be computed by applying the rates prescribed in this regard. Following table will help in understanding the manner of computation of the total tax liability of the taxpayer.

(*) Rebate under section 86 is available to a member of association of persons (AOP) or body of individuals (BOI) in respect of income received by such member from the AOP/BOI.

Rebate (i.e., relief) under section 89 is available to a salaried employee in respect of sum received towards arrears of salary, gratuity, etc.

Rebate under sections 90, 90A and 91 is available to a taxpayer in respect of double taxed income, i.e., income which is taxed in India as well as abroad.

Note : For provisions relating to Minimum Alternate Tax (MAT) in case of corporate taxpayers and Alternate Minimum Tax (AMT) in case of non-corporate taxpayers refer tutorial on “MAT/AMT”.

Ans. As per section 288B, tax payable by the taxpayer or tax refundable to the taxpayer shall be rounded off to the nearest multiple of ten, following points should be kept in mind while rounding off the tax :

• First any part of rupee consisting of any paisa should be ignored.

• After ignoring paisa, if such amount is not a multiples of ten, and the last figure in that amount is five or more, the amount shall be increased to the next higher amount which is a multiple of ten and if the last figure is less than five, the amount shall be reduced to the next lower amount which is a multiple of ten; and the amount so rounded off shall be deemed to be the tax payable by the taxpayer or refundable to the taxpayer.

Illustration for better understanding

If the tax liability or refund due to Mr. Keshav is Rs 2,52,844.99, then first paisa shall be ignored, (i.e., 0.99 paisa shall be ignored) and the remaining amount of Rs 2,52,844 shall be rounded off to Rs 2,52,840 (since last figure is less than five). If the tax liability or refund due is Rs 2,52,845 or Rs 2,52,846.01, then it shall be rounded off to Rs 2,52,850 (since the last figure is five or above).

Ans. An individual who is resident in India and whose total income does not exceed Rs 5,00,000 is entitled to claim rebate under section 87A. Rebate under section 87A is available in the form of deduction from the tax liability. Rebate under section 87A will be lower of 100% of income-tax liability or Rs 12,500. In other words, if the tax liability exceeds Rs 12,500, rebate will be available to the extent of Rs 12,500 only and no rebate will be available if the total income (i.e. taxable income) exceeds Rs 5,00,000.

Ans. Rebate under section 87A is available only to a resident individual, hence, any person other than a resident individual cannot claim rebate under section 87A.

Ans. Rebate under section 87A is available only to an individual who is resident in India, hence, non-residents cannot claim rebate under section 87A.

Ans. Surcharge is an additional tax levied on the amount of income-tax. In case of individuals/HUF/AOP/BOI/ artificial juridical person, surcharge is levied @ 10% on the amount of income-tax where the total income of the taxpayer exceeds Rs 50 lakh but doesn’t exceeds Rs 1 crore.

Surcharge is levied @ 15% of income-tax where the total income of the taxpayer exceeds Rs 1 crore but doesn’t exceeds Rs 2 crore.(*).

Surcharge is levied @ 25% of income-tax where the total income of the taxpayer exceeds Rs 2 crore but doesn’t exceeds Rs 5 crore(*).

Firm, co-operative society and local authority surcharge is levied at 12% if total income exceeds Rs 1 crore.

Domestic company surcharge is levied @ 7% on the amount of income-tax if the total income exceeds Rs 1 crore but does not exceed Rs 10 crore and @ 12% on the amount of income-tax if total income exceeds Rs 10 crore (*).

Foreign company surcharge is levied @ 2% on the amount of income-tax if the total income exceeds Rs 1 crore but does not exceed Rs 10 crore and @ 5% on the amount of income-tax if total income exceeds Rs 10 crore (*).

(*) A taxpayer can claim marginal relief from the amount of surcharge, subject to certain conditions. Refer to next FAQ for concept of marginal relief.

Mr. Kapoor is a doctor, his total income for the year amounted to Rs 44,00,000. Will he be liable to pay surcharge, if yes, then how much?

Surcharge is additional tax levied on the amount of income-tax. In case of individuals surcharge is levied @ 10% on the amount of income-tax where the total income of the taxpayer exceeds Rs 50 lakh. In this case, total income of Mr. Kapoor is below Rs 50 lakh, hence, he will not be liable to pay surcharge.

Ans. The concept of marginal relief is designed to provide relaxation from levy of surcharge to a taxpayer where the total income exceeds marginally above Rs 50 lakh, Rs 1 crore, Rs 2 crore, Rs 5 crore or Rs 10 crore, as the case may be.

Thus, while computing surcharge, in case of taxpayers (i.e. Individuals/HUF/AOP/BOI/artificial juridical person) having total income of more than Rs 50 lakh marginal relief shall be available in such a manner that the net amount payable as income-tax and surcharge shall not exceed the total amount payable as income-tax on total income of Rs 50 lakh by more than the amount of income that exceeds Rs 50 lakh.

In case of a company, surcharge is levied @ 7% (2% in case of foreign company) on the amount of income-tax if the total income exceeds Rs 1 crore but does not exceed Rs 10 crore and @ 12% (5% in case of foreign company) on the amount of income-tax if total income exceeds Rs 10 crore. Hence, in case of company whose total income exceeds Rs 1 crore but does not exceeds Rs 10 crore, marginal relief will be computed as discussed above, but in the case of company having total income above Rs 10 crore marginal relief is available in such a manner that the net amount payable as income-tax and surcharge shall not exceed the total amount payable as income-tax and surcharge on total income of Rs 10 crore by more than the amount of income that exceeds Rs 10 crore.

Mr. Mukesh is salaried employee (age 40 years). His total income from salary for the year 2019-20 amount to Rs 51,00,000. Will he liable to pay surcharge, if yes, then how much and will he get the benefit of margin relief?

