CA Pratibha Goyal | Oct 6, 2023 |

FAQs on Form DRC-01C: Intimation of difference in ITC available as per GSTR-2B and ITC claimed as per GSTR-3B

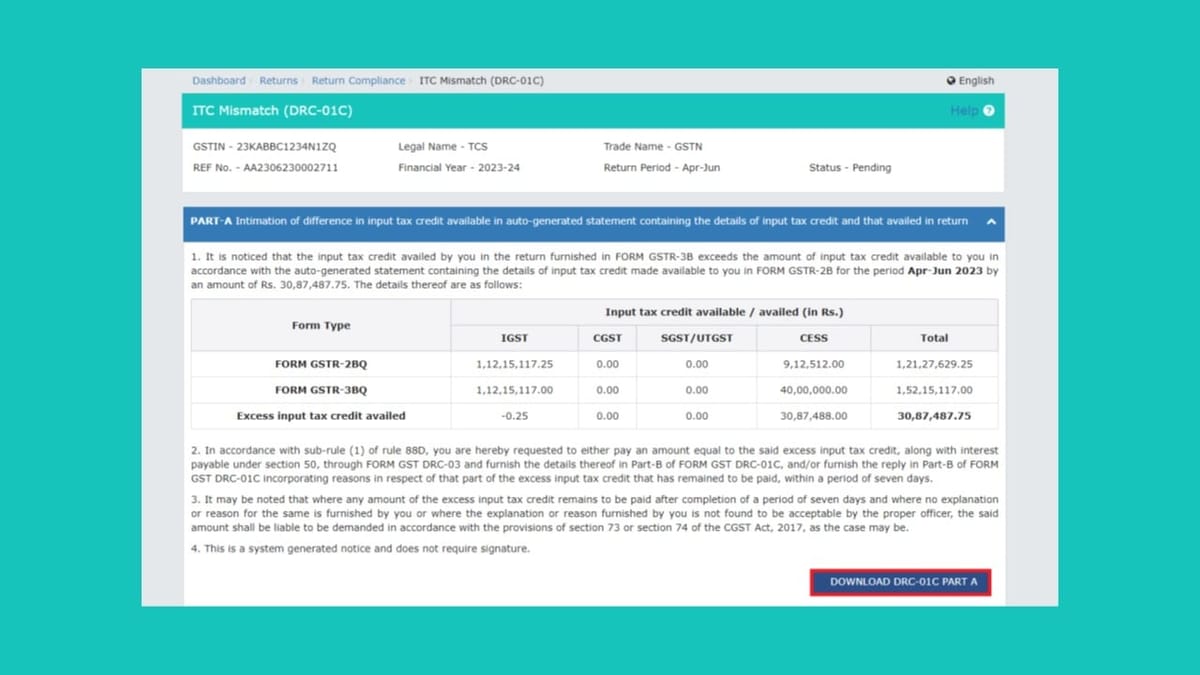

Goods and Service Tax Network (GSTN) has issued an advisory on the difference in Input Tax Credit (ITC) available in GSTR-2B & ITC claimed in the GSTR-3B. Central Board of Indirect Taxes and Customs (CBIC) inserted Rule 88D in CGST Rule, 2017 dealing with the difference in input tax credit available in GSTR-2B and ITC availed in GSTR-3B vide issuing Notification No. 38/2023 – Central Tax dated 04th August 2023. This Functionality in the form of DRC-01C is now operational on the GSTN Portal.

GSTN issues Advisory on DRC-01C Difference in ITC as per GSTR-2B & GSTR-3B

Here are the FAQs and manual for steps on filing Form DRC-01C, Intimation of difference in ITC available as per GSTR-2B and ITC claimed as per GSTR-3B.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"