Deepak Gupta | Feb 9, 2019 |

FAQ’s on MCA Form MSME-1

MCA introduced Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order 2019 on 22nd January 2019 and thereby notified filing of Form MSME-1.

Below are some of the FAQ’s on Form MSME-1 and Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order 2019.

FAQ’s on MCA Form MSME-1

Ans : The Central Government vide notification number S.O.5622 (E), dated the 2nd November, 2018 has directed that all companies, who get supplies of goods or services from micro and small enterprises and whose payments to micro and small enterprise suppliers exceed forty five days from the date of acceptance or the date of deemed acceptance of the goods or services as per the provisions of section 9 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006) (hereafter referred to as Specified Companies), shall submit a half yearly return to the Ministry of Corporate Affairs stating the following:

(a) the amount of payment due; and

(b) the reasons of the delay;

Therefore to Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order 2019 and Form MSME 1 was introduced by MCA so that specified companies can submit a half yearly return to the MCA stating the (a) the amount of payment due; and (b) the reasons of the delay;

What do you mean by a Specified Company?

Specified Company means Every Company Public or Private who Received Goods or Services from Micro or Small Enterprises of which Payment Due or Not Paid till 45 days

What are the steps to be taken by the Specified Enterprise?

1.) Identify the suppliers Registered under MSME Act : First, they have to find out from their suppliers whether they are Registered under MSME Act then ask for submission of their Registration Certificate.

2.) If there are any such suppliers who are Registered under MSME Act and if the payments to them are due for more than 45 days from the date of acceptance of the goods and services, then we have to pay them their all dues immediately, otherwise the Specified Company shall be liable to file MSME Form I.

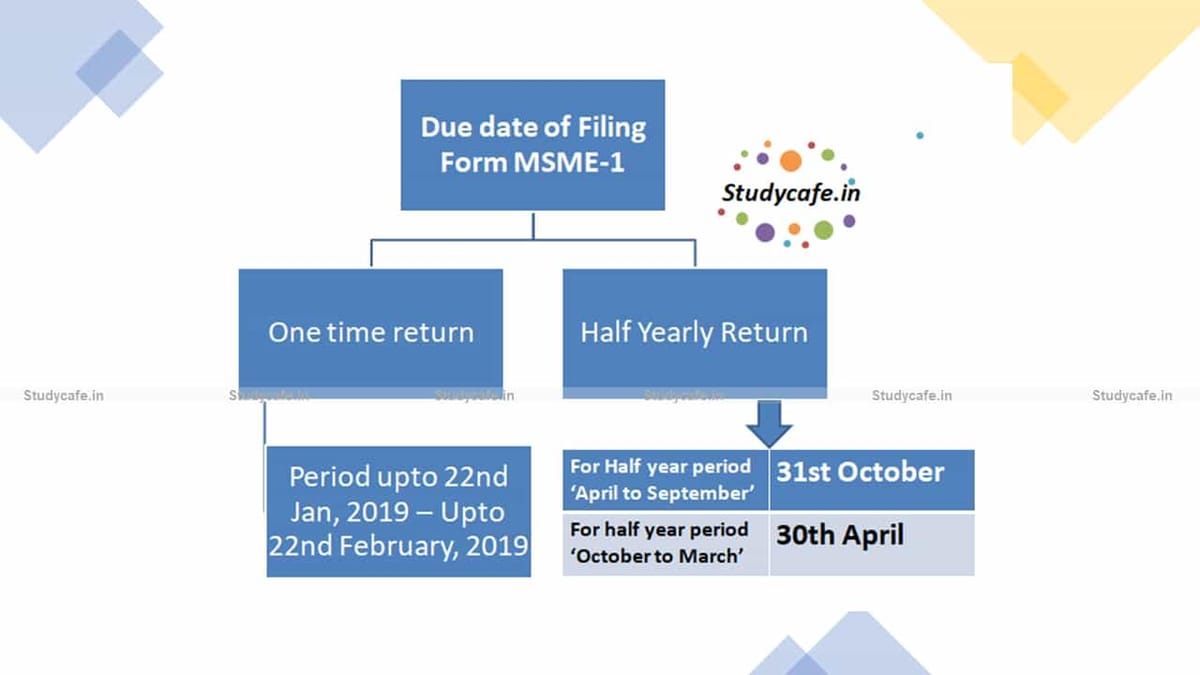

What is Due date of Filing Form MSME-1?

As per General Circular No. 01/ 2019 dated 21.02.2019 the period of thirty days for filing initial return in MSME Form 1 shall be reckoned from the date the said e-form is deployed on MCA 21 portal.

Due date of subsequent returns is mentioned below:

For Half-year period April to September | 31st October |

For half-year period October to March | 30th April |

FAQ’s on MCA Form MSME-1

Information required to be submitted with ROC in Form MSME-1 includes :

1.) Total outstanding amount due

[For One time return, which has to be submitted upto 22nd February, Total outstanding amount due upto 22nd January have to be reported.]

2.) Name of Supplier

3.) PAN of Supplier

4.) Reasons for delay in payment

In accordance with the provision of Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 the Micro, Small and Medium Enterprises (MSME) are depicted below:

Manufacturing Sector | Service Sector | ||

Enterprises | Investment in plant & machinery | Enterprises | Investment in equipment |

Micro Enterprises | Does not exceed Rs. 25 Lakh | Micro Enterprises | Does not exceed Rs. 10 Lakh |

Small Enterprises | More than Rs. 25 Lakh but does not exceed Rs. 5 Crore | Small Enterprises | More than Rs. 10 Lakh but does not exceed Rs. 2 Crore |

Medium Enterprises | More than Rs. 5 Crore but does not exceed Rs. 10 Crore | Medium Enterprises | More than Rs. 2 Crore but does not exceed Rs. 5 Crore |

As per Section 405(4)

can be levied.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"