**

Surcharge is additional tax levied on the amount of income-tax. In case of taxpayers (i.e. Individuals/HUF/AOP/BOI /artificial juridical person), surcharge is levied @ 10% on the amount of income-tax where the total income of the taxpayer exceeds Rs 50 lakh. In this case, total income of Mr. Mukesh exceeds Rs 50 lakh and hence he will be liable to pay surcharge. Marginal relief is available in cases where the total income is slightly above Rs 50 Lakh. The Computation of normal tax liability (i.e. liability without marginal relief) and tax liability under marginal relief (i.e. liability after marginal relief) will be as follows:

(1) Normal tax liability (i.e. without marginal relief)

Apart from above rates, cess will be computed separately.

(2) Tax liability under marginal relief (i.e. after marginal relief)

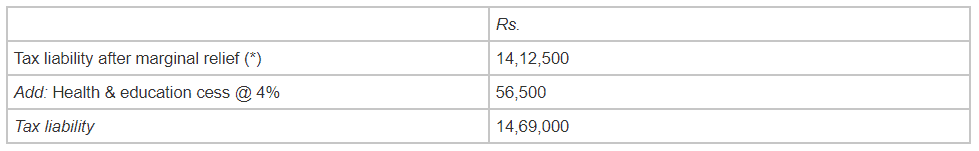

Normal tax liability (i.e. without marginal relief) comes to Rs 14,76,750 and tax liability under marginal relief comes to Rs 14,12,500. It can be observed that tax liability under marginal relief is lower and, hence, Rs 14,12,500 will be the tax liability before cess. Total tax liability will be computed as follows:

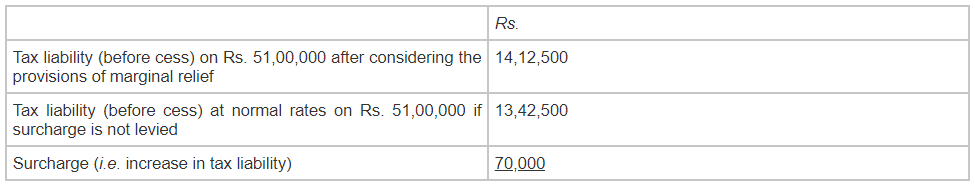

(*) In this case, surcharge paid by Mr. Mukesh will be Rs 70,000 computed as follows:

Mr. Raja is businessman (age 35 years). His total income for the year 2020-21 amounted to Rs 1,02,00,000. Will he be liable to pay surcharge, if yes, then how much and will he get the benefit of marginal relief?

**

Surcharge is additional tax levied on the amount of income-tax. In case of taxpayers (i.e. Individuals/HUF/AOP/BOI /artificial juridical person), surcharge is levied @ 10% on the amount of income-tax where the total income of the taxpayer exceeds Rs 1 crore. In this case, total income of Mr. Raja exceeds Rs 1 crore and hence he will be liable to pay surcharge. Marginal relief is available in cases where the total income is slightly above Rs 1 crore. The Computation of normal tax liability (i.e. liability without marginal relief) and tax liability under marginal relief (i.e. liability after marginal relief) will be as follows:

(1) Normal tax liability (i.e. without marginal relief)

Apart from above rates, cess will be computed separately.

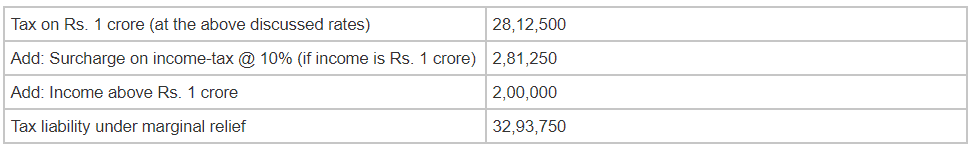

(2) Tax liability under marginal relief (i.e. after marginal relief)

Normal tax liability (i.e. without marginal relief) comes to Rs 33,03,375 and tax liability under marginal relief comes to Rs 32,93,750. It can be observed that tax liability under marginal relief is lower and, hence, Rs 32,93,750 will be the tax liability before cess. Total tax liability will be computed as follows:

Mr. Karan is a businessman (age 35 years). His total income for the year 2020-21 amounted to Rs 1,07,00,000. Will he be liable to pay surcharge, if yes, then how much and will he get the benefit of marginal relief?

**

Surcharge is additional tax levied on the amount of income-tax. In case of taxpayers (i.e. Individuals/ HUF/ AOP/ BOI/ artificial juridical person) surcharge is levied @ 15% on the amount of income-tax where the total income of the taxpayer exceeds Rs 1 crore. In this case, total income of Mr. Karan exceeds Rs 1 crore and hence he will be liable to pay surcharge. Marginal relief is available in cases where the total income is slightly above Rs 1 crore. The computation of normal tax liability (i.e. liability without marginal relief) and tax liability under marginal relief (i.e. liability after marginal relief) will be as follows :

(1) Normal tax liability (i.e. without marginal relief)

(*) Tax rates are discussed in previous illustration.

(2) Tax liability under marginal relief (i.e. after marginal relief)

Normal tax liability (i.e. without marginal relief) comes to Rs 34,75,875 and tax liability under marginal relief comes to Rs 35,12,500. It can be observed that normal tax liability (i.e. without marginal relief) is lower and, hence, Rs 34,75,875 will be the tax liability before cess. Total tax liability will be computed as follows:

Ans. For details on minimum alternate tax (MAT) refer to tutorial on “Minimum Alternate Tax and Alternate Minimum Tax”

Ans. For details on alternate minimum tax (AMT) refer to tutorial on “Minimum Alternate Tax and Alternate Minimum Tax”

Tags : Income Tax

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"